Software is rapidly becoming recognised as key to the value proposition and bankability of energy storage, which in turn lies at the heart of the energy transition. Andy Colthorpe speaks to three providers of software aimed at the energy storage industry. The full version of this article appeared in Volume 26 of the quarterly technical journal, PV Tech Power. Subscribe to the journal or buy individual issues here.

If energy storage is the great enabler of the clean energy transition, then software is the great enabler of energy storage. A lot of discussion rightly focuses on hardware: the types, sizes and quality of batteries, the right configurations of power conversion equipment and so on. Yet it is software that drives the systems to deliver their optimal value and allows both the machines themselves and the humans operating them to make the right decisions.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Energy storage is perhaps the most versatile asset available today to modernise and decarbonise the electricity grid, allowing for the integration of renewable energy, enhancing the resilience and quality of electricity supply and lowering the cost of operating the network.

Batteries can be charged from the grid at off-peak times when power is cheap or from renewable energy at zero marginal cost of fuel. They can discharge rapidly to balance out supply and demand or maintain the operating frequency of the grid. They can reduce the use of fossil fuels to meet the peak demand periods which prove so expensive and polluting for everybody and they can reduce the need for the build-out of transmission and distribution infrastructure. They can even be used to bring offline thermal generators back to life much more efficiently than diesel generators, which could be a valuable use case in those areas where the transition to renewable energy will be more gradual one.

Energy storage can do all of these things, and much more. Often at the same time, or at the very least, from the same asset, at different times. In many cases, being able to do more than one of these things will be central to the value proposition that makes a battery project stack up economically. But in order to be able to serve these applications smartly and in a way that doesn’t lead to excessive wear and tear and degradation of the asset, smart software is as important as choosing the right battery cells and other hardware.

In this article, we speak to providers of diverse software and software-as-a-service solutions to the battery energy storage industry. We look briefly – and in simplified form – at:

Modo Energy, which offers data intelligence on the UK energy storage industry via a cloud-based platform.

ION Energy, using machine learning to provide services including measuring and predicting degradation in battery storage at the cell level.

Wartsila Corporation’s Intellibidder software, which matches energy and resource availability with the right market-based opportunities.

Informational liquidity

“The world’s got a challenge that we need to build more renewables and storage, everybody knows that. And the energy storage industry has got a challenge that it’s a maturing market, with immature technologies that are constantly changing,” Modo Energy CEO Quentin Scrimshire says.

From technology risks to finance risks and various regulatory risks, the sector remained the preserve of early adopters and investors for a while. That profile is now changing, Scrimshire says, and software-driven data companies can help people become better informed of the risks and how to make the right decisions.

“What we do in our analysis, and what our software is capable of doing, we call it ‘informational liquidity’’. We provide informational liquidity to the market through data, which helps everybody make better informed decisions, which essentially greases the wheels of getting money into the sector and getting more energy storage built. If we weren’t providing this kind of service, there’d be a lot of gaps and black holes in people’s knowledge. And that will stop investment happening.”

Like many good stories in the tech world, Modo Energy’s tale really begins with a huge pivot, co-founder and CEO Quentin Scrimshire says. After leaving UK market-leading aggregator Kiwi Power to start up Modo, the plan had been to create software that could automate participation in market opportunities for grid and energy services.

“The idea was, if you’ve got an asset that’ll be spending a lot of the time in the Balancing Mechanism, participation in that market should be automated. We could sell that directly to asset owners, and they could get into the market and register with National Grid. And they could save themselves some money and hopefully improve performance. Win-win,” Scrimshire says.

The company raised capital and spent six months building the software to do that during 2019. Then came the realisation that competition for that type of service in Britain’s energy storage market was growing fierce, with big players like utilities Centrica and EDF able to offer floor prices to customers and “impressive new players” like Habitat Energy and Arenko offering state-of-the-art optimisation and trading.

“We also realised that the market wasn’t growing quite as big as we expected, so batteries weren’t at that time being delivered or built as fast as we expected. We had a conundrum. We were burning cash and we said, “What else should we do with with all of this data and software that we’ve built?” By that time, we had built essentially a model of the whole UK asset portfolio, the whole energy storage market, and how those assets were behaving,” the Modo CEO says.

The team at Modo Energy decided that instead, the company would become “an independent and impartial provider of data intelligence” on the country’s energy storage market. This increased its addressable market from battery asset owners to all interested stakeholders and helped Modo to find its own, less competitive, niche. The ‘secret sauce’ that makes the offering standout, Scrimshire says, is the data science that enables Modo to offer that “informational liquidity” to the market.

“So what we’re trying to do is on a macro level, get more assets built because that helps the world. But on a day-to-day basis, what does that really mean? It’s informational liquidity.”

‘Slicing and dicing from the same data set’

ION Energy on the other hand more explicitly joins the dots between hardware and software. The Mumbai, India-headquartered company was contracted last year to use its platform, Edison Analytics, to manage battery cell degradation across a portfolio of around 600MWh of assets for US energy storage developer esVolta.

Machine learning technology and algorithms can be applied to vital services like predictive maintenance — tracking data from the many thousands of sensors at esVolta’s sites to identify the health of the systems at every single point and figuring out how the batteries can best be used to maximise revenues while minimising degradation — ION Energy CEO Akhil Aryan says.

Someone that uses an energy storage asset to buy and sell energy off the grid and make money from arbitrage, for example, would typically make decisions based on the price of buying and selling that energy. When that means charging and discharging a battery pack, however, the “hidden cost of degradation” has to be factored in.

“When you charge it and every time you discharge it, you’re actually causing the battery to degrade. If you want to get a sense of your net profitability per transaction, you would have to convert that degradation into a dollar value and take that as an input into your trading strategy,” Aryan says.

“That’s one of the things that we do with our feature called dispatch optimisation, meaning that it takes in the forecasted prices for the next seven days on a 24 hour window, and helps identify the best opportunities to dispatch the power, but scheduling that dispatch, by co-optimisation with the degradation of the battery pack. So that you’re making sure the battery never witnesses temperatures above 60 degrees, it’s being discharged at less than 1C discharge rate.”

The CEO had his own pivot moment when it came to co-founding ION Energy: after finding success in developing and selling various IT and artificial intelligence (AI) ventures, he decided in 2015 it was time to leave a role in the advertising technology space and focus on solving “problems that really matter”.

“I decided to think about places where I can leverage my experience, but have an impact on some of the real problems that face humanity,” he says.

Like many in the tech world, Aryan was following Tesla “quite closely” around that time when he realised that Tesla is “an energy storage company that also sells cars”. This got him interested in batteries and another realisation that while batteries were both complex and expensive assets, there could be a “tremendous value in leveraging data from how energy is being consumed from batteries to help extend the life and performance of those assets”.

In other words, applying his experience from “pure software machine learning” to the context of energy storage: “Because that has a direct impact on the adoption of new energy assets, both in mobility and stationary”.

ION Energy has worked — and continues to work — in a number of areas including developing its own battery management system (BMS) and providing support to the growing e-mobility industry. Aryan says that over the years, “general data literacy has really gone up significantly,” meaning that nearly all companies believe in and understand the value of data.

Using that data smartly and generating insights however, is another question and then becomes more of a “creative problem” than a computational one, the CEO says. Amassing terabytes of sensor data in a server inherently has no value, which is where data science comes in to extract or create value.

“Edison, which is our analytics product, is an endpoint for data streams that are being generated from any sensor in any asset. In the start, we’re limiting that to new energies, meaning that you have battery management systems, you have inverters, you have even independent sort of sensors, inside of any system that are now capable of logging data, and collecting that data in one sort of central database.”

That data can then be used in any number of ways, including or besides predictive maintenance. Different departments managing the same portfolio can benefit from essentially “slicing and dicing the same data set”, Aryan says.

Making the revenues stack up

Unlike Modo Energy or ION Energy, Wärtsilä Corporation is not purely a software and data analytics company, it’s a multi-billion Euro power equipment company that has a software and data analytics team in-house within its energy division.

It did however enter the energy storage industry when it acquired an energy storage company with a deep background in software, taking over Greensmith Energy in 2017. Greensmith’s founders were “really heavily into cloud computing” and more than 10 years ago realised that batteries would play a “very central” role in the clean energy transition that was starting to take shape, Luke Wittmer, a data science and optimisation manager at Wärtsilä, says. The founders also recognised, Wittmer adds, that the best use of batteries was not a hardware question, but a computing one.

A battery is still “arguably an expensive asset, but it can serve critical functions simultaneously. It can do so many things at once, in both directions, charging and discharging, it’s a really handy balancing tool for any grid,”Wittmer says. But without software such as GEMS, the software platform Greensmith developed to act as a “central computing hub for any power generation asset,” not just for batteries, many of the fundamental problems of renewable energy would remain unsolved.

More recently, Wärtsilä launched Intellibidder, an application layer that adds automated market bidding capabilities for energy asset operators. For battery storage plants, that increasingly means enabling the stacking of multiple applications and therefore multiple revenues.

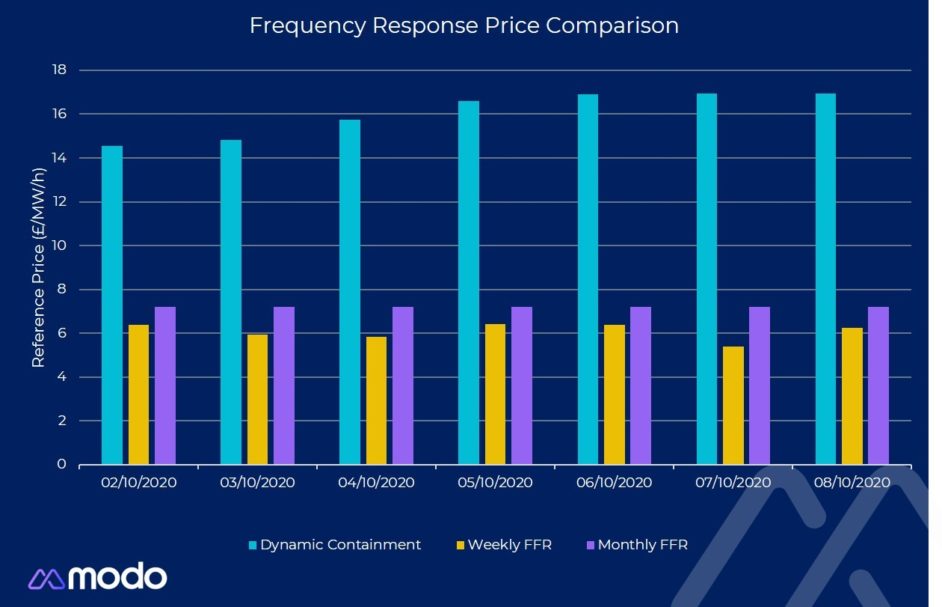

“Whether it’s the UK or Australia or some of the US markets where we’re active, the value of what we’re doing with Intellibidder comes from that revenue stack. It’s very common for us to participate in ancillary services, so in the UK, that’s the Balanc-

ing Mechanism, or frequency response. Whatever the ancillary service markets are in your area, Intellibidder is going to look at the prices of each of these markets, look at your contractual position.”

The software then determines to ensure that contract is met, but could then decide that, for example, based on prices in other markets, different fractions of the remaining power stored in the battery could be played into different markets.

“So if there’s a price spike in the energy price, and you’re discharging for 15 minutes or something, at some power level, if I have a 100MW site, and I bid 25MW to do that, then I’ll be discharging 25MW, but I still have this other 75MW,

that if suddenly the Balancing Mechanism needs me to discharge, you can do that on top of it. You’ll be doing these things literally stacked on top of each other, until all of your power is allocated somewhere.”

Empower the customer, empower consumers

One really interesting point is that unlike battery manufacturing, software doesn’t need gigafactories to scale — valuable services can come from startups just as easily as they can from established market players.

So why buy or subscribe to data analytics or other software services rather than develop it in-house? ION Energy’s Akhil Aryan points out that his customers are in the energy business, not in the data analytics platform business. Putting that side of things into the hands of a specialist software-as-a-service provider can empower those customers to drive up their ROI, he says.

And for all that software technology matters, having a motivated team with the right skillsets behind it is just as, if not more, important. Quentin Scrimshire says that “everybody at Modo is an engineer, or data scientist or software engineer of some sort,” able to meet the challenges of combining an understanding of the very complex, highly regulated energy market with tracking the emergence of opportunities that energy storage presents. In time, Modo’s platform could be as important for energy as a Bloomberg Terminal is for other kinds of trading.

Luke Wittmer would argue too that although now part of a much bigger entity, the cloud computing evangelist ethos of Greensmith Energy lives on as part of Wartsila. The corporation has kept much of the Greensmith core intact as a “very autonomous software group within Wärtsilä,” or “a pure software shop”— albeit one dedicated to solving some of the biggest questions facing the energy transition.

Cover image: ION Energy's Edison Analytics portal shows data metrics on state of charge, battery health and more to build up a full picture of the asset. Image: ION Energy.

This is an extract of an article which appeared in Volume 26 of PV Tech Power, the quarterly technical journal dedicated to the downstream solar PV industry, including 'Storage & Smart Power', a section contributed by Energy-Storage.news. Subscribe to the journal or buy individual volumes, here.