This Friday Briefing eyes the rapid growth of the US market and what risks it might face, plus a look at community engagement through the lens of Vistra’s latest big project.

Figures published in the past few days from Wood Mackenzie and the American Clean Power Association (ACP) have put into focus just how much momentum is behind the US battery storage industry today.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

You may have already seen our coverage from 18 March of ACP’s annual market report into utility-scale clean energy, which found that after a “banner year,” grid-scale cumulative deployments in the country reached 17,027MW/45,588MWh by the end of 2023.

Wood Mackenzie’s US Energy Storage Monitor has been something of a go-to resource for the industry for many years, beginning as a publication of Greentech Media’s GTM Research, which was acquired by Wood Mackenzie a few years ago.

In its Q4 2023 US edition, Wood Mackenzie’s analysts observed a third successive quarter of deployment records being broken and, in this instance, “shattered,” with 3,983MW of new grid-scale projects completed between the start of September and the end of December.

Exciting stuff, and what’s really encouraging is that Wood Mackenzie senior analyst Vanessa Witte noted many of the constraints and headwinds that faced the industry in 2023 appear to be easing, not least of all “supply chain challenges.”

ACP also noted that throughout 2023, while each of the three clean energy technologies its report covered continued to be subject to delays in project development, execution, and commissioning, out of wind, solar PV, and energy storage, batteries suffered the least.

Witte said Wood Mackenzie is forecasting 59GW of grid-scale deployments through 2028, while ACP found the levelised cost of a 4-hour duration battery energy storage system (BESS) in the US has fallen to just US$126 – US$177/MWh.

So far, so very good. And, of course, the Inflation Reduction Act (IRA) continues to provide further impetus to an industry that was already on an upward trajectory.

At this week’s Energy Storage Summit USA, hosted in Texas by our publisher Solar Media, Department of Energy (DOE) office of policy director Carla Frisch said the US development pipeline has grown 300% since the passing of the IRA.

“Before IRA, our national labs were projecting about 50GW of energy storage buildout by 2040. Post-IRA, our analysis, and pretty much everyone else’s, is now projecting more than 200GW by 2040,” Frisch said in a keynote address.

Again, excellent news, but we must not forget that for all this momentous change, the US political landscape could face momentous change of a different kind over the next few months as the election looms.

In his excellent article ‘What goes up must come down: A review of BESS system pricing’ (PV Tech Power Vol.38), supply chain expert Dan Shreve at Clean Energy Associates (CEA) wrote that falling prices are going to drive the fourfold increase in deployments many are forecasting.

You can read an extract of that article on the site, or you can read the article in full as part of the journal (included in your subscription to Energy-Storage.news Premium) for the nuts and bolts of Shreve’s take and CEA’s analysis of the market.

However, the two biggest drivers of risk posed to the US market today are in the policy arena, namely US trade policy and the general election.

Trade policy is CEA’s “top concern in terms of resource availability and pricing,” Shreve wrote. Expansion of the Uyghur Forced Labor Prevention Act (UFLPA) into the energy storage system (ESS) sector could create even bigger waves than it has done in the solar PV market, which was “upended” in 2022.

This is because the supply chains supporting DC container production are “exceptionally complicated,” and unravelling them could take “months or even longer”. That said, some companies are already looking for ways to introduce greater transparency and traceability, but these efforts will likely result in a price premium.

Perhaps because he was writing his article around the time of a certain “Big Game” taking place, Shreve referred to the “political football” being tossed.

He went on to say that the IRA, “central to US clean energy plans,” is not immune from political risk. Detrimental impacts could be felt by the electric vehicle (EV) and BESS sectors were any changes to the structure or value of incentive mechanisms to be made in the wake of a new (or new-old) president with a less-than-friendly stance towards renewables and storage getting into power again.

Perhaps that’s not the worst consequence some people can imagine of the election in November, but for the energy storage industry, it could be pretty severe. A repeal of schemes such as the investment tax credit (ITC) and production tax credit (PTC): “would affect pricing and demand for battery cells, modules and DC containers in the US,” Shreve wrote.

Community engagement for Vistra’s latest big BESS

Community engagement on energy storage project development – and, more specifically, getting community buy-in to the positives of energy storage – is a topic that will not go away.

In fact, it’s something that is going to have to be actively embraced. You may have seen or heard me comment before on media reports of communities objecting to BESS projects in their local area.

In last week’s Friday Briefing, we looked at Cleve Hill, the ‘landmark’ large-scale solar PV plant co-located with battery storage in the UK which has fallen foul of local authorities. The detail there is that it is the battery safety management plan that the local Swale Borough Council in Kent, England, found issue with, but the big picture is that the decision came after protest from the local community based on their perceived fears of fire and explosion risk.

We will have to see if a revised plan for Cleve Hill can allow that project to go ahead as planned – we think it’s likely that it will – but this is the sort of situation that might arise time and again in the future.

From the other side of the pond comes news that Vistra Energy is holding community meetings regarding a proposed large-scale battery storage project in California following the publication of an Environmental Impact Assessment (EIA).

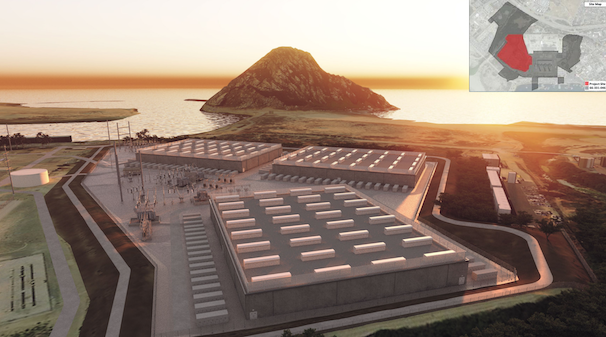

Electricity generator and retailer Vistra held the first such meeting on Wednesday at an elementary school in the Morro Bay area of California’s San Luis Obispo County. The company wants to site a 600MW/2,400MWh battery energy storage system (BESS) asset at the site of the former Morro Bay thermal power plant, which stopped generating in 2014. Vistra proposed the project to local authorities in 2021.

It follows the City of Morro Bay’s publication of the draft EIA on 11 March, and, to cut a long story short, there is tension in the local community, not so much about the fire safety risk, it seems, but more about land use.

Local community advocates want to see the site no longer designated for industrial use, with the bay already now being used for paddling, surfing and other leisure pursuits. In fact, this topic is coming up on the local ballot in November, and it seems likely the industry will watch closely for the outcome.

Happy Friday!

This week on ESN Premium

Northvolt on ramping up, staying competitive, German gigafactory and IPO

Executives from Northvolt discussed the gigafactory company’s ramp-up after a slow 2023 and how the company intends to be competitive in the global market, as well as cell technology, recycling, sourcing from China and an eventual IPO.

Energy-Storage.news was talking to Anders Thor, Northvolt’s VP of communications, whilst at Giga Europe in Stockholm, a two-day event (12 & 13 March) hosted by Benchmark Mineral Intelligence. The event brings together Europe’s battery ecosystem, from gigafactories to raw material producers. Dennis van Schie, Northvolt’s chief supply chain officer, also gave a talk and Q&A on-stage with industry consultant and speaker Nigel Atkins.

EU Batteries Regulation ‘will force energy storage industry to think more about end of life’

The new Batteries Regulation will be a driver of change in the European Union in how the energy storage system industry thinks about procurement and managing batteries at the end of life.

That’s the view of Kevin Shang, senior energy storage analyst at Wood Mackenzie, who spoke to Energy-Storage.news last month at the Energy Storage Summit EU, hosted in London by our publisher Solar Media.

Sungrow’s high expectations for Spanish energy storage market despite lack of regulation

For many years now, Spain has been one of the leading European markets for solar PV but has yet to match that for energy storage.

The expectations for this to happen in the coming years are pretty high for the battery energy storage system (BESS) division of major global PV inverter manufacturer Sungrow.

Proof of this interest in the Spanish market is the company’s choice of location to host its PowerTitan 2.0 Experience Day in Madrid – which Energy-storage.news attended – earlier this month, showcasing its latest product in energy storage systems to the European scene.