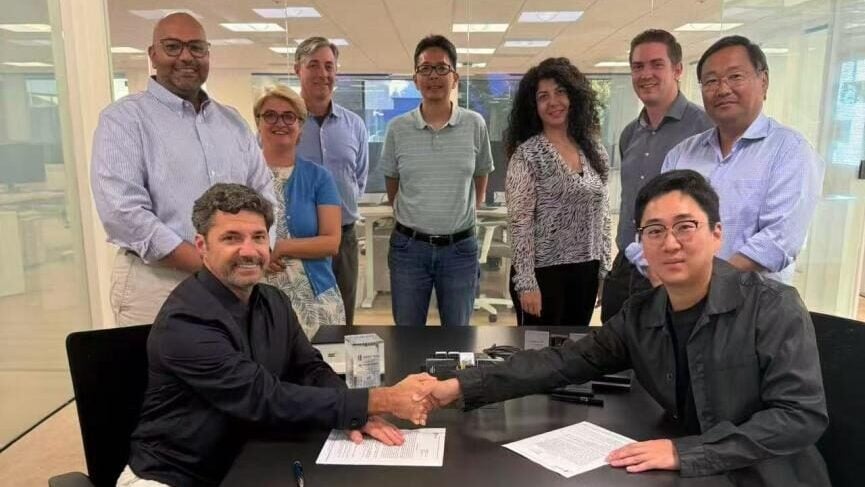

Chinese battery manufacturer Rept Battero and Energy Vault have signed a 2026 supply agreement in the United States.

Under the agreement, Rept Battero will deliver 3GWh of energy storage systems (ESS) to Energy Vault in 2026. The two companies also plan to expand their collaboration in the Australian, US, and European markets.

Rept Battero and Energy Vault have maintained a cooperative relationship for three years, with a cumulative system supply volume exceeding 1.5GWh.

Rept equipment was employed in a recently finalised 100MW/200MWh BESS, integrated by Energy Vault for Jupiter Power in Texas’ ERCOT market.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Rept Battero and Energy Vault also have a 10GWh supply agreement for Rept’s liquid-cooled storage solutions.

In 2024, Rept launched its North American subsidiary at an event in Irvine, California. The company has not announced any intentions of manufacturing cells, modules or systems in North America.

In January of this year, Rept Battero announced plans to develop an 8GWh gigafactory in Indonesia, producing lithium-ion (Li-ion) BESS cells.

Rept Battero’s partially owned subsidiary, PT Rept Battero Indonesia, will develop and build the Indonesian Battery Factory. The overall investment amount has not been disclosed, but shareholders indicated that a combined US$139.5 million will be invested in the regional subsidiary.

The company previously expanded into Indonesia, signing a framework agreement with developer Vena Energy in 2023 for a 2GW solar-plus-storage project potentially featuring up to 8GWh of BESS.

Energy Vault’s Calistoga Resiliency Centre comes online, company secures US$50 million

In other news from Energy Vault, the company, along with utility Pacific Gas and Electric (PG&E) announced the successful completion and operation of the Calistoga Resiliency Centre (CRC) located in California.

CRC integrates hydrogen fuel cells with a lithium-ion BESS to ensure power resilience during grid outages caused by wildfires or natural disasters.

The Calistoga community microgrid will benefit from the CRC by sustaining power during shutoffs or disconnections. According to Energy Vault, the 293MWh system provides about 48 hours of continuous energy, with a peak output of 8.5MW during public safety power shutoff (PSPS) events.

During such events, the system operates in ‘island’ mode, using green hydrogen to generate electricity.

After fulfilling the black-start and grid-forming roles of the microgrid, Energy Vault’s B-VAULT DC battery technology works with the fuel cells to ensure grid stability.

In April, Energy Vault closed on US$28 million in project financing for the CRC, including the sale of an investment tax credit associated with the project.

In August, the company received approval from the California Public Utilities Commission (CPUC) to pursue market-based participation in the California Independent System Operator (CAISO) market with the CRC.

A representative from Energy Vault said to Energy-Storage.news:

“Ultimately, the system will need to be approved for market participation by CAISO itself, but the CPUC clearance is a key milestone toward that goal. That being said, the system’s operation relies on a hybrid combination of lithium-ion battery and hydrogen fuel cell technologies, so there is no distinction to be made in terms of which technology will be considered for CAISO market participation.”

The company also announced on 26 September that it entered into a definitive funding agreement with YA II PN, for up to US$50 million in corporate debenture financing.

Energy Vault noted the funding agreement is separate from and in addition to the recently announced US$300 million preferred equity investment with a leading infrastructure investor, which is pending final closure.

Upon final closing, Asset Vault will be established as a fully consolidated subsidiary to manage Energy Vault’s storage assets, which it will own and operate.

These assets will be backed by long-term offtake agreements, which Energy Vault says will secure project revenue and support Energy Vault’s strategy as an independent power producer (IPP).

The company says this approach will generate steady recurring income and high-margin, contracted cash flows.