According to Wood Mackenzie, energy storage deployment numbers in the US broke records for three successive quarters with previous records “shattered” to finish the year.

The analysis firm has just published the Q4 2023 edition of its US Energy Storage Monitor series, which tallies activities in the sector.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

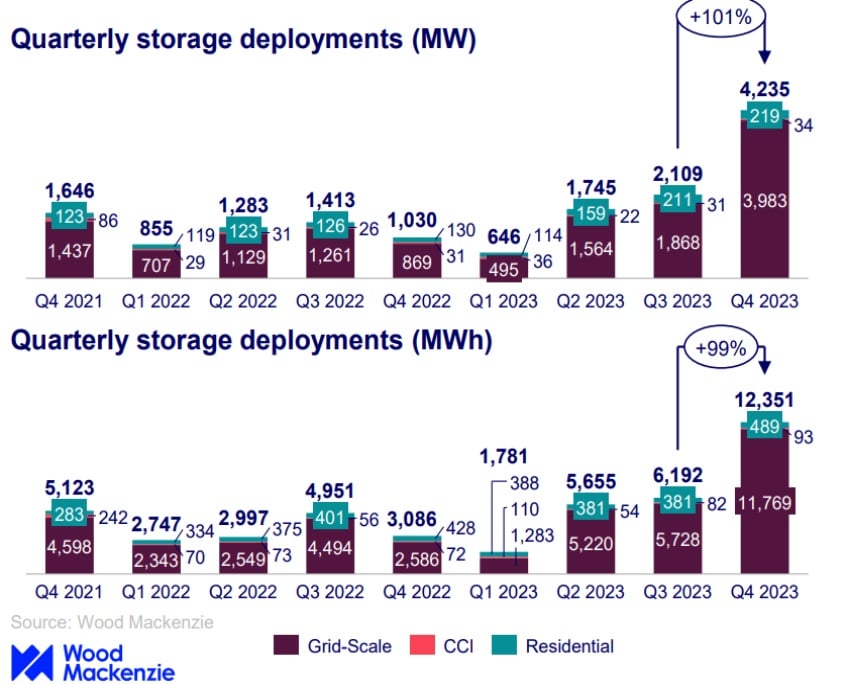

It found that 4,235MW was installed across the three main market segments of grid-scale, residential, and community-scale commercial and industrial (CCI) in the last three months of the year.

Headline deployment figures

For residential and grid-scale segments, it was a record quarter, with grid-scale enjoying a particularly strong period with 3,983MW of new capacity additions, marking the first time on record that quarterly installations exceeded 3GW.

That equated to a 358% increase in megawatt terms from Q4 2022’s 869MW. Grid-scale saw a similar increase in megawatt-hours year-on-year, growing 354% from 2,590MWh in Q4 2022, to 11,769MWh in the final quarter of 2023.

California, the leading state for the quarter, and with 6,593MW brought online in the period dominated the market with a 56% share of all Q4 deployments. Arizona and Texas were the next closest rivals.

Meanwhile, residential, with 218.5MW of deployments, “barely” beat its record of 210.9MW set in the previous quarter. That Q4 2023 figure was a 68% increase from 130.2MW in Q4 2022, although in megawatt-hours, the increase was just 14%, from 428.3MWh to 489.2MWh.

Again, California led, being the first state-level market to exceed 100MW of new storage capacity in any given quarter. However, over the course of the full year, Wood Mackenzie noted that Puerto Rico installed the most storage of any US territory, due to a favourable policy environment.

The CCI segment continued to lag. Growth remained “stagnant,” with just a 9% increase from 31.2MW to 33.9MW when comparing the final quarters year-on-year. The segment fared better in megawatt-hour terms, growing 29% to 92.8MWh of new deployments in Q4 2023 from 72MWh in Q4 2022.

Market challenges eased up

Despite Q3 and Q2 also representing record deployments, Wood Mackenzie had warned in both instances that the industry was facing “multiple headwinds”. For instance, in Q3 2023, the firm reported that 82% of grid-scale projects expected to be completed during the quarter had seen their COD pushed back.

“Q4 2023 was extremely strong for the US energy storage market, helped by easing supply chain challenges and system price declines,” Wood Mackenzie senior energy storage analyst Vanessa Witte said.

Wood Mackenzie is forecasting 59GW of new grid-scale storage capacity in the US between now and 2028. At the Energy Storage Summit USA, hosted by our publisher Solar Media in Austin, Texas, this week, US Department of Energy Office of Policy principal deputy director Carla Frisch said the department had increased its expectations for coming storage deployments to 2040 around four-fold, to about 200GW by 2040.

Frisch said this was broadly in line with “everyone else’s analysis” of the market, while in the shorter term, the Inflation Reduction Act has given the sector a massive boost.

Wood Mackenzie also provided full-year 2023 figures in its Q4 US Energy Storage Monitor. Total deployments across all market segments added up to 8,735MW/25,978MWh for the year.

Numbers pertaining to utility-scale storage, which enjoyed a near-100% increase in deployments year-on-year can also be found in the most recent annual market report from the trade group American Clean Power Association (ACP), which partners with the analysis firm on the Monitor’s publication. Energy-Storage.news covered the ACP report a few days ago.