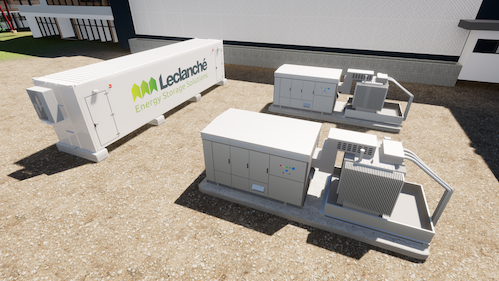

Funding secured from its main shareholder group will help vertically-integrated energy storage company Leclanché push forward activities in its stationary storage business, CEO Anil Srivastava has said.

The Swiss Stock Exchange-listed manufacturer of lithium-ion batteries also makes and integrates energy storage solutions for electrified transport as well as stationary energy storage projects. The company has secured CHF59.6 million (US$63.17 million) in financing from SEFAM, the group of equity and asset fund investors which Leclanché described in an announcement yesterday as a “long-time supportive shareholder”. The financing is in the form of three different types of lending vehicle.

“With our latest financing in place, our Stationary Solutions business unit is primed to move forward on several projects as well as a significant product launch slated for later this year,” CEO Anil Srivastava told Energy-Storage.news.

The funding will allow the battery storage provider to fulfil its order book for 2021 as well as push ahead with that new product launch. While the company had said in mid-2020 that it was undergoing restructuring to overcome a balance sheet “situation” and had conducted a strategic review, management now believes that revenues for 2020 of about CHF23 million will be 45% more than the company took in in 2019 and in turn, Leclanché is expecting that 2021 revenues will be nearly twice that, guiding for about CHF38 million to CHF44 million.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

One of the reasons for its balance sheet difficulties in 2020 was delays to activities due to COVID-19, with the slowing of progress on a project to build a 35.6MW solar PV farm with 44.2MWh of battery storage in St Kitts and Nevis in the Caribbean among the main factors. CEO Srivastava said that the new financing will help Leclanché “accelerate the construction of [the] St Kitts project”.

Despite the continued effects of the coronavirus pandemic on some projects, the company is expecting a positive outcome for this year, including activities in the e-Marine, e-Train and e-Commercial Vehicles sectors. Boats using Leclanché batteries are going into the water including hybrid ferries, the company has received CHF100 million of battery pack orders for trains over five years from manufacturer Bombardier and an unnamed manufacturer has selected the Swiss provider’s batteries to power a new range of electric trucks.

In stationary energy storage, delivery of the St Kitts and Nevis project will also be added to by new stationary storage projects to support electric vehicle (EV) fast-charging facilities in delivering growth in turnover and positive margins, the company said in its release yesterday.

The company has been delivering energy storage systems for a broad range of on-grid and off-grid projects with recent projects reported by this site including the completion a few days ago of India’s first grid-connected community battery energy storage system in Delhi, a short-duration battery energy storage system (BESS) with energy management software to help a Slovakian natural gas plant participate in frequency regulation and a hybrid system combining batteries with flywheels in the Netherlands. The US$70 million St Kitts and Nevis project finally began construction near the end of last year.

Srivastava told Energy-Storage.news that sales enquiries “are up across the group’s portfolio” and the funding announced “will support this and future growth”. The company is predicting that it will be able to break even on EBITDA in the second half of 2023, predicting a turnover of between CHF175 million and CHF200 million by then.

In a statement thanking his investors, the CEO claimed that Leclanché has “compelling and competitive products for the booming EV and energy storage markets,” and that the investment is already leading to “very strong interest from customers” as well as from investors.

Last year as it moved to carry out restructuring, the company said its board of directors had decided to create a build-own-operate project business for stationary energy storage, launch a joint venture for cell manufacturing with Eneris, a clean energy and environmental solutions company headquartered in Poland and Luxembourg, and move more of its efforts into “green tech software and systems integration”.