Mining giant Rio Tinto has invested US$10 million in battery materials company Nano One, a few weeks after Nano One acquired the lithium iron phosphate cathode business of Johnson Matthey.

Rio Tinto’s investment, which amounts to 4.9% of Nano One’ stock, is part of a broader strategic collaboration between the two companies. Nano One produces lithium-ion battery cathode materials including nickel-manganese-cobalt (NMC), lithium iron phosphate (LFP) and manganese-rich (LNMO) chemistries.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

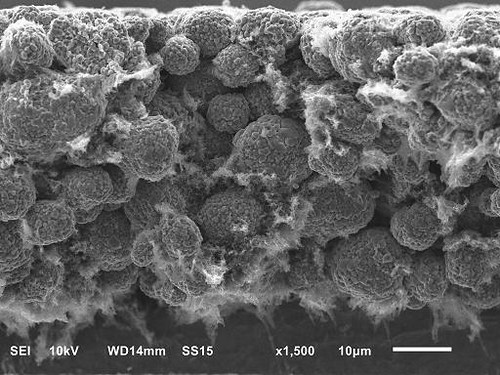

Nano One said the partnership will accelerate the commercialisation of its One-Pot manufacturing technology, which it says produces no sulphate waste stream, and M2CAM (metal direct to cathode) material which uses less water and energy than conventional methods.

The company said its technology can be used to make batteries of all lithium-ion chemistries for electric vehicles (EVs), energy storage systems (ESS) and portable electronics.

The collaboration includes a study of Rio Tinto’s products including iron powders from a facility in Québec as feedstock for the production of Nano One’s cathode materials, as well as the former’s know-how from its Critical Minerals and Technology Centre, a research centre.

The Centre has expertise in the extraction and processing of critical minerals such as lithium and scandium, as well as minerals from Canada, the United States, and other international sources to further drive localidation of the lithium-ion battery value chain, the company said.

On closing of this deal, Nano One will issue a total of 4,643,148 common shares to Rio Tinto at C$2.70 per share, with the investment proceeds going to several specific things alongside general technology and supply chain development, commercialisation and general working capital.

One of these is Nano One’s agreement to acquire 100% of the shares of Johnson Matthey Battery Materials Ltd, a subsidiary of the speciality chemicals and sustainable technologies company based in London, for US$7.9 million. That deal was announced at the end of May 2022.

The main asset Nano One gets is a facility in Quebec which can produce 2,400 tonnes of LFP cathode material a year for the lithium-ion battery sector. Johnson Matthey acquired the facility in 2015, three years after it was launched. It will now be converted to Nano One’s One-Pot LFP process.

Some of Rio Tinto’s investment will also go towards industrial scale piloting of other Nano One cathode active material (CAM) technologies.

Dan Blondal, CEO of Nano One, said: “The global transition to a low-carbon electrified economy will require millions of tonnes of battery materials, so it is critically important to produce these materials efficiently and with the lowest environmental footprint.”

Marnie Finlayson, managing director of Rio Tinto’s Battery Materials portfolio, added: “Localised, clean and secure supply chains are critical for the success of the energy transition that is now underway and this requires partnerships with innovative companies like Nano One to help us differentiate, disrupt and accelerate the path to a net-zero future.”

In related news, Rio Tinto has launched a tender for 4GW of onshore renewables to power three aluminium production and processing assets in Australia, sister site PV Tech reported this week.