Senators in Maine are considering legislation to accelerate energy storage development, including a focus on who is allowed to own resources placed on transmission and distribution grids.

Democrat Senator Eloise Vitelli is leading sponsorship of ‘An act relating to energy storage and the state’s energy goals’ (LD1850), together with six Democrat co-sponsors. It was introduced into the lawmaking process on 27 April and was discussed in a public hearing last week at the US state Senate’s Committee on Energy, Utilities and Technology.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Maine became the ninth US state to introduce an energy storage deployment target in 2021, after Governor Janet Mills signed it into law. At the time, Vitelli was thanked by the national Energy Storage Association (now part of the American Clean Power Association) for her leadership on the issue.

Incidentally, two other states have since also joined that roster, meaning 11 US states now have a policy goal or aspirational target in place.

In addition to driving forward the enactment of the target, Senator Vitelli had also chaired a commission investigating the value of energy storage for Maine prior to that.

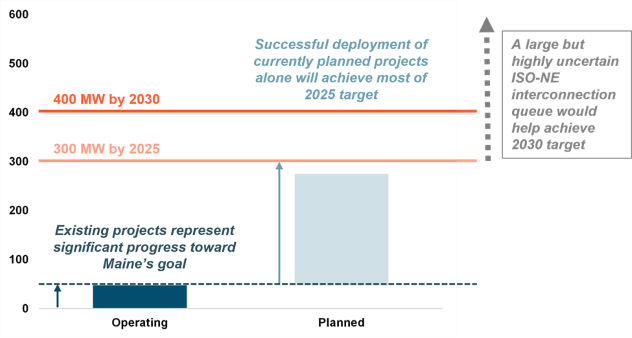

The state is targeting the deployment of 300MW of storage within its state lines by 2025 and then 400MW by 2030. While that’s on the diminutive end of the scale compared to some other states, it represents about 20% of the state’s peak load as recorded in 2021, which in terms of proportion brings it broadly in line with the others.

Unfortunately, Maine’s legislature didn’t make recordings of the committee hearing last week available online, but according to local news outlet Maine Monitor, one of the major questions discussed was the issue of ownership.

With storage classifiable neither as energy generation nor distribution, it falls into a grey area, with utility companies not allowed to own generation assets that fall outside their transmission and distribution (T&D) remit.

This is a fairly common problem faced as battery energy storage, a nascent technology set, proliferates around the world, and Maine Monitor energy and environment reporter Kate Cough quoted Vitelli at the hearing as saying the “conditions under which an investor owned utility may own or may have a financial interest in energy storage systems,” are not clear.

Bill LD1850 aims to order the state’s regulatory Public Utilities Commission (PUC) to clarify that position, but it also seeks to get other important questions answered, and introduce other measures to ensure Maine does attain its targets. As of the beginning of 2022, the state only had 50MW of energy storage on the grid.

Maine could introduce similar procurement process to New York

LD1850 would change the target to “at least” 300MW by 2025 and “at least” 400MW by 2030. Although it retains the provision that the Governor’s office should review progress and the appropriate goals every two years, it calls for these reviews to begin in 2024, not 2031 as the original bill has it.

It also calls for the Energy Office of the Governor to evaluate design and implementation of a programme to procure T&D-connected energy storage systems on a commercial basis. This could include a form of index storage credit mechanism.

This would be a type of credit, somewhat similar to Renewable Energy Credits (RECs) that would be bid for through competitive solicitations.

New York State is currently in the process of rolling out index storage credit-based solicitations for large-scale energy storage.

It appears that like the New York programme’s proposed design, a scheme for Maine would underwrite some of the risk that developers and investors take in energy storage projects, providing a portion of the systems’ revenues through long-term contracts, but leaving the asset owners needing to earn the remainder through merchant market opportunities.

The Energy Office would also have to study the long-duration energy storage (LDES) space, both in terms of evaluating the available and emerging technologies as well as the need for them in Maine and the wider New England ISO service territory. That could be in terms of using several hours storage paired or co-located with generation sources, winter electricity supply reliability or serving as peaking capacity on the grid.

A further public hearing will be held tomorrow, 24 May, with the Energy, Utilities and Technology committee.

Despite the challenges for large-scale storage in particular, being part of the New England ISO service territory means there are likely to be opportunities for storage developers, especially of distributed storage assets, as Energy-Storage.news heard in an interview published yesterday with developer BlueWave. Those opportunities would be based on ISO capacity market and energy trading revenues, according to BlueWave MD of storage development Michael Zimmer.

Senator Vitelli is also leading efforts to pass another bill that will be debated tomorrow, LD1830, for the advancement of Maine’s adoption of renewable energy. Like the storage bill, the legislation would order the PUC to evaluate new resources approvals based on their benefit to the people of the state. Maine is targeting 100% renewables by 2050, and an interim goal of reaching 80% renewable energy on the grid by 2030.

The full bill text for LD1850 can be found here.