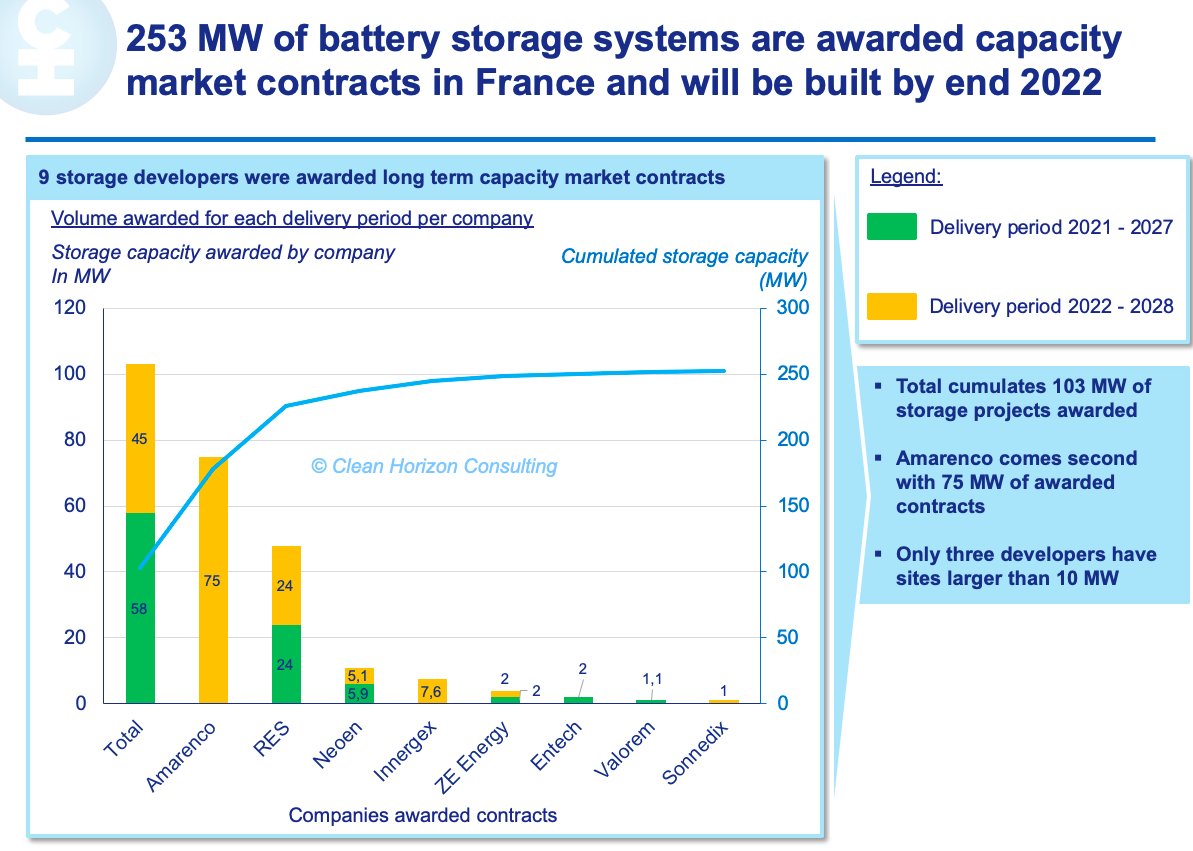

Results announced last week in a Capacity Market (CM) auction in France which had low-emissions requirements, saw 253MW of energy storage awarded 7-year contracts, along with 124MW of demand response capacity.

The European country holds CM auctions which ensure electrical capacity is available guarantee the lights stay on event at times of peak demand or during unexpected stress events that could otherwise cause blackouts. In the latest auction, the electricity transmission network operator (RTE), awarded 377MW of contracts.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Corentin Baschet, a markets analyst at consultancy firm Clean Horizon, told Energy-Storage.news that the latest auction was “only for new build capacity and had emissions requirements enabling only demand side response (DSR) and energy storage to participate”. Emissions were fixed at 200g of CO2 per kWh or less.

Baschet said that the four auctions run since June 2019 are roughly equivalent to Britain’s T-1, T-2, T-3 and T-4 auctions in its own Capacity Market. However, as frequently reported on this site, regulatory and market design issues have effectively locked batteries out from competing in latter auctions in the UK, leading to two asset operators instead registering their battery systems as demand side response – and winning contracts.

Although France’s market rules had no such stipulations, Baschet said, only two of those four French auctions awarded capacity contracts (for the periods between 2021-2027 and between 2022-2028) as market caps were already reached in periods 2020-2026 and 2023-2029. The Clean Horizon analyst noted that the contracts were awarded prices of €29k per MW/year (2021 period) and €28k per MW/year (2022 period).

“These contracts use the same principle as Contracts for Difference (CFDs), capacity has to bid in the yearly capacity market auctions – clearing at an average of €20k/MW/year today,” Corentin Baschet of Clean Horizon said, adding also that some big players in the French market such as EDF, ENGIE and NW Energy participated but were not successful, but nonetheless each have large storage deployment plans already announced in the country.

At last week’s Energy Storage Summit in London, a panel heard from Next Kraftwerke CEO Jochen Schwill that battery storage is “not really working anymore” in various previously existing market opportunities in mainland Europe, such as Germany’s Primary Reserve grid balancing market, although the picture obviously varies across the continent, while there is also hope that energy storage will be recognised as a “pillar of the energy transition” in the European Union’s forthcoming Clean Energy Package policies.

Awarded battery storage contracts:

2021-2027 period

| Company | MW capacity awarded |

|---|---|

| TOTAL FLEX | 58 |

| CSE Volta | 24 |

| Entech | 2 |

| NEOEN | 5.9 |

| Valorem | 1.1 |

| ZE Energy | 2 |

2022-2028 period

| Company | MW capacity awarded |

|---|---|

| ADF7 | 75 |

| ALOE ENERGY | 1 |

| TOTAL FLEX | 45 |

| CSE Coulomb | 24 |

| INNERGEX | 7.6 |

| NEOEN | 5.1 |

| ZE Energy | 2 |