4 October 2021: Tesvolt battery storage systems to be paired with green H2 electrolysers

German battery energy storage system (BESS) manufacturer Tesvolt has signed a deal for its systems to support green hydrogen electrolysers, worth about €40 million (US$46.52 million) by 2023.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Tesvolt said today that it is working with energy supply systems company Schaper Group to integrate BESS into renewable electrolyser projects, supplying power when solar or wind generation is low and charged from those sources during times of surplus generation.

Representing Tesvolt’s single biggest order received to date, up to 40MWh of battery storage will be combined with an electrolyser solution from green hydrogen specialist Apex Group. Apex focuses on delivering heat and electricity from hydrogen for industrial customers. Schaper Group will plan and implement controls technologies and energy integration systems.

“We want to enable climate-neutral production for commercial and industrial companies. And for this the Schaper Group is exactly the right partner. In its projects for the hydrogen pioneer Apex, Schaper has demonstrated that energy supply using only renewables is possible,” Tesvolt commercial director and founder Daniel Hannemann said.

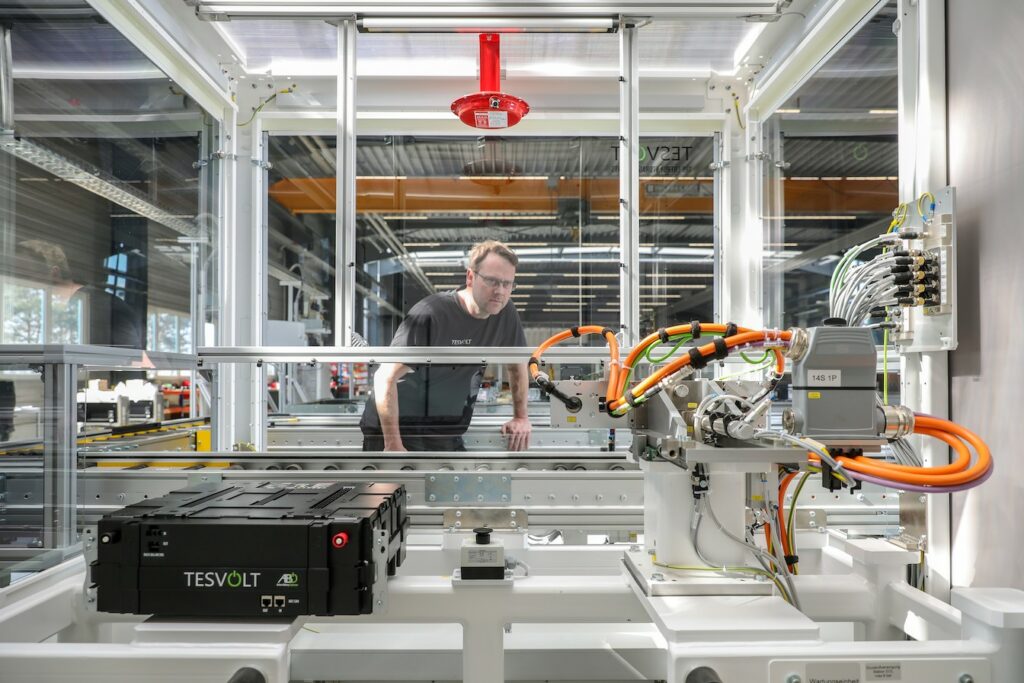

Tesvolt makes its ESS products in Germany using Samsung SDI’s prismatic format nickel manganese cobalt oxide (NMC) lithium-ion battery cells. It recently opened what is thought to be Europe’s first gigawatt-scale lithium-ion ESS assembly plant.

4 October 2021: UK’s AMTE in joint venture to build energy storage battery cell plant in Australia’s Lithium Valley

UK battery cell manufacturer AMTE has created a joint venture (JV) with Australian infrastructure investment group InfraNomics to build battery factories serving the energy storage market.

AMTE said in a press release today that the plan is to initially build a 200,000 battery cell micro production line in Kwinana Industrial Area, a part of Western Australia known as ‘Lithium Valley’ due to its raw material resources and related processing industries’ presence.

Once the micro production line is up and running, the AMTE-InfraNomics JV, called Bardan Cells, is aiming to develop and construct a 1GWh to 2GWh per annum gigafactory for lithium-ion cells to be used in stationary energy storage systems in the region.

AMTE CEO Kevin Brundish said the JV is not just an attractive stand alone investment proposition for his company “given the anticipated demand in Australia for energy storage solutions, but is also attractive as a further test platform for our technologies and will be particularly useful additional experience and proof to investors and customers of our capabilities as we pursue the development of our UK based gigafactory.”

1 October 2021: US$330 million energy transition entrepreneur fund will invest in battery storage

Chicago-headquartered alternative asset management firm Energize Ventures has closed a US$330 million investment fund through which it will back entrepreneurs in areas including battery storage.

The group said the new fund is about 70% funded by institutional investors and family offices, seeking to identify and support energy transition entrepreneurs. Energize Ventures said it sees the rising need for digital technologies to enable sustainable energy growth around the world and wants to back the winners at what it called “this pivotal intersection”.

After the firm already put US$165 million into 14 energy and critical infrastructure sector software companies in its Fund I, including German predictive battery analytics firm TWAICE, its second fund will again focus on areas including renewable energy, mobility, cybersecurity, critical infrastructure, climate resiliency and battery storage.

Investors with Energize include big names in the energy and energy tech sectors, including Invenergy, Schneider Electric’s VC arm SE Ventures, GE Renewable Energy and more. Fund II investors include the likes of Credit Suisse, Xcel Energy, American Electric Power and Equinor Ventures.