Europe’s big battery storage year leads this Friday Briefing, which is a little shorter than usual, with Solar Media’s offices closed for a short break.

Europe’s 10GW year

For a long time, Europe’s energy storage deployments have lagged behind those of the US, with around a gigawatt registered each year in the UK, Europe’s biggest market by country while the rest of Europe has accounted for barely a gigawatt each year.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

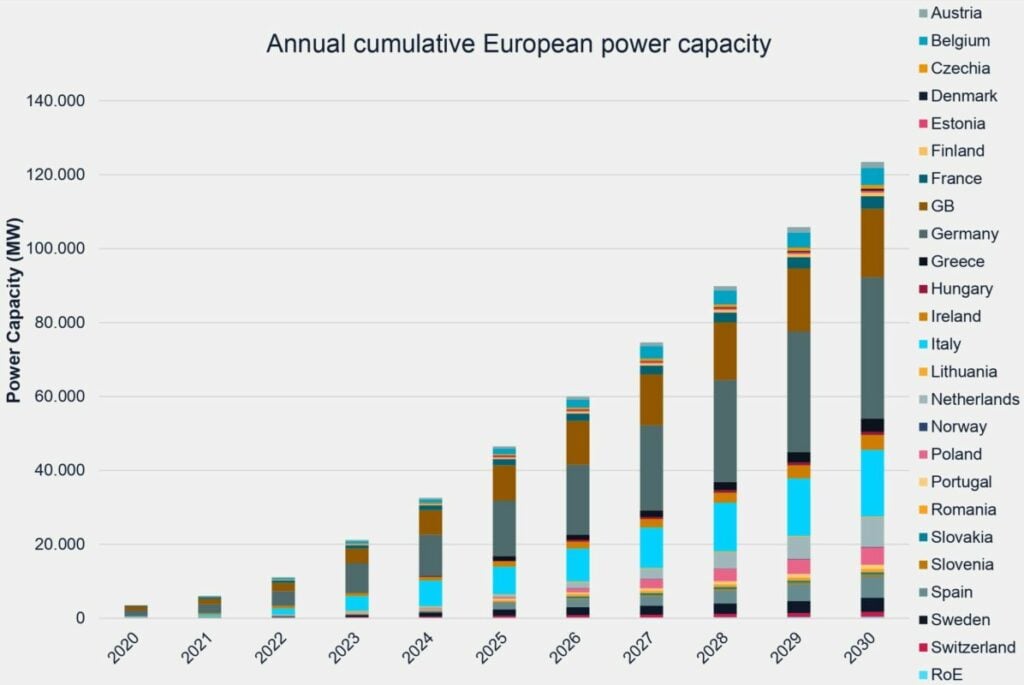

That appears to have changed, with 10GW of storage deployed in European countries during 2023, according to the eighth edition of the European Market Monitor on Energy Storage (EMMES), published on Thursday (28 March) by the trade association EASE and analysis and research group LCP Delta.

Recent figures from Wood Mackenzie found the numbers for the US to be around 8.7GW.

As we had already heard at the Energy Storage Summit EU 2024 in February, the picture for energy storage in Europe is changing. While EASE – the European Association for Storage of Energy, to give the full monicker – has highlighted in its modelling that something like 14GW each year will be needed for in the European Union (EU) countries alone to meet climate targets, it’s an exciting change of pace.

What’s perhaps most interesting however, is that US deployments are heavily dominated by front-of-the-meter (FTM), grid-scale battery energy storage systems (BESS), while the opposite is true in Europe, according to the EMMES researchers.

For example, for Q4 2023, Wood Mackenzie said that of 4,235MW of new energy storage that came online during the quarter, 3,983MW was utility-scale FTM BESS, and that was by no means an unusual finding throughout the years that the firm’s US Energy Storage Monitor – formerly GTM Research’s Energy Storage Monitor before a 2017 buyout by Wood Mackenzie – has been tracking the market.

EMMES, on the other hand, highlighted that of approximately 10.1GW that came online in 2023, only around 2.8GW was in the FTM market segment, and the remaining 7.3GW was behind-the-meter (BTM) storage capacity, largely residential.

Soaring electricity prices in the wake of the gas crisis that followed Russia’s invasion of Ukraine, a desire for greater independence from utility suppliers, and of course, citizens’ commitment to lowering their carbon footprint are all likely drivers for this market momentum.

While that’s incredible to see, it does however point to a need for rapid scaling up of utility-scale deployments. The good news is that there are indications Europe’s policymakers and regulators have begun to recognise this, and from our recent conversations with a number of sources, there is industry appetite too, both from within Europe and from overseas companies looking to get involved in the action.

More about EMMES next week when we return to the office.

Availability knocks, gigafactories rock

This week, we hosted two live webinars: one on the topic of scaling battery storage gigafactories from ideas to mass production with ATS Automation and the other with TWAICE on the important role of battery analytics in ensuring BESS availability and performance.

Many thanks to all who attended, and especially those that asked great questions that kept our speakers on their toes, kept me as a moderator extremely busy, and helped illuminate both subjects for their fellow audience members.

Both webinars were extremely interesting and as usual, you’ll be able to watch them again, or for the first time, via the on-demand section of the site, where by registering you can also receive presentation slides and contact the speakers.

For now, we’ll leave you with the video of our session with Rob Faulhammer of ATS Automation, with the video of the webinar with Lennart Hinrichs and Ryan Franks of TWAICE to follow in the coming days.

Happy Friday!

This week on ESN Premium

Texas BESS reliability issue is ‘not over’ for ERCOT despite NPRR 1186 state-of-charge rule rebuff

The issue of ensuring reliability of BESS resources in the Texas electricity market has not gone away for grid operator ERCOT, despite the state regulator’s recent quashing of proposed minimum state-of-charge (SOC) rules.

As reported by Energy-Storage.news in January this year, the Public Utility Commission of Texas (PUCT) ordered ERCOT to rescind NPRR (Nodal Protocol Revision Request) 1186, a rule which forced battery energy storage system (BESS) resources to hold additional capacity when providing ancillary services.

ERCOT’s reasoning was to ensure that BESS resources could fulfil their ancillary service duties, with some units occasionally failing to provide the power they were contracted to provide.

Speaking to Energy-Storage.news at our publisher Solar Media’s Energy Storage Summit USA 2024 in the capital Austin last week, optimiser Gridmatic’s VP business development David Miller explained that the issue is not over.

Undeniable ‘momentum behind energy storage’ in Europe

The “momentum behind energy storage,” leading to its wider adoption across the grid in Europe is becoming increasingly undeniable, Energy-Storage.news Premium has heard.

Speaking with the site at last month’s Energy Storage Summit EU, Florian Mayr, a strategy, business development, and transactions expert at advisory group Apricum, said that there has been a fundamental change in the way the technology is viewed by policymakers and regulators, particularly at the European Union (EU) level.

There is growing recognition in the European Union that “energy storage has to be part of the equation” in providing flexibility to an electricity system increasingly reliant on low-carbon energy sources, Mayr said.

“I think what we’re seeing in many markets [in Europe], including also notorious laggards like Germany, suddenly there’s movement. Energy storage is seen as an asset, not as a burden, and part of the solution to the problem.”

BESS price falls pushing marginal projects into IRR investors need, US developer says

BESS price falls have pushed many marginal projects in merchant markets into a rate of return needed for investment, US developer Available Power told Energy-Storage.news amidst the sale process for its own 100MW/200MWh ERCOT project.

The falling prices of BESS over the course of the last 6-12 months has been well-documented by Energy-Storage.news recently, and Available Power’s president Ben Gregory said this has significantly boosted the market for projects in merchant markets (like Texas, where ERCOT is the grid operator).

“A lot of M&A slowed down and then picked up once lithium and BESS prices came down, because a lot of projects that were on the margins for IRR (internal rate of return) became more attractive,” Gregory said, speaking in an interview at Solar Media’s Energy Storage Summit USA 2024 in Austin, Texas’ state capital, last week.