Despite geopolitical unrest, the global energy storage system market doubled in 2023 by gigawatt-hours installed. Dan Shreve of Clean Energy Associates looks at the pricing dynamics helping propel storage to ever greater heights.

This is an extract of a feature article that originally appeared in Vol.38 of PV Tech Power, Solar Media’s quarterly journal covering the solar and storage industries. Every edition includes ‘Storage & Smart Power’, a dedicated section contributed by the Energy-Storage.news team, and full access to upcoming issues as well as the nine-year back catalogue are included as part of a subscription to Energy-Storage.news Premium.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

2023 is in the books, and early indications are that the global energy storage system (ESS) market may very well have doubled again in terms of gigawatt-hours (GWh) installed. This is a remarkable feat, especially in the face of geopolitical tumult, elevated interest rates and impossibly crowded interconnection queues.

The market has shown reliance and is, indeed, poised for further growth, with a fourfold increase in annual installs possible by 2030. The reason why is simple: pricing.

As a start, CEA has found that pricing for an ESS direct current (DC) container — comprised of lithium iron phosphate (LFP) cells, 20ft, ~3.7MWh capacity, delivered with duties paid to the US from China — fell from peaks of US$270/kWh in mid-2022 to US$180/kWh by the end of 2023.

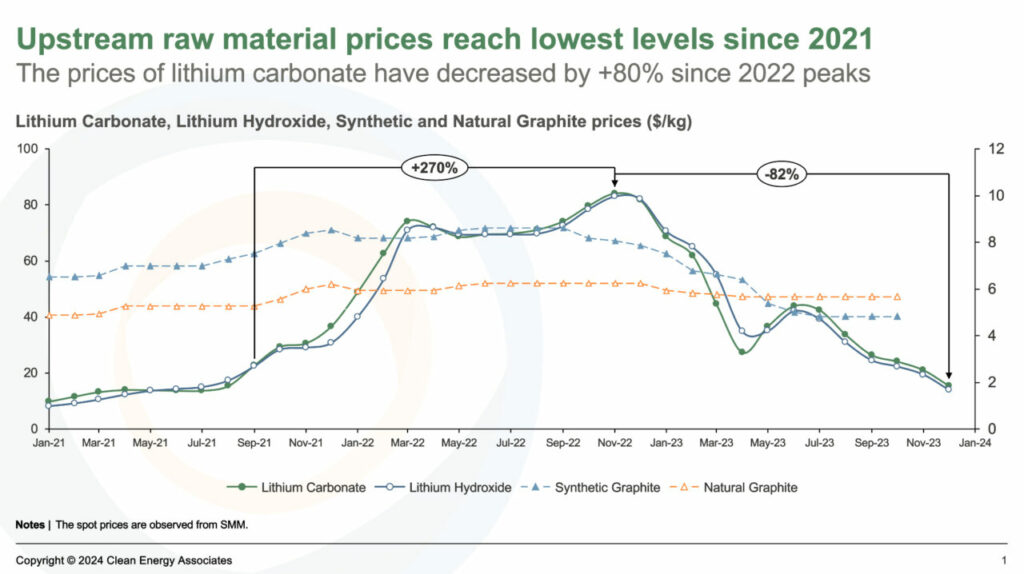

The primary price driver is universally recognised as a frothy lithium market that suddenly lost its fizz. Lithium carbonate pricing is down more than 80% from its 2022 peak. Supply/demand imbalances are to blame; or rather, how third-party estimates regarding those imbalances developed over the past three years (Figure 1).

To illustrate, in December 2021, S&P Global forecasted 2023 global lithium supply to top 762,000 tons, with a small surplus of 9,000 tons over demand. By the end of 2022, supply estimates for 2023 had grown to 864,000 tons, surpluses were nil and long-term shortages were expected. The market shifted dramatically in 2023, and S&P’s latest estimate pegged global lithium supply at 968,000 tons, corresponding to a market surplus of 95,000 tons. A longer-term lithium carbonate surplus is now the industry consensus.

To be clear, the supply swing caught the entire market by surprise. Most industry pundits misjudged the pace of supply expansion from existing lithium mines, the dwindling electric vehicle (EV) demand dynamics, and the apprehensive buying behaviour in this still-youthful commodity segment.

For example, although supply/demand imbalances drove price volatility from 2021 through 2023, the magnitude of those price excursions was exacerbated by stocking and destocking within the lithium-ion battery value chain. EV battery cell suppliers, especially those in China, have been locked in a heated battle for market share for years. Fears of critical raw material shortages at a time when global EV demand was achieving growth rates of +60% stoked irrational buying behaviour.

The result was a 270% increase in lithium carbonate costs from Q3 2021 to Q4 2022. The removal of China’s New Energy Vehicle incentive in 2023, lingering range anxieties among Western consumers and a global increase in interest rates cast a pall on the EV market, resulting in a “disappointing” YOY growth rate of 31%. As demand slipped, suppliers were left sitting atop mountains of inventory and thus moved aggressively on price to bring their balance sheets back in order.

Savvy ESS developers recognise the critical importance of monitoring the broader EV sector alongside their own market. EVs represent around 80% of global lithium-ion battery demand, and the knock-on impacts to the ESS segment in terms of raw material pricing are meaningful as DC container suppliers generally apply raw material index pricing to their proposals.

Consequently, ESS developers and integrators should be mindful of near- to mid-term EV downside demand risk as they could be leaving money on the table. The next wave of EV adopters will need a rollback of interest rates, rollout of lower-cost EVs and an expansion of charging infrastructure, all of which will take time. BNEF just downgraded its global EV forecast (again) for 2024 by 775,000 vehicles.

Just when you thought it was safe… pricing falls to new lows

ESS market participants entered 2024 with enthusiasm and confidence, under the impression that market conditions had settled down and that they would finally be able to ink purchase orders.

That euphoria was dashed by the time Intersolar North America 2024 took place as US$20/kg lithium carbonate pricing fell to US$14/kg. This left many to wonder where the floor for lithium really is. Interviews with ESS developers by CEA at the event revealed pricing for DC containers had dropped again, with average pricing at US$150/kWh. Aggressive bids from Tier II/III suppliers seeking to gain a foothold in the US were even lower, which raises the question as to whether current pricing is sustainable.

Lithium’s impact on ESS system pricing has been established but does not fully explain the extent of current market pricing. In fact, the lithium impact is diminishing mightily, as lithium carbonate within the battery cathode constitutes only around 5% of DC container system cost at current market pricing.

CEA has been advocating for months that ESS developers and integrators begin to evaluate other price drivers for their DC container buy, including the impact of anode active materials costs, increased battery module manufacturing efficiencies, battery cell technology advancements and supplier margins in general.

In terms of production efficiencies, the market continues to move along the same path as the solar photovoltaic market, pushing to increase the level of automation applied at gigafactories. In the case of batteries, operational scale has enabled producers to introduce automation to handle tasks such as cell sorting, cell stacking, busbar installation and welding of electrical connections.

Battery module balance of system component integration and cell/module testing likewise are being automated to increase production throughput. These capital investments have a meaningful impact and can lower DC container production costs by more than US$10/kWh.

Technology advancement in the ESS sector will also contribute to a steady downward price trajectory for DC battery containers. The ESS value chain remains focused on evolutionary advancements to the ubiquitous prismatic LFP battery cell, as evidenced by the mass market transition from 280Ah to +300Ah battery cells.

This is largely the result of battery manufacturers increasing electrode active material loading while reducing electrode thickness, without sacrificing battery performance. This evolution in energy density will yield incremental cost reductions from the current 280Ah architecture in large part thanks to balance of system savings at the container level.

The IRA is not bulletproof

The Inflation Reduction Act (IRA) is central to current US energy transition plans, and any changes to its structure or the value of its incentive mechanisms could have detrimental impacts to both the domestic ESS and EV sectors. A new administration could hinder its implementation through executive action by withholding loans and grants, or even revising Department of Treasury guidance for rules that have not been finalised. A new Congress could potentially revisit the Investment Tax Credit, Production Tax Credit or the New Clean Vehicle Credit.

A repeal of these provisions would affect pricing and demand for battery cells, modules and DC containers in the US.

This is an extract of a feature article that originally appeared in Vol.37 of PV Tech Power, Solar Media’s quarterly journal covering the solar and storage industries. Every edition includes ‘Storage & Smart Power’, a dedicated section contributed by the Energy-Storage.news team, and full access to upcoming issues as well as the nine-year back catalogue are included as part of a subscription to Energy-Storage.news Premium.

About the Author

Dan Shreve is Vice President of Market Intelligence at Clean Energy Associates (CEA). He has worked in a range of renewable energy engineering and commercial leadership roles for over 20 years. He previously served as Head of Energy Storage Research at Wood Mackenzie after its acquisition of MAKE, a global wind energy advisory, where he was a Managing Partner. He earned a Bachelor’s in Mechanical Engineering from Worcester Polytechnic Institute, and his MBA from the University of New York.