According to a new report from the US Energy Storage Coalition (ESC), PJM faces an urgent near-term requirement for affordable capacity to accommodate large loads expected through 2032.

Prepared by The Brattle Group for ESC, the report, ‘Outlook for Energy Storage in PJM,’ says that PJM faces “several power supply constraints that raise resource adequacy concerns.”

Integrating forecasted data centre loads and achieving states’ clean energy goals necessitate deploying substantial firm capacity alongside intermittent renewable resources.

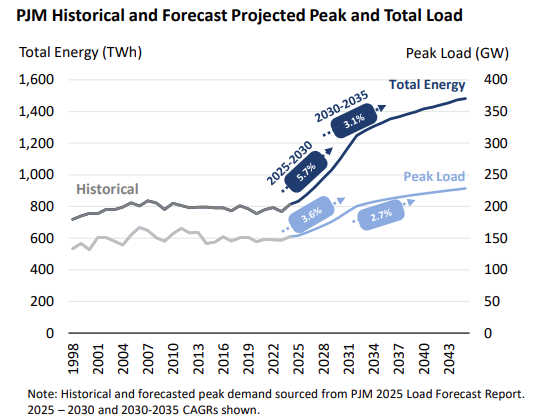

Limited supply availability, ongoing interconnection backlog issues, and high resource costs are likely to constrain capacity choices for meeting PJM’s projected 19% peak load increase from 2025 to 2030.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Load Growth

According to the report, the projected peak demand increase is so significant that it could exceed available supply in the short term.

Brattle says that battery storage can help address this resource inadequacy.

The study assumes that all forecasted demand in PJM’2 2025 Load Forecast Report will materialise, meaning that by 2028, PJM’s summer peak will increase by 16GW, and by 2032, by an additional 30GW.

Interconnection queue backlogs, long wait times for new supply—particularly gas-fired generation, and trade barriers for renewables and storage are expected to constrain PJM’s supply well into the early 2030s.

While efforts have been taken to increase available near-term capacity, PJM’s interconnection process still imposes a multi-year study wait-time.

The report assumes that by 2032, at most, an additional 10GW+ of new gas facilities would be in service.

The report models the PJM system through 2045, using current load growth and cost forecasts, to determine the most cost-effective future resource mix for the region. It then assesses the impact on resource adequacy for PJM by analysing a hypothetical case where battery storage is not an available resource option.

Brattle’s study projects that significant amounts of dispatchable resources, such as storage and gas, will be essential for ensuring resource adequacy and handling weather-related risks in PJM.

The role of energy storage

PJM will require 16 to 23GW of battery storage within the next 7 to 15 years.

This assumes that the market can incorporate more than 17GW of new gas resources by 2032 and postpones nearly all planned thermal retirements to the middle of the next decade.

Battery storage becomes even more essential as the slower deployment of gas resources worsens resource adequacy challenges.

Despite price pressures caused by trade barrier uncertainties, substantial storage remains in PJM’s interconnection queue. This could help compensate if the required firm gas capacity is not developed in time to support large loads by the end of the decade.

Brattle also highlights that storage facilities can be brought into service much faster than gas turbines, due to supply rebalances and backlogged demand.

With battery storage, PJM could prevent up to 15GW of load shedding risk during difficult system conditions in 2032, like extreme cold snaps. Without this, load shedding could lead to planning failures, serious customer impacts, and an unreliable system.

The report states that PJM will need to continue utilising new gas resources and maintaining conventional firm resources through the 2040s; battery storage will help reliably meet the increasing demand in the coming decades.

Notably, Brattle also projects that customer costs could increase by 30% without energy storage deployment.

The prices were 22% higher than in 2024’s auction for capacity in the 2025-2026 delivery year.

Brattle indicated that although storage can engage in PJM’s capacity, energy, and ancillary services markets, outdated regulations prevent it from competing on an equal footing.

The current rules are tailored for traditional generation assets and do not consider the opportunity cost of using energy or saving it for a more valuable time.

Energy-Storage.news’ publisher Solar Media will host the 12th edition of the Solar & Storage Finance USA event on 21-22 October 2025 in New York.

Panellists will discuss the fate of US solar and storage in a post-subsidy world, the evolving economics of standalone BESS and de-risking solar and storage supply chains.

Attendees are encouraged to respond to an anonymous survey on the US solar and storage sector, that will shape discussions at the summit. Tickets for the event are available on the official website.