Research firm Wood Mackenzie has released its latest global battery energy storage system BESS integrator report, for 2023, showing the market became more competitive with a smaller share by the top five.

The market share of the top five providers has fallen from 62% in 2022 to 47% in 2023, reflecting a trend of more companies entering the space at scale, particularly from China, which the firm noted in its report last year.

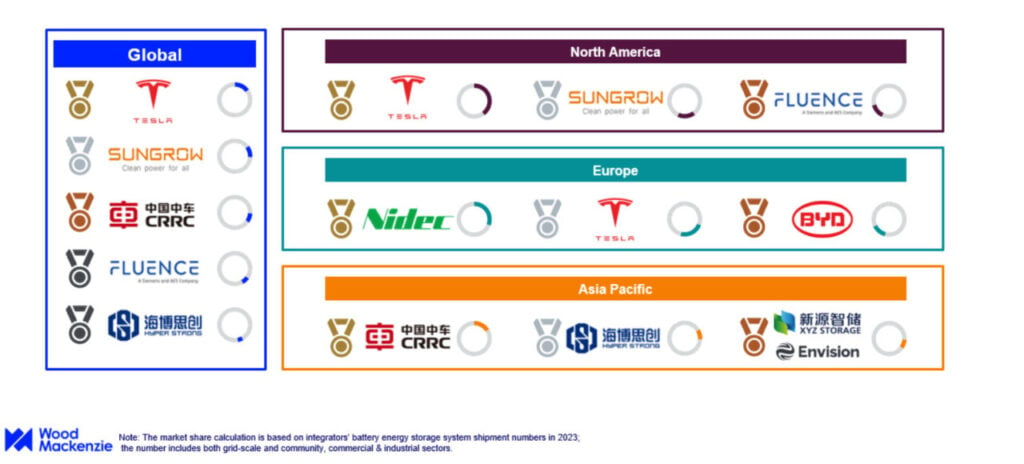

EV and BESS firm Tesla has taken the top spot from inverter and BESS company Sungrow, as shown in the left of the infographic above, while the third-largest is power and industrial solutions firm CRRC, followed by pure-play BESS integrators Fluence and HyperStrong. Sungrow, CRRC and HyperStrong are based in China while Tesla and Fluence are US-headquartered. Six of the global top ten providers are China-based.

Wood Mackenzie’s Kevin Shang, principal research analyst, energy storage technology and supply chain, said: “The global BESS integrator market is becoming increasingly competitive, especially in China, resulting in declining market concentration. As a sector with a relatively low entry barrier, the BESS integrator industry has attracted a significant number of new players.”

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The firm’s data includes both grid-scale and commercial & industrial (C&I) projects. Energy-Storage.news has reported extensively on the falling price of BESS because of increased competition.

However, Wood Mackenzie’s research showed that the regional energy storage markets of North America and Europe have actually become more, not less consolidated by the top three providers. In Europe, power solutions firm Nidec, Tesla and BYD – Tesla’s biggest competitor, also China-based – increased their market share, from around 54% in 2022 to 68% in 2023.

The same trend was noted in the US, with Tesla, Sungrow and Fluence remaining market leaders and increasing their share to 72% compared to 60% in 2022.

Wood Mackenzie also said Chinese companies strengthened their position in the Asia Pacific market although didn’t provide numbers in its press release.

“Tesla has the energy storage industry’s most vertically integrated supply chain, from manufacturing hardware to providing energy storage solutions. This enables Tesla to deliver continued improvements and new features to clients quickly and helps customers maintain storage assets for their entire lifespan,” Shang added.

“Importantly, established companies have also been bolstering their competitiveness in terms of price, performance of products and solutions across all regions.”

While the BESS landscape is becoming more competitive, providers are increasingly converging on the same, 20-foot 5MWh-plus form factor as the standard product, as covered in a recent article (Premium access).