A total of 11.9GW of energy storage across all scales and technologies was installed in Europe in 2024, bringing cumulative installations to 89GW.

According to the ninth annual edition of the European Market Monitor on Energy Storage (EMMES) from trade association European Association for Storage of Energy (EASE) and research consultancy LCP Delta, 2024 was a record year of deployments.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The report summarises historical activity, key takeaways, analysis and forecasts on the future direction of Europe’s energy storage markets.

It found that last year, 11.9GW/21.1GWh of storage was deployed in the continent, which was a modest 2% increase in power capacity and a more significant 35% increase in energy storage capacity.

Front-of-the-meter (FTM) additions of large-scale energy storage totalled 4.9GW/12.1GWh, which was a 60% increase in megawatt terms and 280% in megawatt-hours capacity.

In the behind-the-meter (BTM) customer-sited segment, 6.9GW/9.6GWh was added, which in contrast to FTM were declines of 17% and 19% respectively.

In contrast to the US market, which is heavily skewed to the FTM segment versus BTM in about an 80:20 ratio, the European market is, therefore, about 60% BTM installs and the remainder grid-connected front-of-meter (FTM) large-scale assets.

However, 2024 marked the first year that FTM installations in Europe outpaced BTM in energy capacity. LCP Delta energy storage research manager Silvestros Vlachopoulos commented in a webinar to present key findings from EMMES 9 that this trend is expected to continue.

Nonetheless, it was the second year in a row that more than a million European homes installed battery storage, typically co-located with solar PV systems and with Germany and Italy as the two leading markets by country.

By way of context, US trade group American Clean Power Association (ACP) and research firm Wood Mackenzie’s US Energy Storage Monitor recently found that 12.3GW/37.1GWh of new storage was deployed in that country in 2024.

That was also a new record, marking the first time US installs exceeded 10GW in a calendar year, and the US saw more overall growth than Europe, with a 33% rise in megawatts and a 34% uplift in megawatt-hours from 2023.

Last year Europe had slightly outdone the US to see its first year where new installs were in double digits of megawatts, with LCP Delta finding just over 10GW of installs in 2023, while Wood Mackenzie tallied 8.7GW of new additions from the US market.

Of the 89GW of cumulative installations in Europe, the majority, 53.1GW, is pumped hydro energy storage (PHES) and electrochemical storage—primarily lithium-ion (Li-ion) batteries—accounts for 34.9GW.

However, as Vlachopoulos noted, most of Europe’s pumped hydro was installed several decades ago during the 20th Century. While some new PHES additions are being seen, electrochemical storage is the fastest-growing market segment, comprising 13GW of FTM storage and 22GW of BTM storage.

Thermal energy storage represented the majority of the remainder, with about 0.3GW of other technologies, such as compressed air and carbon dioxide-based storage, accounting for the rest.

‘Ambitious forecast’ out to 2030

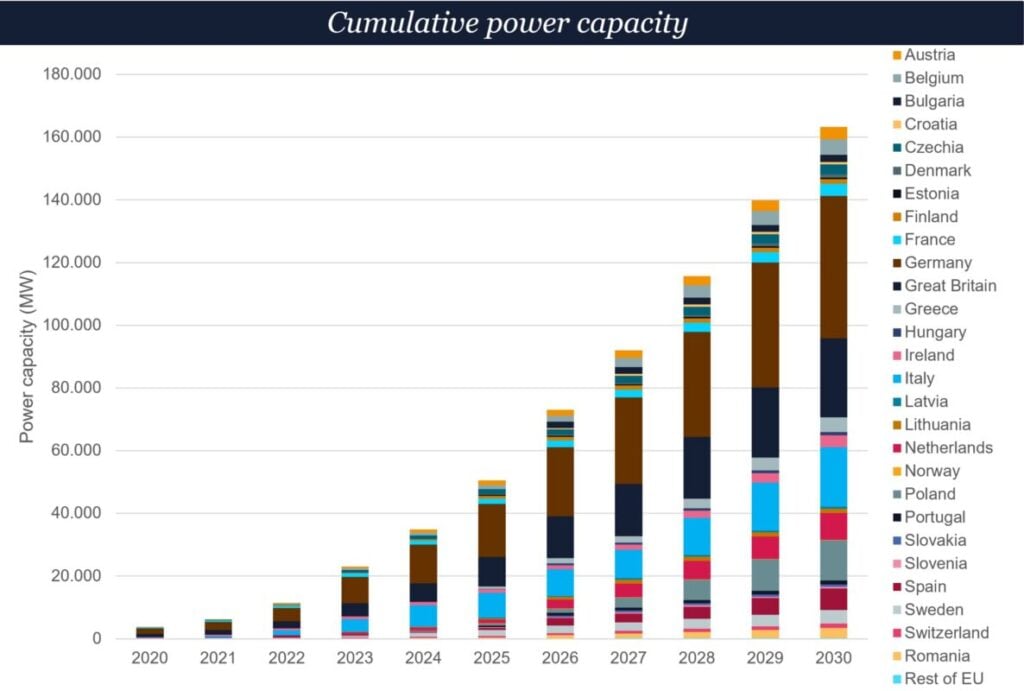

LCP Delta is predicting that by 2030, an additional 128GW/300GWh of electrochemical storage will be installed, meaning that Europe will have cumulatively installed about 163GW of mostly battery-based storage by the end of this decade, Vlachopoulous said.

The analyst said this “quite ambitious forecast” is driven by the nuances of market development in different countries and the growth of scale will be different across the various market segments.

His LCP Delta colleague Eibhilín Cadogan, battery storage research lead, discussed BTM market developments, noting that Europe now has 17 million solar homes and 3.4 million homes with battery storage.

The fall in installations from 2023-2024 can largely be attributed to 2023 seeing a peak in installs at 8.1GW BTM, driven by the energy crisis sparked by Russia’s invasion of Ukraine and subsidy schemes.

Energy price pressures eased somewhat in 2024, and many subsidy schemes were scaled back or phased out. At the same time, the consumer cost of borrowing has increased.

As later said in the webinar by Vlachopoulos and EASE policy analyst Jacobo Topsoni, Cadogan said market recovery and acceleration of growth would likely be seen from around 2027, with electricity cost rises, price spikes and volatility as well as new business models among the factors.

Meanwhile, Vlachpoulous said installation numbers will grow in the next few years as the UK—leader in FTM installs—clears its large queue of projects awaiting grid connection, around 15GW of projects supported by European Union (EU) Recovery & Resiliency Facility funding come online from 2026-2027.

From 2028-2030, “big schemes and big volumes,” including Italy’s 50GWh MACSE auctions and Germany’s GridBooster storage-as-a-transmission asset projects, will come online, among others like Poland’s capacity market projects.

Even more so, towards the end of the decade, rather than seeing “one or two markets doing the heavy lifting,” LCP Delta expects to see a rollout of storage in countries across Europe, Vlachopoulos said.

Falling CapEx requirements for energy storage investment and EU initiatives such as the requirement for EU Member States to assess their electricity system flexibility needs, for which storage will be a key tool to address gaps, will be among the drivers.

EU flexibility assessments likely the biggest driver of state aid

EASE’s Topsoni picked up this and other policy themes, explaining that the European Commission (EC) is seeking to “give clarity to energy storage developers,” particularly around state aid rules.

The EU Clean Industrial Deal package, which comprises “many things, many initiatives,” includes the Clean Industry State Aid Framework. This framework will aim to support the uptake of renewable energy, aid industrial decarbonisation, and facilitate clean energy manufacturing across the value chain.

For Member States to qualify for state aid, each will need to enact market reforms to ensure that energy storage can access wholesale markets, provide frequency and non-frequency ancillary services and provide market-based dispatch or grid congestion management.

In other words, Topsoni said, countries will need to show evidence that the state aid supports energy storage backed by a strong business case, and will not just subsidise projects for the sake of building them.

Among the policy drivers discussed, however, Topsoni said that non-fossil fuel flexibility assessments would “probably be the biggest one,” for storage, although these would take time to develop into market opportunities, again, probably from around 2027 onward.

Member States would have to assess how much flexibility will be needed at different times of day, in different time frames, from intraday to monthly and even seasonal flexibility.

They would then have to calculate how much energy storage and other flexibility tools, such as curtailment, would fill those gaps and develop so-called “super schemes” to procure those resources.

There would be a “huge variation” from country to country, but again, Topsoni said there will be a need to ensure a strong business case beyond the EU support scheme backs storage.

Other drivers including industrial decarbonisation and pan-European harmonisation of things like network tariff reforms to remove double taxation of storage for drawing energy from and injecting power into the grid are also on the table, but there is less certainty as yet about the direction the EU might take in these areas.

Watch a discussion of Europe’s ‘hottest markets’ for energy storage, from our publisher Solar Media’s 2025 Energy Storage Summit EU held in February on our YouTube channel below.