Coming off the back of a record-breaking year for the US energy storage industry in 2022, the market has seen a second successive quarter of declines in recorded installation figures.

That’s according to market research group Wood Mackenzie Power & Renewables, which has just published the latest edition of its US Energy Storage Monitor report in partnership with trade group American Clean Power Association (ACP).

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The firm noted in March that during 2022, almost as much energy storage was deployed in the country as in the preceding two years combined. Around 4.8GW of installations were recorded in 2022, the US market’s biggest year to date, while 2020 and 2021’s totals added up to 5GW.

“We are seeing the effects of supply chain issues and interconnection queue backlogs hinder market growth. This is the first consecutive quarterly decline we have seen in the energy storage market since 2015 when installations were much smaller in volume and more unpredictable,” Wood Mackenzie senior energy storage analyst Vanessa Witte said.

In the report’s Q2 2023 edition, just published, Wood Mackenzie said the US storage industry added 778MW and 2,145MWh in the first quarter of the year. That represents a 26% decline from Q4 2022, and that drop was largely driven by delays impacting the grid-scale segment.

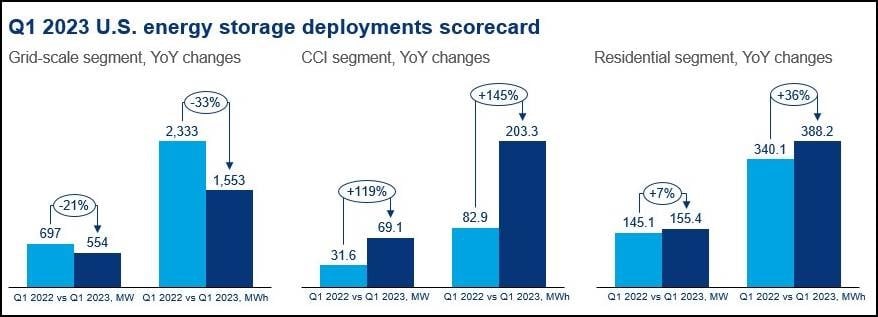

Grid-scale still retains the largest share of output and capacity additions by a long way, with 554MW/1,533MWh recorded in the segment in the first three months of 2023. While that was enough to bring cumulative grid-scale installations in the US above 10GW for the first time, at 10.4GW, as a quarter it was the lowest amount of activity seen since Q2 2021.

More than 1.8GW of projects expected to come online during Q1 were delayed and pushed into commercial operation start dates later in the year. The industry is experiencing “rolling delays”, Wood Mackenzie found, with 80% of Q4 2022’s delayed projects delayed once again from rescheduled commissioning dates in Q1 2023.

The majority of delayed projects, 1.4GW, are expected to come online in Q2, and another 0.2GW in Q3, which means the Q2 pipeline of expected capacity additions looks strong.

Stronger second quarter ahead

In other words, the good news is that although Q1 was a challenging quarter, as Witte said, deployment volumes are consistently much higher now that just a few years ago, but perhaps more importantly, battery storage system prices have begun to trend downwards once more, as demand from the EV sector has softened.

Battery prices appear to have peaked in late 2022, although a drop in lithium raw materials costs has not been relayed back to module prices.

Meanwhile, the queue for grid interconnection continues to grow, with 430GW of projects waiting, but at least – in part due to the queue already being “bloated” – during Q1 this didn’t grow much.

“While the market has faced challenges, we do anticipate a stronger second quarter, as many project CODs have been pushed, but are still very viable,” Vanessa Witte said, adding that Wood Mackenzie’s outlook for the industry “is still bullish, with projected growth strong through 2027”.

“Near-term we will see some challenges, but we expect them to be corrected and activity to increase as more renewable generation will drive the need for storage,” Witte said.

Wood Mackenzie’s solar industry analysts have forecast that the US’ solar PV installations will reach 20GW this year, a considerable increase from 13GW in 2022, which as Witte implied will support energy storage’s growth too.

The US’ two leading state-level markets, Texas and California, accounted for 84% of project activity in Q1 2023, but delays in both states as well as other big regions Arizona and Hawaii also contributed to that quarterly decline.

Interestingly, in the market segments for residential energy storage and community, commercial and industrial (CCI – previously categorised as ‘non-residential’ in Wood Mackenzie reports) storage conversely enjoyed strong performance in Q1.

Residential enjoyed its highest-ever first quarter figures, with 155.4MW/388.2MWh, versus 141.5MW/340MWh in Q1 2022, although it did record a decline from Q4 2022 – marking the first time in six straight quarters there has been a quarter-on-quarter drop.

CCI meanwhile continues to be the smallest segment by far, but in Q1 2023 saw the first increase in installations after four straight quarters of lower-than-average numbers. In the first quarter of this year, 69.1MW/203.3MWh of CCI deployments were recorded.

Wood Mackenzie is expecting growth in all segments of the market, forecasting close to 75GW of installations from 2023 to 2027. Grid-scale storage will represent about 81% of that total.