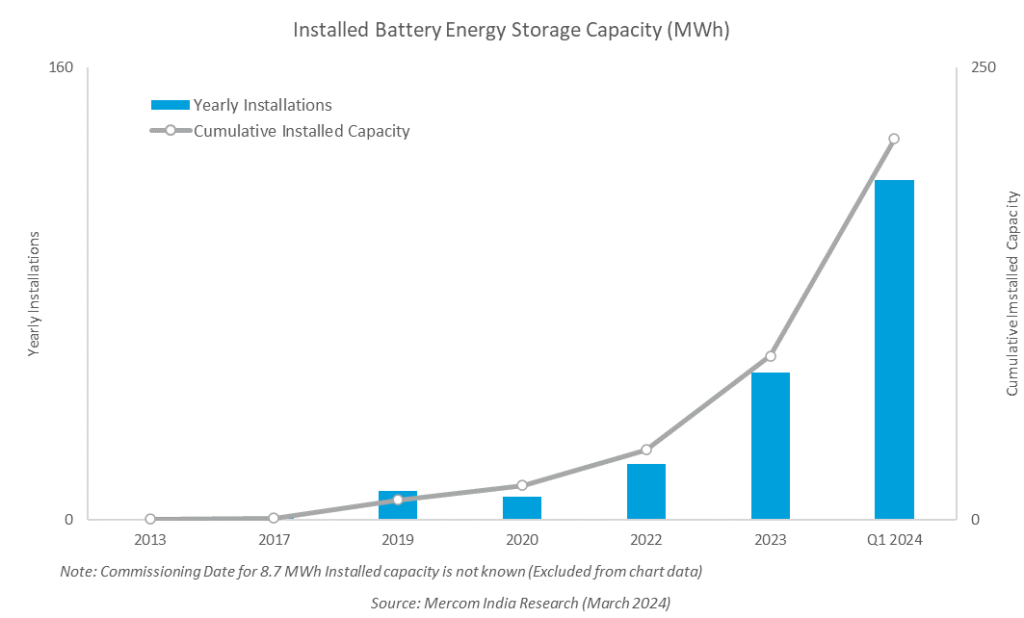

India’s cumulative battery energy storage system (BESS) installations stood at 219.1MWh at the end of March 2024, according to Mercom India.

The research and analysis firm, a subsidiary of Texas, US-headquartered Mercom Capital Group, wrote in its new report, ‘India’s Energy Storage Landscape’, that 90.6% of those deployed systems are paired with solar PV projects.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The report’s authors also found that around 1GW/1.6GWh of standalone BESS, projects were in various stages of development around the country at that time and 9.7GW of renewable energy development projects included energy storage.

In addition, India’s existing 3.3GW fleet of pumped hydro energy storage (PHES) could be significantly boosted by the completion of some of the 18.1GW of PHES projects in development that Mercom identified.

In the first quarter of the year, 40MW/120MWh of utility-scale battery storage was added to the grid, represented by one solar-plus-storage project in the state of Chhattisgarh.

The state-owned Solar Energy Corporation of India (SECI) announced its commissioning in February, and India’s prime minister, Narendra Modi, visited the plant for its official inauguration, as reported by Energy-Storage.news.

It meant that Chhattisgarh, in central India, was home to 54.8% of India’s total installed utility-scale BESS capacity.

Meanwhile, Rajasthan—which Mercom noted in April was the leading Indian state for solar PV deployments with 29% of total installed cumulative capacity by the end of Q1, as reported by our colleagues at PV Tech—accounted for more than 61% of the pipeline of planned BESS installations.

411GWh will be needed by early 2030s to meet India’s renewable goals

The growth in energy storage deployments and development are relatively small but significant steps in getting India towards a projected requirement for 82.37GWh of energy storage by 2026-2027.

That’s according to the national Central Electricity Authority (CEA), which has modelled how much storage, including batteries and PHES, will be needed to get the country towards its goal of deploying 500GW of non-fossil fuel generation by 2030.

By 2031-2032, that requirement will grow to 74GW/411.4GWh, with 175.18GWh from pumped hydro and 236.22GWh from BESS, according to the CEA’s National Electricity Plan published last year.

India targets net zero emissions by 2070 and the Union Government has identified energy storage as a key technology set to enable that goal while providing stability and flexibility to the grid, as well as extending access to electricity to rural areas.

Various tenders have already been held to promote this uptake of energy storage. Roughly 9GW of tendering for round-the-clock renewables backed with storage was held from January to September last year from national and state-level agencies, including SECI, and distribution companies (discoms).

From there, Mercom found that in Q1 2024 alone, 7.4GW of tenders relating to energy storage, including standalone and renewable-paired, were held across India. Mercom said that by the end of the first quarter, 57GW of tenders had been issued in total, with 11.5GW of awarded projects.

The industry anticipates the imminent tendering of 4,000MWh of capacity from standalone BESS projects supported with Viability Gap Funding (VGF) from India’s government, to be hosted by SECI.

The government Ministry of Power has also created the Energy Storage Obligation (ESO) regulatory framework for mandated increases in storage deployment by entities deploying large-scale solar PV and wind generation. The ESO started at 1% in 2023-2024, and will rise 0.5% annually to 4% by 2029-2030, only being treated as fulfilled when at least 85% of stored energy capacity is procured from renewable energy sources on an annual basis.

In the meantime, in June Energy-Storage.news reported on tender activities including a 250MW/500MWh solicitation from state-owned power producer NTPC, and SECI’s launch of a 1,000MW/2,000MWh standalone BESS tender, the country’s biggest so far for standalone facilities.

According to one source Energy-Storage.news spoke with, it can be a relatively long process to get tendered projects from contract award status to completion, around two years from the receipt of Letter of Intent (LOI) issuance.