More than a tenth of a 250MW energy storage procurement by utility Southern California Edison will comprise of Ice Energy’s Ice Bear units, deployed in partnership with NRG Energy.

Southern California Edison’s (SCE) choice to procure the energy storage was made in 2014, described at the time by California Energy Storage Alliance (CESA) executive director Janice Lin as a “monumental decision”. The procurement was awarded to five companies, AES Energy Storage (100MW), Stem (85MW), Advanced Microgrid Solutions (50MW), Ice Energy Holdings (25MW) and NRG (0.5MW).

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

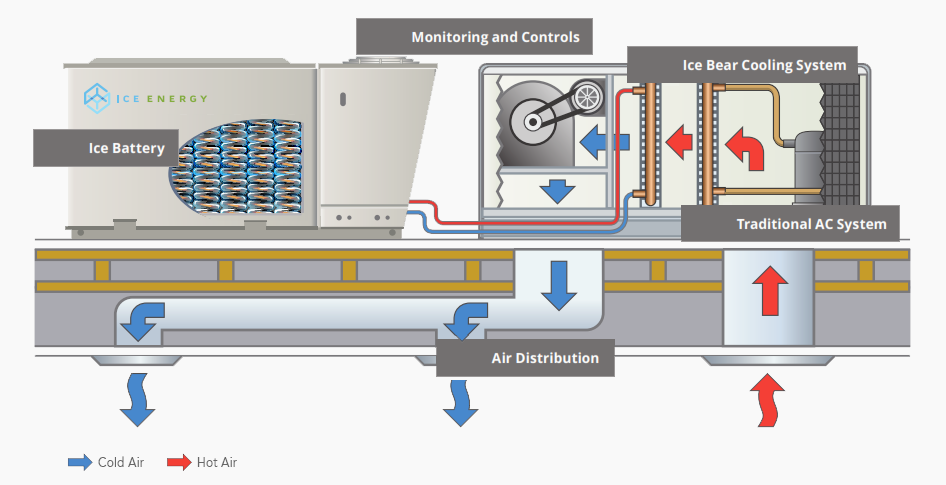

Ice Energy and NRG announced last week that they will jointly develop 25.6MW through the contract. They will deliver 1,800 behind-the-meter systems, using Ice’s latest Ice Bear 30 model. Ice Energy’s ice battery uses copper coils to pump cold refrigerant through tap water to make ice, which can be done during off-peak hours. Typically, Ice Bears replace the outdoor condensing units of homeowners’ air conditioning systems. The Ice Bears will be offered to SCE commercial and industrial customers on a first come first served basis.

The 25.6MW of units will be provided to SCE under 20-year power purchase agreements (PPAs). Ice Energy has already sold a megawatt of the systems in February this year to the Southern California Public Power Authority (SCPPA), which covers municipal utilities in 10 cities and one irrigation district.

“Our distributed ice batteries will solve local grid issues in Orange County while reducing CO2 emissions by up to 200,000 tonnes over the life of the project. Orange County commercial and industrial customers that qualify for the program will get free use of Ice Bears, lowering electric bills and further extending the life of their HVAC systems,” Ice Energy CEO Mike Hopkins said.

There are a small handful of competing providers of ‘cold’ energy storage to fight it out with Ice Energy for a share of the market, with rivals that include Viking Cold, Calmac and Axiom Energy. In California, which has the famous ‘duck curve’ to contend with for solar supply and demand balancing, cooling energy storage could be a powerful tool for utilities, Viking Cold CEO James Bell told Energy-Storage.News last year.