The new edition of the Battery StorageTech Bankability report reveals an increasing number of competitive providers, writes PV Tech Research analyst Charlotte Gisbourne.

Battery energy storage systems (BESS) recorded another record-breaking year of deployment in 2024. These emerging trends are a direct result of worldwide efforts to curtail the effects of global warming and introduce more renewable energy generation into the ecosystem.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Following the first release of the Battery StorageTech Bankability Report in 2024, the latest report (covering performance during Q4’24) has been completed.

This release sees increased coverage at the company level, looking specifically at the suppliers of BESS solutions, and focusing on both manufacturing and financial metrics to assist in the due diligence required in choosing a supplier.

New additions and shifting scores

With each report release, the overall weightings—used to determine the final bankability ratings—are re-evaluated to accommodate the new companies added within our supplier universe. This is done ultimately to compare each supplier to the industry benchmarks as a whole and to gauge how each supplier compares to its competitors.

While movement can be seen within the final bankability scores, the majority of the existing companies remain within the same bands, as revealed in the report from Q3’24. This is partly due to minimal changes quarter-over-quarter in regard to the full-year guidance and forecasts for the calendar year 2024.

One notable change, however, is Samsung SDI’s fall from ‘A’ to ‘BBB,’ due in part to a declining financial score. The company’s revenues and earnings failed to meet expectations. The slump in electric vehicle (EV) demand and small battery sales is likely a contributing factor here, as the energy storage system (ESS) business unit still reported an increase in revenue.

In contrast, Jinko Solar has gone up one band to ‘CCC’ on the back of new evaluations with regard to in-house battery manufacturing and systems assembly capital investments.

Manufacturing trends

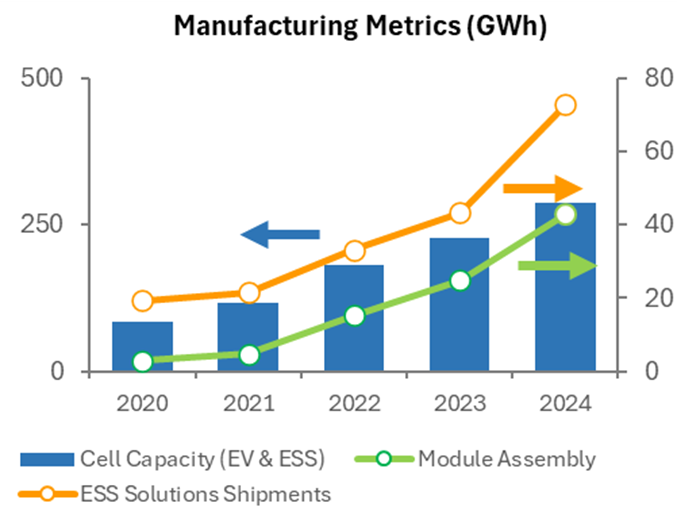

The following figures show a consolidated representation of the new companies added to the report this quarter. The analysis is based on this amalgamation, in addition to a comparison with the full consolidation of all the companies covered in the report. Therefore, the figures shown provide a good health check of the newly added BESS suppliers.

Within this group of energy storage suppliers, more integrators have been included and this accounts for the lowered cell capacity per company (by nearly four times) compared to the whole industry. The leading companies included in the initial report tended to have in-house cell production.

Although this is not a prerequisite to be a top ESS supplier, nor to enter the ‘A’ bands in the report, in-house cell production still allows a company more control over supply chains, which could prove essential amidst rapidly changing political and trade relations.

This vertical integration could have potentially aided in the rise of the top companies, as energy storage became more prevalent, and these manufacturers could make use of already existing production lines for EV batteries.

The newly added companies utilise more out-sourcing of module assembly as well, with less than 60% of the shipped modules assembled in-house. This flexible business model allows for newly established companies to quickly grow market share and meet market demand, without the substantive CapEx required for building battery plants (and subsequent liabilities incurred on the balance sheet).

Shipment trends

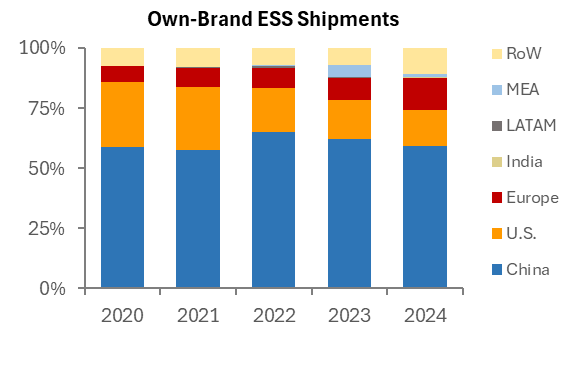

The newly added companies closely follow the deployment trends of the industry as a whole from a geographic end-market perspective.

China retains the majority of shipments and is home to some of the largest ESS suppliers in terms of market share, as well as some key emerging players. Over half of the new companies included are Chinese, so this set of companies has a higher share of Chinese deployments prior to 2022.

The higher share from the Middle East and Africa (MEA) region in 2023 is mostly due to one significant project in Saudi Arabia in that year, delivered by one of the companies included.

Financial trends

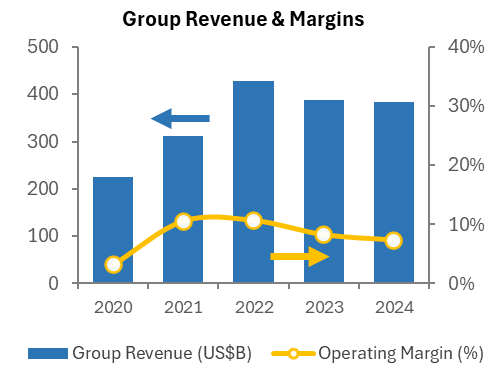

Looking now at financial metrics, the decline in revenues is driven by the large companies included having a spread of reporting divisions in adjacent technology sectors. As the financial data for all companies is taken at the (reporting) parent company level, the impact of these primary business divisions strongly comes into play.

This particularly impacts energy storage suppliers acquired by large entities; for example, one such supplier, whose revenue drove up 2022 totals, became an outlier to the overall trend observed.

In regard to private companies—including some of the newly added companies—financial numbers have been omitted unless provided and audited by the companies themselves or publicly made available.

The fall in operating margins mirrors the overall industry trends, with the price of lithium-ion batteries being a key driving force.

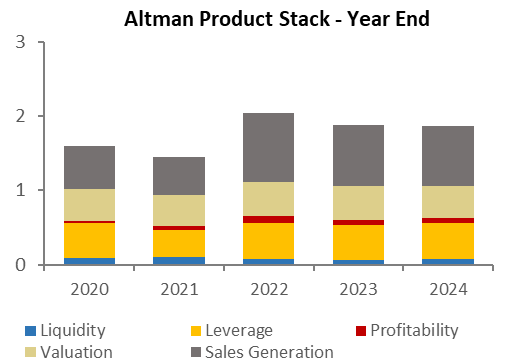

Using the traditional Altman-Z score methodology and findings, the amalgamation of the newly added companies has consistently been in the ‘grey zone’, with scores between 1.8 and 3. However, this does not instantly mean these companies are more at risk than the Top 15 of the industry, for which Altman-Z scores can be seen here.

The liquidity, leverage, and profitability ratios are around the same level, with the new companies actually managing debt better (revealed in the higher leverage ratios). To explain this, many of the Top 15 ESS suppliers were significantly over-valued on the back of investor excitement when the sector was in its infancy.

Going forward, the industry as a whole could soon have cash flow issues as margins get further squeezed. This is particularly prevalent with the possibility of a new US Antidumping and Countervailing Duty (AD/CVD) being imposed on graphite, a key component in lithium-ion battery anodes, coming from China into the US.

Such additional tariffs—while lacking strong domestic manufacturing—could see US energy storage manufacturers make the choice between falling operating profits and raising prices, hoping customers won’t be spooked.

Integrators with less to worry about in this regard could maybe see a rise in market share in the coming years. Despite some of the new companies being amongst the leaders in the industry, none have managed to reach an ‘A’ band score in the final bankability pyramid hierarchy. The lower manufacturing scores (comprising of capacity, production, assembly, and shipments) are a key factor here.

However, the majority of new suppliers are in the middle of the ratings pyramid and residing in the ‘B’ tiers. With large capacity agreements already signed for overseas expansions, there is strong potential for bankability score improvements in 2025 and beyond.

The learn more about the EnergyStorageTech Bankability Report, or to arrange for a free demo, please contact our team at the link here.