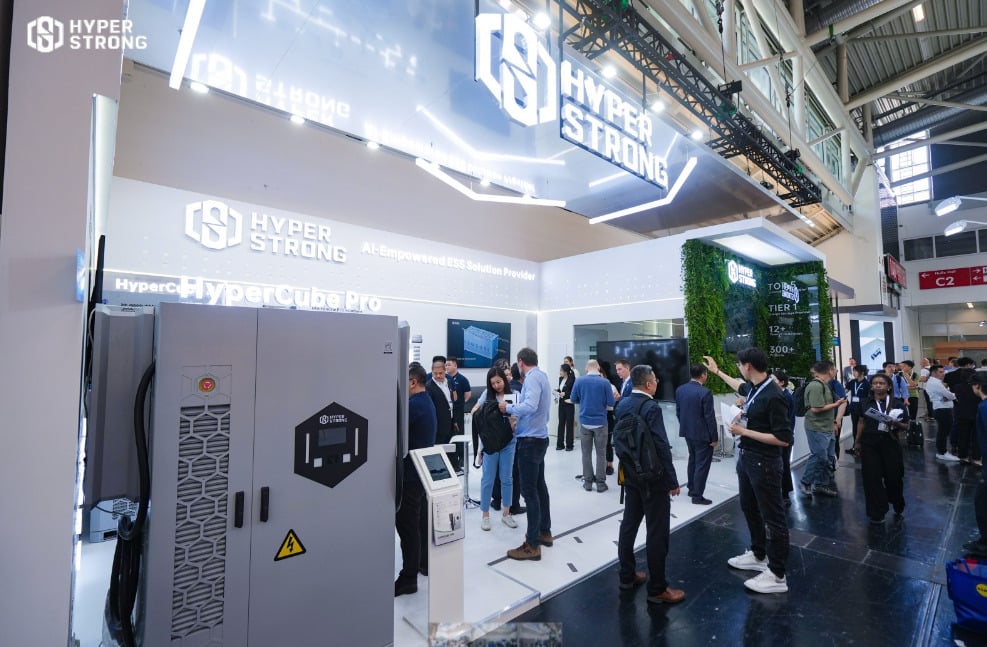

Hyperstrong, the largest battery energy storage system (BESS) integrator in China, has inked a new deal today (23 October) with solar and energy-storage-as-a-service provider Tesseract ESS to explore opportunities in the Australian market.

This marks the first deal Hyperstrong, with over 20GWh of energy storage systems deployed globally, has signed since opening its new APAC headquarters in Sydney on Monday (21 October).

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The deal was signed on the first day of All-Energy Australia 2024 in Melbourne. The two companies will develop opportunities for modular BESS solutions for commercial and industrial (C&I) applications.

Kevin Changbin Qiu, HyperStrong’s CMO, said the partnership marks the company’s symbolic entry into the Australian market.

“Hyperstrong is committed to helping C&I customers achieve their ambitions to access affordable and clean energy. It is our vision to build a sustainable energy storage system ecosystem in Australia and to deliver advanced, safe and reliable energy storage solutions to help businesses grow,” Qiu said.

Central to the partnership is Tesseract ESS’ Unity Node, a range of modular, integrated all-in-one ESS that Hyperstrong will manufacture. Tesseract, a new entrant to the energy storage market, will use these in 2-to-3-hour storage durations, with AC and DC coupled configurations.

The Unity Node solar and battery solution will be available through a power purchase agreement (PPA) under Tesseract ESS’ Unity Energy Plan. This plan requires no upfront capital expenditure, allowing customers to pay only for the energy they use. Terms last for ten years or more.

Chong Tong, co-founder and chairman of Tesseract Group, believes the C&I market in Australia has been underserved and manufacturers have suffered under high electricity prices that impact profitability.

“Unless we accelerate clean energy for these behind-the-meter sectors we will struggle to meet our renewable energy targets,” Tong added.

Hyperstrong claims to have led China’s energy storage market for shipments over three consecutive years, shipping 20GWh over the last 12 years, and was recently ranked among the top five global integrators for deployments by S&P Global.

‘Solar and energy storage does not have to be complex’, Tesseract CEO says

Speaking exclusively to Energy-Storage.news at All-Energy Melbourne 2024, Dr Andrew Mears, CEO and executive director of Tesseract ESS, says the company aims to support distributed energy across the Australian market.

“Distributed energy is an amazing opportunity for transformation,” Dr Mears says. “It’s a way of democratising and broadening the impact of the renewable energy transition because, ultimately, that’s the cheapest and most sustainable form of energy.”

Dr Mears also believes the C&I industry has major barriers hindering its energy transition, particularly in the mid-commercial size range.

“It became clear to me that in particular in the C&I sector, there were some key barriers that were precluding a lot of the potential for businesses in that mid-commercial size range and so Tesserac set out to solve those problems,” Dr Mears says.

“Those problems are the high upfront capital costs and the technology’s complexity as it is still emerging and maturing. It’s a very fragmented market.”

But, with energy storage seen as a perfect complement to variable renewable energy generation technologies such as solar PV, this is often an area of the energy transition that can become overcomplex.

Indeed, a key message Dr Mears wants the industry to understand is that “solar and energy storage doesn’t need to be complicated”.