The US’ cumulative battery storage installations reached 14.689GW at the end of Q3 2023, with ERCOT in Texas contributing 40% of new additions during the quarter.

That’s according to government filings compiled by S&P Global Commodity Insights, which found that 1.909GW was added during the three month period, a 16% increase from the previous quarter, while year-on-year, there has been a 53.3% increase in the installed base.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

However, despite the big leap, there could have been much more added: the number of new megawatts deployed in the third quarter was only around half of what was expected, with delays to major projects such as a 169MW phase of developer Terra-Gen’s Edwards Sanborn project and CIM Group’s 228MW Westlands Solar Blue project, both in California.

Both of those have been pushed back from commercial start dates in Q3 to Q4 2023 instead, in which S&P expects to see around 4.5GW of new additions in total. If all of those are added to the grid successfully, the US’ installed base would exceed 19GW by the end of this year.

S&P also found that prices of key raw materials lithium carbonate and hydroxide have continued to decline during 2023. Having reach all-time highs in 2022, prices for both are at their lowest since October 2021, with S&P’s commodities reporting group Platts finding a 70% drop in the price of lithium carbonate and a 72% drop in lithium hydroxide cost since the start of this year.

ERCOT back after quiet Q2

According to S&P, ERCOT led US deployments in the first quarter of this year, but reported after the second quarter that there were no new grid-scale battery energy storage system (BESS) facilities brought online in its service territory in that three-month period.

In Q3, ERCOT came top among US regions, with 763.4MW of new BESS, representing 40% of the total new capacity, while California’s CAISO – still the single biggest region now with close to 7GW installed – took a 30.6% share.

In Q4, S&P said CAISO has a 42.2% share of planned additions, while in second place are the Western US states (and parts of Canada and Mexico) that comprise the Western Electricity Coordinating Council (WECC) which has a 27.9% share. That’s similar to WECC’s 27.8% share of Q3 additions of 531MW. ERCOT meanwhile would contribute 24.5% of new additions in Q4, with about a gigawatt expected.

Of the top five biggest projects to come online during the third quarter this year, two are in California, two are in Texas and one in Arizona, with the biggest the 325MW/1,300MWh Desert Peak Project by NextEra Energy Resources in California.

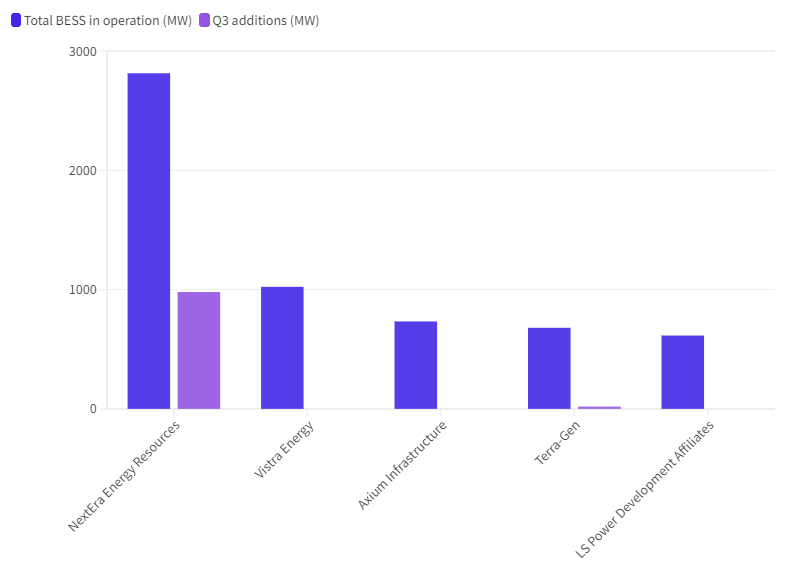

NextEra Energy Resources ranks top for operating battery storage

NextEra Energy Resources actually had three out of the top five biggest new projects according to S&P. That contributed to the wholesale power generation company being top for operating battery storage by megawatts in the country.

The company added 980MW during the quarter, and now has an operational fleet of 2.814GW. Vistra Energy, the second biggest by total operating capacity, with 1,023GW, made no additions during the period.

Conservative by comparison

S&P’s compiled Q3 figures are more conservative than those released at the beginning of this month by the American Clean Power Association (ACP), which said 2,142MW/6,227MWh of new large-scale battery storage facilities came online in the quarter (S&P did not provide megawatt-hour numbers). ACP found that 2023 installations had already exceeded the 2022 total by the end of the first nine months of the year.