After an initial rush to deploy megawatts that gave CAISO and ERCOT the lead in US BESS adoption, both markets have become focused on capacity and availability, writes Amit Mathrani of Rabobank Americas.

This is an extract of a feature article that originally appeared in Vol.43 of PV Tech Power, Solar Media’s quarterly journal covering the solar and storage industries.

Every edition includes ‘Storage & Smart Power’, a dedicated section contributed by the Energy-Storage.news team, and full access to upcoming issues as well as the 10-year back catalogue is included as part of a subscription to Energy-Storage.news Premium.

Battery energy storage has sprinted from niche experiment to indispensable grid asset in barely half a decade. Nowhere is that transformation clearer than in California and Texas. By the end of 2024, the California ISO (CAISO) operated 12.5GW of utility-scale battery capacity, up from just 1GW in 2020, while the Electric Reliability Council of Texas (ERCOT) surged from essentially 0.5GW to 10GW over the same period.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

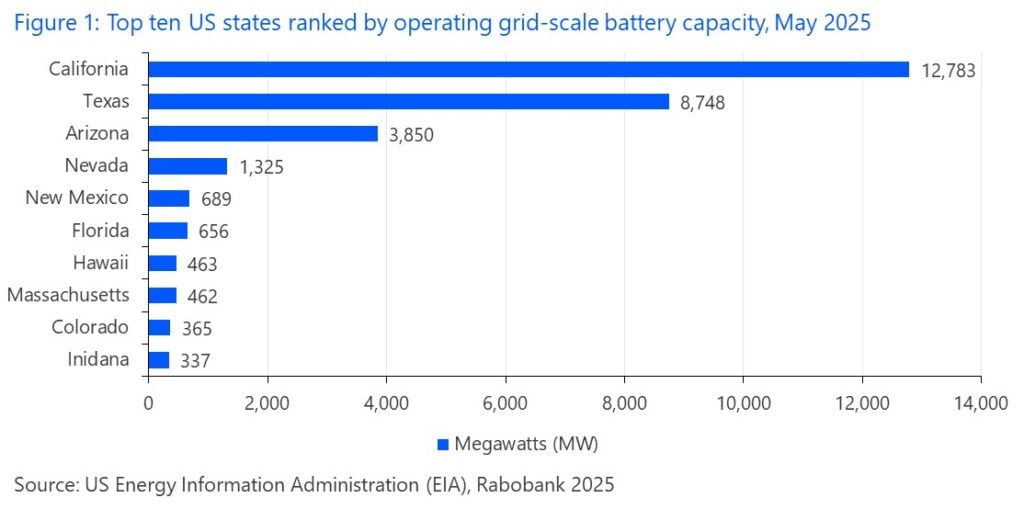

Together, these two markets now host a little more than 65% of all US grid-connected battery storage capacity (see Figure 1 below).

The similarities end with scale. CAISO’s build-out has been propelled by policy mandates and long-term Resource Adequacy (RA) contracts that favour 4-hour duration, close to urban load centres. ERCOT’s boom, by contrast, has unfolded in a pure merchant setting, with no capacity market, minimal regulatory guardrails, and revenues earned (or lost) in real-time energy and ancillary service markets. The result is a dual stress test on the same technology. California now grapples with revenue compression and interconnection logjams, Texas with price cannibalisation, transmission bottlenecks, and a push towards multi-hour discharge.

These contrasts preview the grid’s next chapter. Duration is edging out volume, siting advantage now beats speed, and investors increasingly prize fluency with evolving policy rules and flawless operations.

Other ISOs – PJM, MISO, NYISO – are already importing elements of both playbooks. To see where battery economics and grid planning are headed next, let’s start with California and Texas.

Two different routes to battery supremacy

California and Texas share the same headline: double-digit-gigawatt battery fleets built in record time. However, the mechanics behind that growth could not be further apart. CAISO’s 12.5GW of operating BESS is the product of a policy-catalysed glide path: mid-term reliability mandates such as the California Public Utilities Commission’s (CPUC) 15.5GW of clean capacity by 2027, a 4-hour resource adequacy standard that underpins long-term offtake contracts, and interconnection reforms that now screen projects for site control and deliverability before they enter detailed study.

By Contrast, ERCOT’s 10GW of operating capacity has been built almost entirely without mandates, capacity payments, or federal oversight. Early projects were mostly 1-hour systems chasing ancillary service revenue.

Currently, the fleet averages 1.5-2 hours, and the queue mix is expected to shift toward 4-hour duration ahead of the Dispatchable Reliability Reserve Service (DRRS) launch in ERCOT in 2026 to compensate resources that can provide at least four hours of continuous energy during emergency conditions, supporting system stability without requiring formal capacity obligations.

For investors, the divergence frames a strategic spectrum: from California’s contract-anchored, lower-beta returns to Texas’s volatility-driven, higher-beta upside. Understanding where a new market will sit on that spectrum is now the opening question in any storage diligence process.

Location, congestion and the new gatekeepers

Batteries that earn today sit where the grid needs relief – nodes defined by congestion, scarcity and price spikes. Interconnection headroom and transmission topology decide which projects reach commercial operation and which languish in restudy, with no developer enthusiasm.

California: One zone attracts the lion’s share – and the bottlenecks

Southern California still remains attractive to battery storage developers. As of April 2025, SP-15 hosts more than 51GW of storage requests, over three times the capacity queued in either ZP-26 or NP-15. The sheer weight of applications has forced CAISO to rewrite its interconnection rulebook. In response to FERC’s Order 2023, CAISO’s May 2025 tariff amendment now requires every new requester to prove 90% site control on Day One and 100% before signing a Large Generator Interconnection Agreement [1, 2].

Projects that miss the market drop to the back of the line. A parallel reform introduces a screening stage that ranks projects on viability and alignment with state resource plans before they enter full study.

History justifies the clampdown. As Lawrence Berkeley National Laboratory’s (LBNL’s) Queued Up 2024 survey showed, only 12% of CAISO requests submitted between 2000 and 2018 reached commercial operation, the lowest build rate among US ISOs. Each late-stage withdrawal triggers restudies that delay the rest of the cluster, raising carrying costs and eroding tax-credit timing.

Investors now treat queue position and deliverability status as hard diligence gates, equal to offtake strength. Transmission headroom is equally selective. CAISO’s 2024-2025 Transmission Plan identifies US$4.8 billion in upgrades, but most come online after 2029, leaving near-term projects exposed to local congestion, especially around solar-heavy Kern and Fresno counties.

Texas: Fast queues, slower electrons

ERCOT still moves projects from application to energisation in 18-30 months. Lightning speed by ISO standards.

However, geography is beginning to narrow the fast lane. The 2024 ERCOT Constraints & Needs report lists the Tonkawa Switch – Morgan Creek 345kV path as the single most expensive constraint on the system, absorbing US$156 million in congestion rent between October 2023 and November 2024. The broader West Texas Export Interface booked US$148 million over the same period, and ERCOT’s economic forecast shows rents rising to US$178 million in 2026 without new wires.

Batteries sited behind those bottlenecks often clear into the real-time market but collect a discounted nodal price. Houston, once considered congestion-proof, is not immune. Projected constraints in the North-Houston Interface reach US$46 million in annual congestion rent by 2026. ERCOT has endorsed a US$2.2 billion pipeline of upgrades, yet most will enter service after 2027, meaning today’s queue will energise into tomorrow’s pinch-points.

Sponsors installing batteries on the load side of a popular constraint are starting to price nodal basis risk the way wind developers priced curtailment a decade ago. For developers and lenders, congestion risk now shapes deal terms as much as project size. Lenders are paying closer attention to site control, deliverability studies, and nodal-price hedging, knowing that a project stuck behind a constraint can miss the very spreads its model assumed.

Credit stays, strings tighten

At the federal level, this year’s Independence Day celebrations brought clarity. The ‘One, Big, Beautiful Bill Act’ left the 30% standalone storage ITC, created by the Inflation Reduction Act (IRA), intact through 2032 – no phase downs, no haircut.

The catch is provenance. Starting in 2028, battery cells or packs with more than 30% ‘foreign entity of concern’ (FEOC) content lose the credit, and the 15% Section 301 tariff reinstated in May for Chinese lithium-ion cells remains in force. Tax equity is safe, but only for projects that can document an increasingly domestic supply chain.

Policy still leaves plenty of runway for storage, but the path isn’t straight anymore. Anyone building or financing battery storage projects under these policy crosswinds now spends as much time following committee hearings and tariff dockets as they do watching price curves.

Discipline can make or break battery economics

The question for storage assets has shifted from, “Can the BESS project make money?” to, “Can it keep that revenue once SoC rules, outage penalties, insurance costs and degradation kick in?”

Operational discipline now drives the gap between a deal that meets pro-forma and one that backpedals on covenants. CAISO has required 4-hour batteries to hold a minimum reserve going into the evening ramp. The rule was supposed to sunset in 2024; instead, the ISO extended it through 2026 while it evaluates longer-term reliability options. The extension means storage resources must hold energy through the late afternoon peak with a preset charge margin or face potential bidding restrictions and availability penalties.

At the same time, availability risk is widening. CAISO’s Q4 2024 Market Issues & Performance Report shows battery outages, planned and forced, rose 26% Y-o-Y, reflecting both rapid fleet expansion and longer downtimes for fire safety retrofits.

The most public reminder came on January 2025, when a thermal runaway event at Vistra’s 300MW Moss Landing Energy Storage Facility forced a three-month outage and community air-quality monitoring. While no injuries occurred, the incident hardened lender and insurer attitudes overnight. Verisk – Munich Re highlight tighter underwriting criteria for lithium projects lacking dedicated setbacks or advanced suppression.

Performance penalties compound those cost pressures. In a typical CAISO 4-hour Resource Adequacy contract, a single missed dispatch during a system stress hour can forfeit an entire month of capacity payments. An outcome that now carries more weight than day-ahead spread assumptions in many debt models. Sponsors respond by investing in redundant battery-management telemetry, automated SoC forecasting, and additional fire suppression layers that push EPC budgets up by 2-3% but protect far larger revenue streams.

Texas presents a different operational gauntlet. ERCOT’s merchant batteries cycle more frequently, often three to four times per day during shoulder seasons, to capture brief price spikes that still emerge between solar oversupply and evening peaks.

High-cycle operation accelerates degradation. Lithium iron phosphate (LFP) packs rated at 10,000 cycles see usable energy fall below 80% of nameplate in seven years under ERCOT’s dispatch pattern, compared with ten years in CAISO’s less frenetic market, according to performance warranties filed with two recent interconnection agreements. That degradation matters because ERCOT’s forthcoming DRRS imposes a 4-hour continuous-discharge requirement.

Sponsors that fall short risk losing DRRS eligibility unless they augment mid-life with new modules. In a market where spreads compress faster than projects retire, operational proof is becoming the last lever left to protect asset value.

Strategic outlook: five signals investors should track next

Battery storage’s first phase was a land-grab for megawatts. The second is proving to be a contest of selective discipline. Together, California and Texas host roughly 60% of all US grid-connected capacity, offering a preview of what the rest of the country will soon confront. From their experience, five strategic signals stand out.

Duration premiums harden quickly once price spikes fade. ERCOT’s ELCC tables already value 5-hour systems at nearly five times the dependable capacity of 1-hour units; CPUC modelling now assumes 8-hour resources enter by 2030. Markets that still reward 1-hour batteries are living on borrowed time.

Deliverability trumps queue position. CAISO’s viability screen and Texas’ looming congestion bottlenecks mean a smaller, well-sited project can secure cheaper capital than a larger asset stuck behind a restudy or constraint.

Rule-defined revenues outlast merchant spreads. 4-hour Resource Adequacy in California and the forthcoming 4-hour DRRS product in Texas have replaced opportunistic arbitrage as the anchor cash flow. Future markets—PJM’s capacity reforms, MISO’s seasonal accreditation— are heading the same way.

Operational discipline is no longer optional. A single missed stress-hour dispatch can wipe out a month of RA payments; a thermal event can raise insurance costs across an entire portfolio. Lenders now treat SoC telemetry, fire suppression audits, and augmentation reserves as gating items, not nice-to-haves.

Policy risk is a two-sided coin. The ‘One, Big, Beautiful Bill Act’ kept the ITC for storage but tightened the FEOC rules; state legislatures can pivot from laissezfaire to duration mandates in one session. References Hedging that volatility through flexible design, staged capex, and locational optionality will separate resilient balance sheets from speculative bets. Put bluntly, the next phase belongs to those that match hours to need, electrons to the right node, and operations to ever-stricter rulebooks, before the rules tighten further.

References:

[1] CAISO Docket No. ER24-2042-000, Tariff Amendment to Implement Track 2 of Interconnection Process Enhancements 2023 Initiative

[2] Federal Energy Regulatory Commission Order on CAISO Compliance filing – Order No. 2023, Docket No. ER242042-000

About the Author

Amit Mathrani is a vice-president and senior energy transition research specialist at Rabobank North America. RaboResearch F&A North America provides dynamic insight and value to energy transition industry members, other Rabobank clients and stakeholders. Amit Mathrani has a background in strategy development and management consulting for energy companies, where he developed strategic roadmaps for an affordable clean energy transition.