The market for power conversion systems (PCS) used in energy storage is becoming “increasingly crowded” with competitors, while the diverse field of players will contribute to “rapid technological innovations and price reductions”, Navigant Research has said.

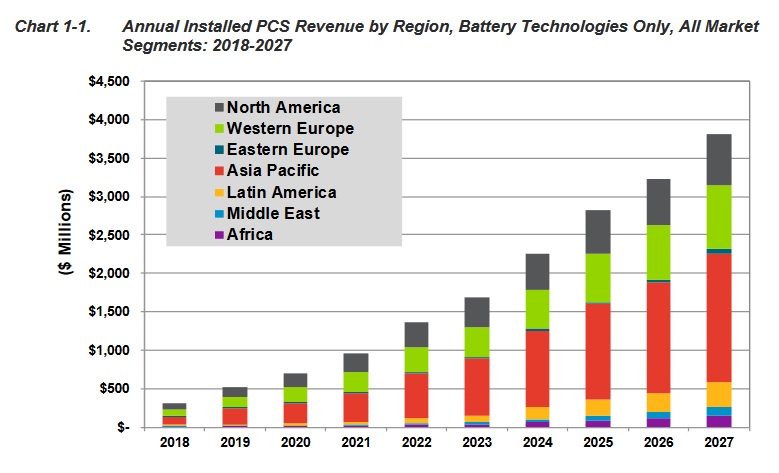

Due to it being home to some of the largest and fastest growing markets for energy storage, the Asia-Pacific region could represent as much as 43.2% of the overall global market cumulatively for energy storage PCS.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

According to 'Innovations in power conversion technology for grid storage', a new report from Navigant, North America, Western Europe and Latin America will be other big contributors to the overall picture, although authors Alex Eller and Peter Asmus wrote that “all world regions are expected to see significant growth over the 10-year forecast period”. Navigant also added that while North America is likely to see a higher capacity of energy storage installations in the next few years, Western Europe will deploy more distributed systems – at higher price points – than North America, meaning revenues from PCS market will be higher.

The report also identifies some of the key and leading players in the nascent ES PCS market: digital automation specialist ABB, Dynapower, Hyosung, Rhombus Energy Solutions and Solaredge, for a deeper look. It also looks at products and system setups from specific vendors, including Ideal Power, SolarEdge and Tesla.

Navigant also gave predictions for price reduction trajectories for PCS, although figures will only be made available to subscribers to the company’s research service. Nonetheless, it did say that the energy storage industry’s focus on battery price reduction has diminished as the market has matured, resulting in increasing efforts to reduce costs for balance of system (BOS) components and the PCS.

Renewable energy sources producing DC power, such as solar PV, and variable AC (wind), use PCS to convert their energy to regulated AC power which can be grid-integrated, thus, “PCS enable the utilisation of renewables, storage, and microgrids on a large scale”.

“The market for energy storage PCS is growing increasingly crowded as new companies enter the market leveraging a variety of backgrounds and expertise to introduce new products,” the authors wrote.

Market participants come from a range of backgrounds and expertise, from more pure play component vendors to those with a track record of developing inverters and other products for solar and wind.

According to Eller and Asmus, there are three key innovations or areas of innovation likely to drive the market forward: Smart islanding and backup power, where inverters and PCS combine to provide resilience and uninterruptible power systems (UPS) in the event of grid outages or off-grid use; cost reductions, driven by innovations in materials and components, including improvements in system architecture that reduce the complexity of system design; and the use of energy storage to support grids, with “features such as automatic reactive power support and variable settings to ride-through disruptions” helping with the integration of variable renewable energy through coordinating the different distributed energy resources (DERs) attached to grids.

Navigant said trends seen in leading energy storage and solar-plus-storage markets such as California, Hawaii, Europe and Japan are driving the need for smart inverter technology and therefore improvements in PCS components too. The US research firm said that as DERs continue to proliferate around the world, this trend is likely to be seen in other parts of the world.