Annual deployments of distributed energy storage connected to virtual power plants (VPP) are expected to reach 3GW by 2030, according to research firm Guidehouse Insights.

The VPP Applications for Distributed Energy Storage report expects annual installations of VPP-enabled distributed energy storage (DES) to grow by an average compound annual growth rate (CAGR) of 28% over the decade, from 288.1MW installed last year to 3GW by 2030.

“As distributed energy markets increasingly become more connected and designed with intelligent management technology, more DER (distributed energy resource) deployments are anticipated to have VPP capabilities at the ready,” said Maria Chavez, research analyst with Guidehouse Insights.

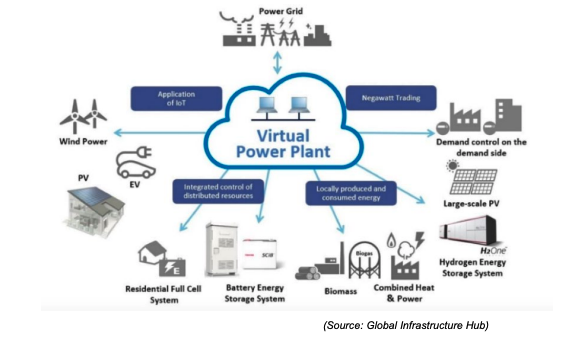

The company expects the proportion of DES deployments that are VPP-enabled to be over one-fifth by the end of the decade. It defines VPPs as systems that rely on software and a smart grid to remotely and automatically dispatch DER flexibility services to distribution or wholesale markets, via an aggregation and optimisation platform.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Guidehouse anticipates that the Asia Pacific, North America and Europe markets will completely dominate the VPP-enabled DES market by 2030. Asia Pacific will account for around 40% of the 3GW deployment figure, North America around 35% and Europe 25%, the report said.

Utilities are increasingly incentivising participation for residential storage systems in VPPs, like one that Netherlands-based inverter and home storage company Enphase Energy recently participated in. But barriers to VPP penetration remain, like upfront costs of deployment and aggregation, privacy and cybersecurity risks for system owners and regulatory hurdles, the report adds.

The research firm breaks down the VPP market into three segments in a separate but related report, Guidehouse Insights Leaderboard: Virtual Power Plant Platform Vendors.

The first is demand response VPPs, which treat load management as a grid resource and are most advanced in the US. The second is supply side VPPs, which pool portfolios of generation resources through smart grid technology to firm up power, largely pioneered in Europe. The last is a mixed-asset VPPs which combine the three and is where the market is trending towards, the report added.