Europe consistently breaks stationary battery storage deployment records, but more still needs to be done to accelerate uptake, according to a new report.

With the solar, energy storage and e-mobility industry sectors gathering at the Intersolar event in Munich, Germany, this week, European solar PV trade association SolarPower Europe has just published its ‘European Market Outlook for Battery Storage 2025-2029’.

The continent’s fleet of cumulative installations stands at just over 61GWh, according to the report, which offers analysis of the market, forecasts of how it will develop under three scenarios, and recommended actions that SolarPower Europe is advocating for to accelerate deployment.

Last year saw 21.9GWh of deployments across utility-scale, residential and commercial & industrial (C&I) market segments, breaking the record for an eleventh consecutive year. Around 18.5GWh of those deployments were in European Union Member States.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The total number is slightly higher than the 2024 figures released a couple of months ago by the European Association for Storage of Energy (EASE), which, in partnership with the consultancy LCP Delta tallied 21.1GWh of installations last year in its ninth annual European Market Monitor on Energy Storage (EMMES) report.

EASE-LCP Delta gave the grid-connected output of those batteries as 11.9GW, while SolarPower Europe did not offer gigawatt or megawatt numbers in the version of the report seen by Energy-Storage.news.

However, after 2022 and 2023 saw significant boosts in demand for residential batteries driven by energy security fears and soaring electricity prices, 2024 was the first year in five that the growth rate slowed. The market increased by about 15% on an annual basis, whereas previously, it experienced a near-doubling year-on-year for three years.

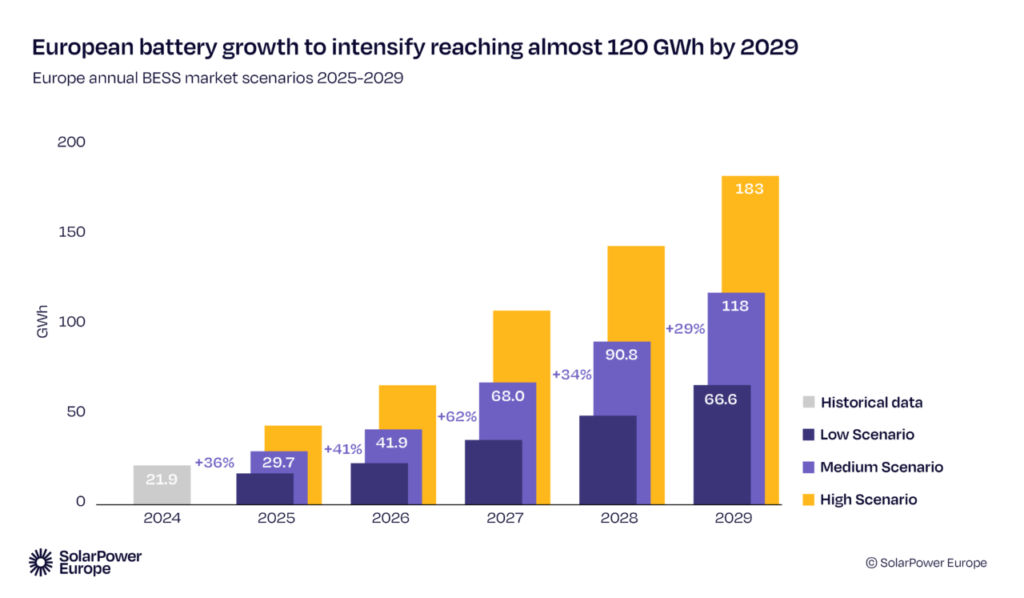

This year, the trade association’s analysts expect to see around 29.7GWh installed in Europe. Utility-scale installs are forecast to overtake residential for the first time, unlike in the US, which has seen the opposite dynamic play out with utility procurements driving the market much faster than residential purchases.

The report also found that if market growth continues along the lines of current trends, Europe is on course for 400GWh of cumulative stationary battery storage deployments by 2029, including 344GWh by the 27 EU Member States, approximating a compound annual growth rate (CAGR) of about 45%.

“If Europe has already entered the solar age, the battery storage age is just beginning,” SolarPower Europe CEO Walburga Hemetsberger said.

SolarPower Europe is allied with EASE, WindEurope and VC investor Breakthrough Energy in the Energy Storage Coalition, which collectively advocates for European action to promote storage.

More needed from policy and regulation

Despite this surge, SolarPower Europe said the continent is not on track to deploy the 780GWh of battery storage it claimed will be needed to ensure flexibility, reliability and decarbonisation of the energy sector in line with policy targets by 2030.

This number came from the association’s mid-2024 study, ‘Mission Solar 2040: Europe’s flexibility revolution,’ which argued for the role of flexible resources including battery storage to enable the integration of high shares of renewables and dramatically reducing curtailment—paying generators to stop exporting to the grid when there is an overabundance of solar, for example.

Even under SolarPower Europe’s most bullish scenario, cumulative installations would only reach 600GWh by 2029, the new report claimed.

“With solar energy mainstreaming across the continent, now is the time for European decision-makers to put batteries at the centre of a flexible, electrified energy system,” Hemetsberger said.

With three markets – Germany, Italy and the UK – accounting for around 80% of installs last year, more efforts are needed to ensure uptake of storage in the rest of Europe as well as to maintain momentum in the leading countries.

SolarPower Europe offered five recommendations for actions that it said should be taken at the policy and regulatory levels. Chief among them is that the European Commission (EC), should adopt a so-called Energy Storage Action Plan within its flexibility planning.

This would ease market barriers, harmonise markets across EU countries and place energy storage at the heart of national energy strategies, it said. The trade association is also calling for reform to grid connection procedures and pricing frameworks, full and fair access to electricity markets, competitive and accessible balancing markets and enhancements to smart metering and data communication standards.

“We urge the European Commission to double down on their efforts here and come forward with an EU Energy Storage Action Plan as part of a broader Energy System Flexibility Package. The recent electricity outage in the Iberian Peninsula is a stark reminder of why this is important,” said SolarPower Europe CEO Hemetsberger.

The report can be found here (PDF).