The battery energy storage system (BESS) industry is changing rapidly as the market grows. At the heart of what is becoming a crowded and competitive market is the role of the system integrator: putting together the components and technologies that bring BESS projects to life.

In an interview with Energy-Storage.news, analyst Oliver Forsyth from IHS Markit explains exactly how things are changing in system integration. New market entrants are joining, often from the solar inverter or battery cell manufacturer space.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Bespoke project-by-project battery storage system design is giving way to more modular, standardised solutions from the big players. The emphasis on expertise in software is as pronounced as the emphasis on expertise in hardware when system integrators seek to differentiate their offerings.

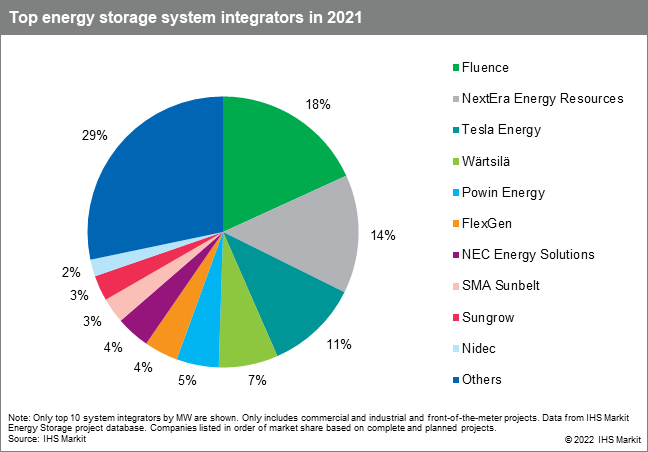

As the chart below shows, IHS Markit surveyed dozens of leading system integrators and produced rankings based on metrics including installed and planned projects by megawatt. While the idea of a top 10 ranking is in itself interesting, what could be even more illuminating is what IHS Markit’s team learned along the way.

The system integrator space is dynamic, and constantly moving, Forsyth says. IHS Markit’s annual report covers around 50 participants, but there are hundreds more, including local players focused on their specific regional markets.

He also adds the caveat that rankings are influenced by whether companies agree to participate or not, so there are a “number of key notable exceptions” that didn’t share all the required data for the survey, which meant they were not ranked as highly as might be expected.

Growth of software, long-term O&M contracting as differentiators

System integrators, defined as companies involved in system assembly, design and commissioning of energy storage projects are increasingly adding software expertise to their core competency set.

“All batteries basically need some software to control them in some shape or form: whether that’s a complex software system, doing some sort of algorithmic trading, or whether it’s a fairly ‘dumb’ kind of energy management system (EMS), that does what it needs to do and manages that just fine. All systems will need some sort of software,” Forsyth says.

“That’s becoming increasingly obvious to both the system integrators and the customers, so I think that’s becoming a requirement for a system integrator.”

Another big addition to the core competency set of integrators is a focus on bundling up long-term services and creating customer peace of mind.

System integrators are diving deeper into understanding what is required of them within warranties and what their customers — often project developers — are looking for. The market is better trying to understand the whole after sales service piece, from operations and maintenance (O&M), to warranties.

This is still a very “tailored” offering. It’s also something system integrators have traditionally tried to stay away from. However, they and their customers are beginning to understand that with their whole system approach, integrators have a better awareness of what’s involved in delivering on a project long-term than others within the value chain.

O&M allows system integrators to get involved with mitigating and managing risk on a level that differentiates them from competitors, Forsyth says.

“The battery industry hasn’t really been around for that long — so we haven’t really seen the full lifecycle of many of these assets to fully understand how some of these assets get degradated over time.

“Developers and all those that own and operate these assets are starting to realise that there is an element of risk here that they want to pass on to someone else, they don’t want to hold that risk.”

Battery OEMs or balance of plant (BOP) equipment makers aren’t likely to want to hold the risk either, because although they supply the components, they don’t have long-term visibility into how the asset operates. Similarly, asset operators and optimisers might be experts in trading from and earning revenues from batteries — “but they don’t really want to take on the risk of the asset,” leaving system integrators as the natural fit.

That said, a limitation for many system integrators is that “they’re not necessarily the most leveraged or the most capital intensive businesses in this part of the industry,” meaning the pool of integrators big enough or with a long enough track record to offer that risk mitigation is limited.

Insurance companies would be a great example of balance sheet-backed, leveraged partners but as yet they have not really been seen to step into this industry, leaving system integrators as perhaps the best-placed to offer long-term assurances.

A lot has changed even in the past year alone

In early 2021, IHS Markit analyst Julian Jansen wrote an article for our journal PV Tech Power which highlighted the strategies of leading system integrators. This was based on the 2020 edition of the annual report.

In an interesting quirk of fate, Jansen is now working at Fluence as a growth and market director for the EMEA region. Many of the trends identified by his predecessor as beginning to emerge at that time are continuing or growing, Oliver Forsyth says.

One of those is the entry into the space of competitors from different upstream and downstream ends of the industry, diversifying from supplying equipment like battery cells or power conversion systems (PCS) or developing and owning projects to add system integration into their offerings.

A prominent example from the downstream is NextEra Energy, which was ranked second in the IHS Markit survey.

“They are very large, they do a lot of the building and managing and owning of these assets themselves across various other assets. So it was very natural for them to move into this battery space themselves,” Forsyth says.

RWE, although not yet prominent enough to have broken into the top 10, is another great example, according to the analyst. The Germany-headquartered vertically integrated energy company is “very keen” on progressing its in-house capabilities in battery storage, with a number of projects in the works in the US and Europe, including two hybrid plants pairing run-of-river hydropower with 117MW of batteries in Germany.

RWE is still an unusual example however, because what the company is doing requires in-house capability that is significant — “not all developers have the global scale to make this cost worthwhile,” Forsyth adds. RWE is also working with system integrators, for example, Wärtsilä Energy will supply the developer with 80MWh of battery storage equipment and controls platform for its Hickory Park solar-plus-storage project in Georgia, US.

Instead, the bigger threat to the ‘traditional’ system integrators in this young industry is what Forsyth describes as “mid-size developers willing to procure batteries directly,” helping them save margin on the largest cost piece of a BESS. Those developers will then outsource the integration to a system integrator or an EPC capable of assembling and commissioning the system.

A lot of those developers are willing to try and do as much of that procurement and putting together the project by themselves, which could eat into integrators’ market share and margins.

That said, IHS Markit has observed that others that have tried that strategy are starting to back away from it, and once again calling on the system integrators for their specialised knowledge and experience.

“Over the last six months, what we’ve noticed is that people are starting to back away from this, simply because there is risk that people weren’t fully aware of and it isn’t clear in this case, who takes on that role, of taking on that risk of building and commissioning that system.

“There is inherent risk involved and a lot of the EPCs and others that have stepped into this space aren’t quite experienced with building and commissioning energy storage systems. That’s kind of why we’re seeing a shift back towards using more system integrators.”

From the other end — upstream — batteries manufacturers are definitely moving downstream and doing more of the integration work themselves.

“BYD is a classic example. They’ve been there for quite a while offering their full containerised system, both AC and DC, including the PCS.”

Other large international battery OEM players like LG Energy Solution, CATL and Samsung SDI have launched their own plug and play solutions which are fairly easy for EPCs or integrators to work with, again, eating into what might previously have been the preserve of the integrator alone.

Oliver Forsyth notes however that the big caveat is that with the exception of BYD, the others are not PCS makers, so they are supplying their solutions with DC connections only, and therefore largely targeting the US solar-plus-storage market where that configuration is most in demand.

The recent acquisition by LG Energy Solution of NEC ES — one of the global market leaders until its exit from the industry and still accounting for a 4% share of the US market — is an intriguing proposition in this regard, with LGES having said it will leverage the acquisition to extend its system integration capabilities.

For battery OEMs to take a significant share of the system integration market, they will need to develop their software, their O&M capabilities and ability to offer long-term whole system warranties, manage the asset and be able to integrate the PCS.

It will take them some time to do this, but Forsyth says that in three to five years from now, that could be a big threat for system integrators.

Meanwhile, the energy storage divisions of solar inverter manufacturers SMA Sunbelt and Sungrow have already made incursions into the system integration space: both ranked in the IHS Markit top 10.

“Obviously, there’s a level of understanding of the PCS and the power electronics that gives them an advantage in that space. How much of an advantage? It’s not large enough to completely dominate the market, but there is something there,” the analyst says.

“We’ve seen some of those major PCS providers step in, to some extent, because of the inverter market being so competitive, it was a natural step for them into the battery space. We’ve seen them do well,” he says, noting that SMA Sunbelt has had much of its success in Europe, while Sungrow has done well within China and is now starting to grow a “significant global presence” in Europe and the US.

Energy management system expertise

One piece of IP held firmly to by system integrators and still considered an advantage is their expertise with energy management systems (EMS).

System integrators have deep knowledge of the hardware required for BESS projects, which in turns makes them well qualified to know what sort of software will drive that hardware.

For developers or equipment manufacturers, EMS or battery management system (BMS) technology is a nascent technology within a market that’s still a relatively niche market compared to their main activities.

Exceptions are the likes of RWE or NextEra, that have developed some in-house capabilities around the EMS, but these very much sit as exceptions, or perhaps LGES, which has acquired those capabilities via NEC ES.

“It’s that marriage of the hardware and the software, which is tricky and each of the hardware from the integrators — even from each of the battery OEMs — is slightly different. So you have to understand that technology to be able to apply that software,” Forsyth says.

“It’s hard for an outside player to get into that, because they need to understand that level of hardware, which you may only understand if you’ve built that hardware from the ground up.”

One advantage that gives system integrators is that they can apply their EMS across projects using systems and components from different vendors, opening up their pipeline of potential projects versus a developer doing it in-house or an OEM working on its own hardware only.

Room for smaller players

An interesting niche within a niche are the third-party EMS providers, like Indie Energy or Fractal in the US, which Forsyth describes as EMS core providers.

These companies are competing with system integrators to some extent, and offering their EMS tech to developers which will in turn likely hire integrators for the bulk of the project work. The developer could get the EMS from the system integrator but instead is taking the extra step of going to a third party for it.

“In that step, you have to be obviously offering something substantially better, or be able to justify why you should take a step further and go to a third party provider. And clearly it’s happening across the market and so there is clearly some value there.”

Forsyth is curious to see how this will play out, he says, because system integrators are recognising the threat and investing in their software to try and even the playing field.

In a more general sense, will there be room for smaller players alongside the global system integrators?

It is likely there will be consolidation globally in such a competitive market with such tight margins, where trends, Forsyth says, are “constantly changing”.

Nonetheless, there will be unique local challenges that might require locally focused companies to handle, for example grid codes, which can vary hugely from region to region, and of course language barriers. It can also be cheaper to do business with those smaller players.

Conversely, big players like Fluence are “kind of trying to go everywhere”.

“They’re spreading all over the globe, trying to get these local competencies — and that’s great if they can make sure they can grow and make those markets work for them — but it is also a costly expenditure,” Forsyth says.

Customers will need to make the choice between a locally-focused system integrator that has more in-depth knowledge of their market and its grid codes and may come in at a lower price, or an international or global player that might be more expensive and have less specialised knowledge but is able to point to its track record and quality of projects already installed.

‘Challenging space to be in’

New market entrants beware. As the cautionary tale of NEC ES demonstrated, making a profit in the system integration space is challenging.

“It is something that a lot of the investors of these companies, are trying to figure out: will this company be profitable long term? Because I don’t think many of them are, it is a challenging space to be in,” Forsyth says.

Not only is there a lot of competition but customers are expecting price declines to come “almost year-on-year,” yet the industry is currently seeing a lot of raw materials and logistics-driven price spikes.

“I think there are routes to make this profitable but again: this market space can’t have the amount of system integrators that we have at the moment.”

Back in October last year, IHS Markit forecast that 2021 would be a year with more than 12GW of battery storage installations worldwide, with the market to exceed 30GW by 2030. System integrators have unquestionably been the pioneers of establishing this industry but what role — or roles — they will play going forward is going to be closely watched.