Peak Energy, a startup claiming to be the ‘first American venture to advance globally proven sodium-ion battery systems,’ has raised US$55 million in a Series A funding round.

The company, based in Denver, Colorado, and San Francisco, California, said on Wednesday (17 July) that it has secured the financing ahead of beginning pilot production of sodium-ion (Na-ion) batteries and energy storage system (ESS) technology in 2025.

The investment round was led by Xora Innovation, an early-stage tech venture capital (VC) arm of Singapore government-owned investment group Temasek, with participation from critical infrastructure industries investor Eclipse, strategic partner TDK Ventures and other parties.

Sodium is a much cheaper and more abundant material than lithium. Na-ion batteries are not capable of energy densities as high as lithium-ion (Li-ion) and are expected to last fewer cycles.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

However, they have the potential to be low-cost if produced at scale, coupled with an expectation of a lower risk of thermal runaway.

Na-ion batteries can also use many of the same production methods as Li-ion batteries. They have been identified as a potential solution for less demanding applications, such as shorter-range electric vehicles (EVs) and stationary battery energy storage systems (BESS).

Peak Energy, led by CEO Landon Mossburg, who was formerly with the North American arm of Swedish battery startup Northvolt and Tesla Energy before that, emerged from stealth mode in October 2023, announcing the raise of US$10 million in a round led by Eclipse and participated in by TDK Ventures.

At that time the company said it wanted to offer grid-scale BESS technology at 50% lower cost than incumbent Li-ion solutions.

It will manufacture its products in the US, Peak Energy said, with a group of six customers set to be involved in the pilot programme it hopes to launch next year. While the customers were not named, they include three of the country’s biggest independent power producers (IPPs), and an electric utility, the company claimed.

It aims to open a large-scale factory in 2027 and achieve the industry’s lowest cost per kilowatt-hour by 2030.

Peak Energy not the only horse in sodium-ion race

The company will have some competition. Despite Peak Energy’s claim to be an American first, rival Natron Energy opened a manufacturing plant in Michigan, US, in April.

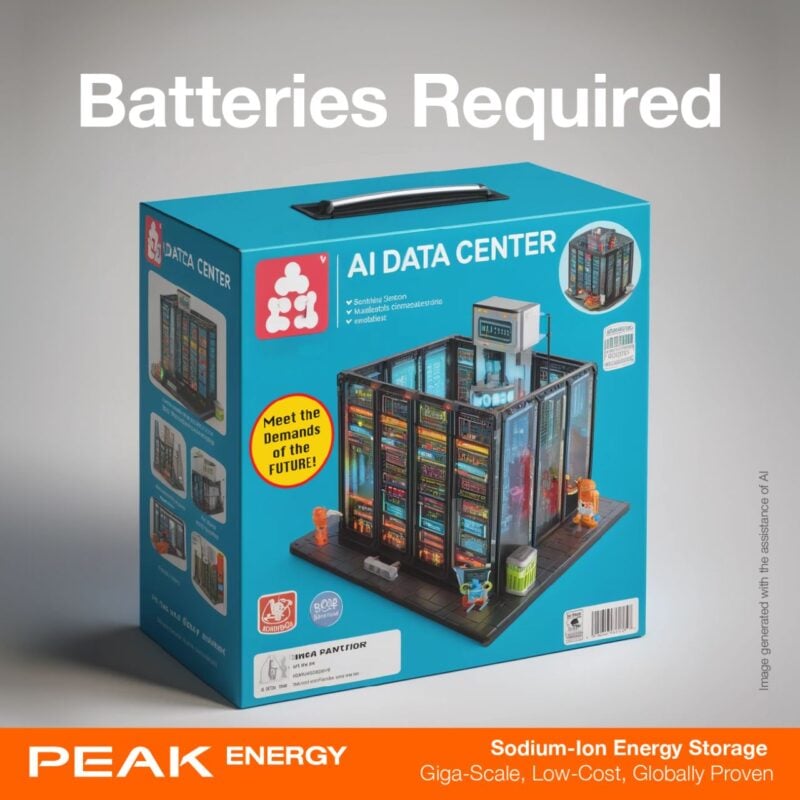

Once ramped, the Natron factory will have 600MW annual production capacity of patented battery technology featuring ‘Prussian Blue’ electrodes. Like Peak Energy, Natron sees data centres as a potential high-demand end market for Na-ion batteries.

In China, the country which currently leads the world for Li-ion production as well as technology development, the first 50MW/100MWh phase of the first grid-scale sodium-ion BESS project in the world went into operation earlier this year.

That project now comprises 42 BESS containers utilising 185Ah Na-ion batteries with 21 power conversion system (PCS) units and the plans are for it to be expanded to 100MW/200MWh.

Various other startups and established battery manufacturers are targeting supremacy in the sodium-ion space. Germany’s Varta in May announced it was leading an R&D consortium supported by the German government.

Peak Energy’s former employer Northvolt is also looking into the technology, two other European startups, Tiamat, and Altris, raised funding in January, while the world’s biggest battery manufacturer, CATL, again based in China, is also developing Na-ion batteries and a gigawatt-hour scale factory was opened in the Asian powerhouse by state-owned power company China Three Gorges Corporation late last year.