Fotowatio Renewable Ventures (FRV) has submitted plans for a 1,600MWh battery energy storage system (BESS) in New South Wales, Australia, to the federal government’s Environment Protection and Biodiversity Conservation (EPBC) Act.

The Armidale East BESS, being pursued by developer and independent power producer (IPP) FRV Australia, is a 4-hour duration system being proposed in Pint Pot Creek, adjacent to the existing 141MW Metz solar PV power plant.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Subject to approval, the main construction phase would take approximately 10 months to complete and will include the delivery of the BESS, substation and connection infrastructure. Commissioning and testing of the site would take an additional six months before operation can begin.

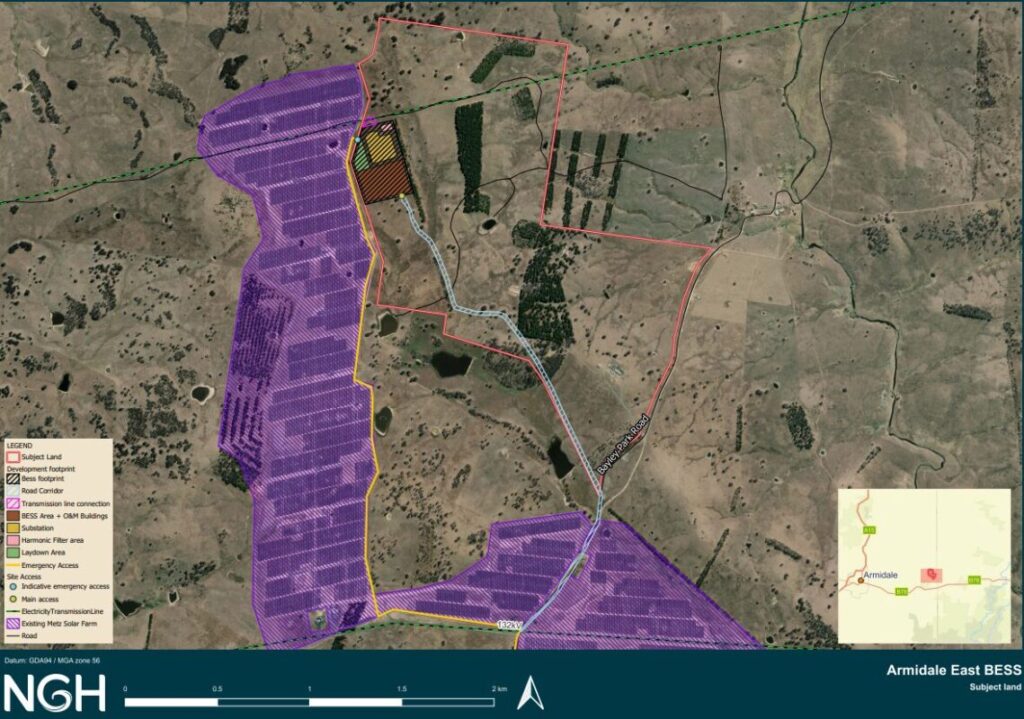

The Armidale BESS would have an operational lifespan of up to 40 years, with cell refurbishment required at 20 years. Below is a map of the proposed site showcasing the adjacent solar PV plant.

The BESS would connect to the grid via 330kV overhead transmission cables owned by the transmission system operator Transgrid that runs north into the Armidale substation.

Last year, FRV Australia put its first solar-plus-storage project in the country online. The facility in Dalby, Queensland, comprises a 2.45MWdc solar PV plant and a co-located 2.54MW/5MWh BESS. The project sits on around 30 hectares of land.

The New England Renewable Energy Zone

The BESS will be situated within the New England Renewable Energy Zone (REZ) being developed in the northern part of the state. This REZ aims to deliver 8GW of additional network capacity, supporting renewable energy generation technologies such as solar PV and energy storage.

According to EnergyCo, the New England REZ is expected to attract more than AUS$24 billion (US$15.5 billion) in private investment by 2034, supporting over 6,000 construction jobs and 2,000 ongoing operational jobs.

REZs are each deemed critical infrastructure projects. They combine transmission infrastructure with large-scale energy generation, such as solar PV and wind, alongside energy storage capabilities. EnergyCo describes them as the “modern-day equivalent of power stations.”

Australia’s various REZs will be a critical juncture for its energy transition, mainly as it looks to wean itself off fossil fuels, particularly with the withdrawal of its coal-fired power plants.

Several large-scale renewable energy generation and energy storage projects have been proposed for the New England REZ, several of which are being pursued by developer Acen Australia.

The larger of the two is the 1.4GWh Deeargee solar-plus-storage site, which features a 320MW solar PV power plant. The site was also submitted to the EPBC Act in late January 2025.

Acen noted that the Deeargee PV plant will be located around 5km south of its existing and operational 521MWdc stage one of its New England Solar plant. The second stage will increase this generation capacity to 936MWdc.

A shift towards 4-hour duration BESS

Readers of Energy-Storage.news’ Australian coverage will likely be aware of a general shift towards 4-hour duration systems. FRV Australia’s Armidale BESS becomes the latest example of this shift in the market.

Beginning with shorter-duration systems that primarily served high power functions such as playing into the NEM’s Frequency Control Ancillary Services (FCAS) market, BESS developers had then adopted a more typical 2-hour duration model as the shift began towards energy trading. The market is now increasingly seeing 4-hour duration large-scale assets in development or construction.

These longer-duration systems are becoming more lucrative. Research conducted by Wood Mackenzie last year found that a 4-hour duration BESS in 2026 could earn an average of AU$263,000/MW (US$163,461/MW) over its lifetime.

Eku Energy’s chief technology officer Elias Saba recently told ESN Premium that this rise in projected earnings from a longer duration of BESS could be due to the rising appetite of offtakers.

“A lot of the large load exposed customers around the NEM, and also some of the commodity traders, whether it’s in the NEM or in a different region, are interested in energy storage, both for the capability and flexibility of the asset, but also the ability to hedge exposure via the trading of the asset in the market, and to also protect the risk positions in their books,” Saba said.

Eku Energy’s Elias Saba will speak at our publisher Solar Media’s Energy Storage Summit Australia 2025, which will take place in Sydney from 18-19 March.