The revenue advantage of 2-hour battery energy storage systems (BESS) in Germany versus 1-hour systems is nearly three times higher than it was two years ago, optimisation firm Entrix told Energy-Storage.news after its latest fundraising round.

Munich-headquartered Entrix raised funding from family office Abacon Capital, home energy solutions startup Enpal, venture capital firms KRAFTWERK.ventures, Pelion Green Future and several individual investors in the funding process.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Although the size of the fundraising round has not been revealed, Entrix CEO Steffen Schülzchen told Energy-Storage.news it brings the company’s total raised to-date to over €8 million (US$8.6 million) with the “vast majority” coming from the latest round.

The company offers AI-powered optimisation solutions for large-scale BESS projects, hybrid renewable projects with storage, and virtual power plants aggregating smaller battery systems, in Germany and the UK.

Schülzchen, commenting on the fundraise, said: “We are excited to have such strong investors from the energy sector on board. With their support, we not only secure capital but also gain access to their exceptional profound expertise and industry networks. This puts us in an ideal position to advance the development of our solution, geared towards the optimal trading of flexible energy assets.”

Changing battery storage revenue stack in Germany

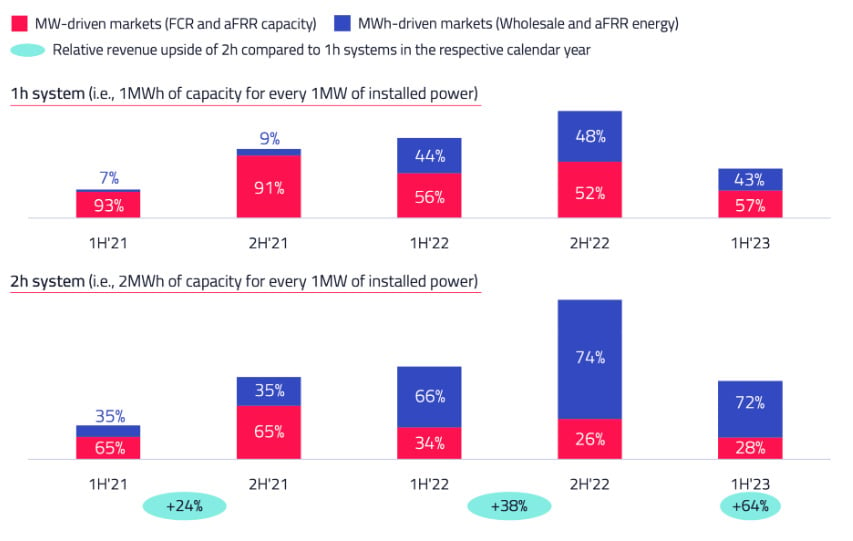

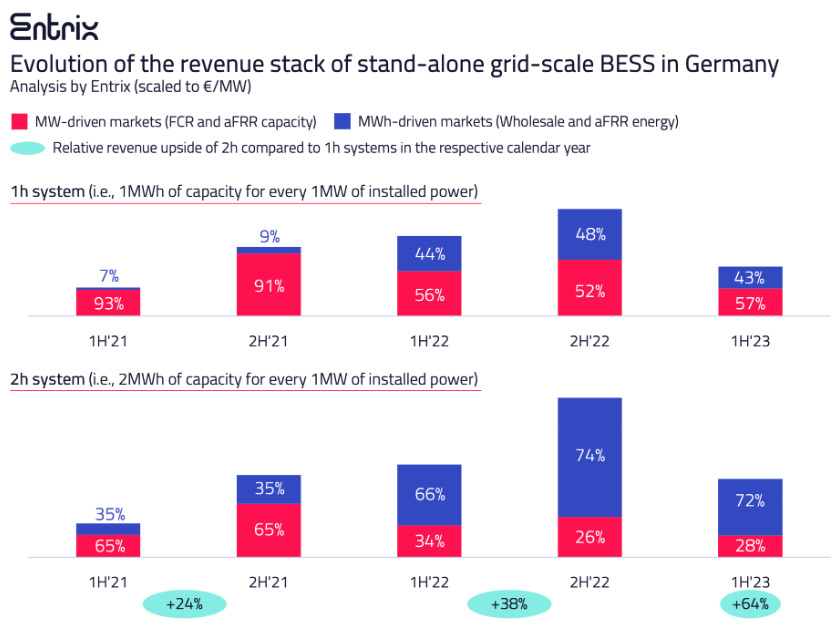

Schülzchen told Energy-Storage.news the revenue stack for standalone grid-scale BESS in Germany has changed substantially in the last 2.5 years.

“In 2021, the revenue was still largely driven by FCR (frequency containment reserve, an ancillary service) which accounted for over 90% of the revenues for 1-hour systems and approximately 2/3 of the revenues for 2-hour systems. Due to strongly decreasing prices in FCR (relative to increasing opportunities in wholesale trading) and the PICASSO-reform in mid-2022, which de facto added aFRR as a new revenue stream for batteries in Germany, the revenue stack today looks very different.”

“Today, 1-hour systems generate some 40% of their revenues through arbitrage trading whilst 2-hour systems generate over 70% from arbitrage trading and aFRR energy. As a side effect, 2-hour systems by now also capture some over 60% higher revenues than 1-hour systems.”

As illustrated in the chart below provided by Entrix, that advantage for 2-hour systems in Germany has grown substantially, from +38% in 2022 and +24% in 2021.

However, the actual revenues per MWh, illustrated by the height of each column, have more than halved in H1 2023 versus H1 2022 presuambly due to ancillary service prices in FCR and aFRR coming down from the highs of 2022.

For the full-year, Schülzchen expects 2-hour system revenues in 2023 to decrease by 35% year-on-year while one-hour systems will fall 45%. Revenues in the UK market have also fallen sharply this year, as noted in an Energy-Storage.news article today.

A move towards more numerous and more energy-intensive revenue sources means managing large-scale BESS in the market has become more complicated. Energy-Storage.news recently wrote about this trend across markets, in an interview with, amongst others, UK, US and Australia-focused BESS optimiser Habitat Energy.

Germany is no different, with Schülzchen adding: “A few years ago, it was possible to successfully operate a battery following a single-market approach focusing on FCR, which also has the simplest bidding scheme. Today, batteries can only be operated profitably if they are dynamically optimised across all relevant markets.”

“In Germany, arbitrage trading especially occurs on the continuous intraday market which is, together with aFRR energy, the most complex market to participate in. Entrix dynamically optimises batteries across all revenue streams and hence helps to unlock their full potential.”

Schülzchen discussed revenues for grid-scale storage at the Energy Storage Summit 2023 in London, hosted by our publisher Solar Media, earlier this year.