Stem Inc. reported a 69% year-on-year fall in annual revenues as the US energy storage pioneer continues its pivot towards renewable energy software and services.

California-headquartered Stem announced its fourth-quarter and full-year 2024 financial results yesterday (4 March). Q4 2024 revenue was US$55.8 million, a 67% drop from US$167.4 million in the same period of 2023, while full-year revenue was US$144.6 million, versus US$461.5 million reported the previous year.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Net loss for the year was US$854 million, compared to US$140.4 million net loss in 2023, and adjusted EBITDA fell about 16% from US$-19.5 million in 2023 to US$-22.8 million.

The company attributed the revenue fall to declining battery storage hardware sales, which it said is a consequence of its increasing focus on software and services, which it hopes will help it generate annual recurring revenue (ARR) more effectively.

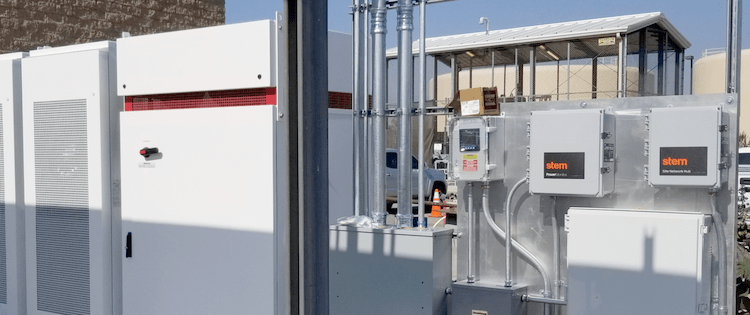

Stem became known in the clean energy industry around a decade ago as one of the early movers in the US commercial and industrial (C&I) battery storage space.

It offered customers in key markets like California the opportunity to reduce electricity bills through ‘peak shaving’—reducing the amount of power they used from the grid during monthly coincident peaks—and at the same time enrolling customers’ systems into grid services programmes that could earn Stem revenues.

Later, it rolled out other hardware-focused offerings, including front-of-the-meter (FTM) solar-plus-storage projects in Massachusetts. Throughout, it touted the capabilities of its AI-driven software platform, Athena, to optimise and monitor storage assets.

Stem also expanded its software and service arms with in-house expansion and moves like the 2022 acquisition of solar PV asset management software provider AlsoEnergy for around US$695 million.

The company listed on the New York Stock Exchange (NYSE) in 2021 after a special purpose acquisition company (SPAC) merger but received a stock exchange warning last September that its shares could be delisted after trading below the required minimum average share price of US$1.00 for more than 30 consecutive days.

At the time of writing, the shares were trading at US$0.46, 95.29% down from their US$10.00 price when they were first listed. Since the NYSE warning, Stem shares have only gone above US$1.00 for a few days at the beginning of this year.

New CEO puts full focus onto software

Stem got a new permanent CEO in January. Software specialist Arun Narayanan took over from interim chief executive David Buzby, who had stepped in after longstanding CEO John Carrington left during the company’s review of its overall strategy in September.

Narayanan said yesterday that Stem now has a “compelling” vision to build “the leading clean energy software company” and is “well-positioned to achieve it”.

“The strategy we set in motion during the fourth quarter of 2024 is designed to drive sustained, scalable growth in recurring software and services revenue.”

Guidance offered for 2025 revenue is in the range of US$125 million to US$175 million, and Stem only expects “up to US$35 million” of that to come from battery hardware. The bulk will come from software, edge hardware and services.

CFO Doran Hole—himself a relatively recent recruit, having joined from Ameresco—said the company also expects to grow its ARR by 15% in 2025. He claimed that along with “an expanded focus on reducing operating expenses,” this would “drive substantial improvements in adjusted EBITDA and cash flow.”

As well as reducing its emphasis on battery hardware sales, the company is increasing its efforts to target the solar PV services segment. Contracted energy storage assets under management (AUM) grew by just 100MWh from the end of 2023 to the end of 2024, from 5.5GWh to 5.6GWh, while the company had 29.9GW of solar monitoring AUM at the end of last year, compared to 27.5GW at the end of 2023.