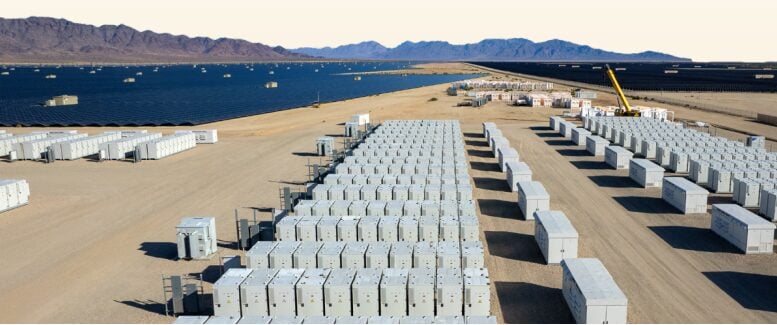

The Solar Energy Industries Association (SEIA) has released a whitepaper recommending the US deploy 10 million distributed solar installations and reach 700GWh of installed energy storage capacity by 2030.

The whitepaper analyses the economic and energy security imperative of having a strong storage sector, outlining policy recommendations to open markets for storage development, build financial support, grow a domestic storage supply chain and progress long-duration energy storage (LDES).

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

According to market research firm Wood Mackenzie, there is currently 83GWh of installed energy storage capacity in the US. This includes about 500,000 distributed storage installations. Forecasts show that storage capacity is expected to reach 450GWh by 2030 under a ‘business as usual’ scenario.

Wood Mackenzie’s reporting places US energy storage capacity over 600GWh from reaching SEIA’s recommendation of 700GWh and forecasts for deployed energy storage by 2030 would place the US about 250GWh away from SEIA’s recommendation.

SEIA’s recommendations for accelerating energy storage development and manufacturing include:

- Preserving the federal tax credit for standalone storage

- Ensuring equal grid access and fair compensation to storage for grid services

- Reforming interconnection processes to account for storage flexibility

- Establishing affordable retail rates for storage charging

- Supporting domestic manufacturing with targeted trade policies and streamlined permitting

- Implementing state-level procurement programs

- Emphasising investments in low-income communities, including areas disproportionately impacted by extreme weather and poor air quality

- Investing in further development of long-duration storage “

Several of SEIA’s recommendations are already and likely to be met with future resistance. With US president Donald Trump taking action, of which the full extent is not yet known, to weaken the Inflation Reduction Act (IRA) and pause federal fund disbursement.

Investment Tax Credits (ITCs) were largely affected by the IRA. As of 2022, the IRA broadened access to ITCs to include standalone energy storage, whereas previously only energy storage systems installed with and charging from solar PV systems were eligible.

Additionally, before the IRA, ITCs could only be used by setting up complicated tax equity joint ventures to invest in the project. The IRA introduced a new way to sell ITCs, through ‘transferability’(Premium access article), allowing developers to sell ITCs associated with clean energy projects to another company in exchange for funds.

The IRA and ITC, both for standalone and solar hybrid storage, have also been helpful in accomplishing state energy storage procurement goals, which many US states are still lacking. However, a lack of procurement goals does not always signify a lack of storage.

For example, Texas, where the grid is managed by the Electric Reliability Council of Texas (ERCOT), is the second most active battery energy storage system (BESS) market in the US after California, despite not having an energy storage procurement goal.

There may also be trouble in investing in low-income communities. The president continues to sign orders such as “Ending Illegal Discrimination And Restoring Merit-Based Opportunity”, which vilify diversity, equity and inclusion (DEI) practices, further shifting the onus of investing in under-supported communities to commercial enterprises.

Included in the president’s action is a rescindment of executive order 12898, which directed federal agencies to identify and address environmental justice in minority populations and low-income populations.

Supporting domestic manufacturing and creating a robust energy storage supply chain in the US will also be crucial. China already has a robust battery supply chain. Iola Hughes, head of research at Rho Motion said of the US storage market for Energy-Storage.news:

“The election of Donald Trump as the 47th President of the United States raises some questions about supply, given the heavy reliance on Chinese cells and the potential for higher tariffs. An increase in tariffs on Chinese batteries for BESS—currently set to take effect in 2026—would strain US integrators and developers, especially in the near term, where few domestic alternatives exist.”

Recently, the IRS released an amended cost breakdown of BESS to be used for calculating if a product qualifies for domestic content tax credit incentives, and our colleagues at PV Tech published an article looking at what changed in 2025-08 with regards to solar PV technology.

Joan White, SEIA’s director of storage and interconnection said of the whitepaper: “The US storage market is at an inflection point, but with the mix of policy support and private, state and federal collaboration, we can achieve SEIA’s storage targets while creating jobs and ensuring reliable, around the clock power for every home and business in this county.”

In addition to the whitepaper, SEIA is releasing a 50-state guide to energy storage policies at the state level, which can be accessed here.