VC funding for energy storage projects increased significantly, while debt and public market financing remained “steady” during 2017, Mercom Capital has found.

The consulting and communications group, which has offices in the US and India, last week announced the publication of its most recent quarterly report into VC funding and merger and acquisition (M&A) activity in the battery storage, energy efficiency and smart grid spaces. The report also wraps up findings for the full 2017 year.

From 38 VC deals brokered in 2016, worth US$365 million, 2017 saw battery energy storage companies raise US$714 million across just 30 deals. Total corporate funding, which is taken to include debt and public market financing, hit a high of US$890 million across the sector last year, compared to US$540 million for the whole of 2016.

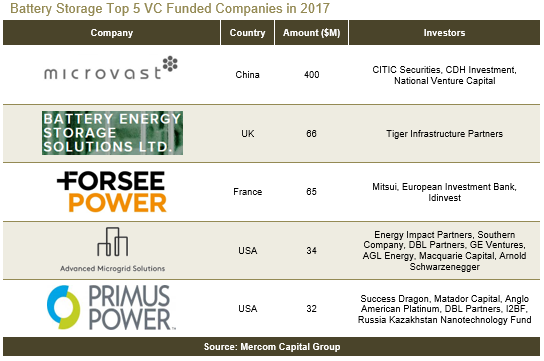

Much of that increase in VC funding was ascribed to the success of Microvast Power Systems, a Chinese company making lithium-ion batteries for electric vehicles (EVs). Microvast raised US$400 million in the first half of 2017, led by Chinese investment bank CITIC Securities. In second place for the year was the UK’s Battery Energy Storage Solutions (BESS), raising US$66 million, led by Tiger Infrastructure Partners.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Rounding off the top five were: Forsee Power, a French company formerly known as Dow Kokam France, active in areas including ‘2nd life’ reuse of electric vehicle (EV) batteries, which netted US$65 million; Advanced Microgrid Solutions, one of the US’ leaders in C&I energy storage with US$34 million raised and flow battery maker Primus Power, which raised US$32 million in VC investment during the year.

However, project finance funds dropped following some big wins in 2016. While US$820 million was put across seven funds in 2016, only US$446 million was invested into such funds last year through three separate project funds, Mercom reported. In terms of project funding deals, 2017 saw nearly US$1.2 billion invested, far higher than US$33 million raised across four deals in 2016.

Debt and public market financing meanwhile was at US$177 million in 2017, almost unchanged from US$175 million in 2016. The former came from 12 deals, while the latter was spread across seven deals.

Finally, while Mercom pointed out that the majority of M&A transactions in the sector were for undisclosed amounts. The most valuable of the disclosed transactions was the US$170 million paid for storage system integrator, system provider and software specialist Greensmith, by utility Wartsila.