The CEO of LG Energy Solution Vertech, Jaehong Park, speaks to Energy-Storage.news Premium for an exclusive interview.

When LG Energy Solution, the energy storage arm of South Korean conglomerate LG’s battery business acquired NEC Energy Solutions (NEC ES) in 2022, all industry eyes were on what would come next.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

NEC ES had been an early leader in the battery energy storage system (BESS) integration space and might have been the first to get to a gigawatt of deployments had owner NEC not decided to pull the plug due to a reported lack of profitability in mid-2020.

NEC ES had integrated its BESS hardware with third-party battery cells with a proprietary controls software platform, AEROS. Its acquisition potentially combined one of the sector’s biggest names in system integration with one of the world’s largest battery OEMs.

As regular readers will know, LG Energy Solution (LG ES) then launched its system integration arm at last year’s RE+ show in Las Vegas, highlighting the importance of the North American market in its strategy.

Company representatives have said that the competitive advantages of the new business, LG ES Vertech, include the ability to leverage the parent company’s know-how, experience and volumes of lithium iron phosphate (LFP) manufacturing as well as downstream capabilities provided by AEROs and other NEC ES assets.

Before we dive into our interview with Jaehong Park, which took place a couple of weeks ago, we should address the news that LG ES is hitting the pause button on its new dedicated 17GWh LFP cell production line for BESS products in the US.

It was widely reported in local media this week from Arizona, where the line will be sited alongside production facilities for electric vehicle (EV) batteries that LG ES has temporarily put on hold work for the BESS-dedicated second phase of the factory’s construction in the town of Queen Creek.

In a note sent to Energy-Storage.news this week (3 July), Jaehong Park of LG ES Vertech said that the pause is in fact to accommodate planned higher volumes of manufacturing, rather than due to a dip in expected demand.

“LG Energy Solution is adjusting the pace of planned investment execution efficiently and flexibly according to market conditions, and focusing on optimising our operations,” Park said.

“As part of such efforts, LG Energy Solution is adjusting our ESS-purpose US manufacturing plan to get products to market faster. This includes a slow-down of the construction of our Arizona ESS battery facility as part of our broader approach that will allow us to reach higher US production volumes more quickly than previously forecasted. Meanwhile, the construction of cylindrical EV battery facility is ongoing as planned.”

“We remain firmly committed to US manufacturing, and can confirm that we will meet all of our domestic content requirements by Q4, 2025.”

Park added that the company cannot yet reveal specific details of the “new approach,” but called it an “exciting opportunity”.

Last week, we published Jaehong Park’s views—excerpted from same interview as the following conversation—on the advantages of vertically integrating everything from battery hardware and software to power conversion system (PCS) and other key technologies.

These included the idea that customers have one service provider or vendor to contract with for their projects, bringing accountabilities for all levels of the project to one system integrator, and the higher degree of control it offered LG ES over its products and solutions would be deployed in the field and operated.

‘Strategic movement to acquire NEC ES’

Jaehong Park’s professional journey in the energy storage business began in 2010, and says that even then, he and colleagues were anticipating the rapid growth of storage to take off in the US in five years’ time.

It seemed the wait would continually be extended by another five years as time went on, but today, he says, after years of pilot projects and work to ensure the technology would benefit stakeholders, “energy storage is an important part of the energy sector now”.

“After I joined LG as a part of the ESS team, we were mainly focusing on battery manufacturing technology and processing technology to make it make economic sense.”

Park says he thinks LG ES contributed significantly to helping the industry achieve economies of scale and to make the technology feasible to address the needs of the energy transition, which few would be likely to argue with.

“After a while we found that energy is something more than just a manufacturing technology, and that’s the reason why as a strategic movement, we decided to acquire NEC ES. The main reason why we decided to take that path was because energy is not just a commodity,” Park says.

LG ES decided that along with the hardware that stores the energy, control technologies, data science and analytics are the “key technologies that play such an important role to improve the efficiency of energy storage.”

“Being a battery supplier [only] would not help us to collect that data and they will not help us to address those pain points that the customer has.”

After the acquisition, LG ES carried out “extensive and intensive research” on directions to take in order to satisfy future demand, and as of December last year had already booked or was in negotiations for 10GWh of system integration orders from North American customers.

Park says that with the US manufacturing line on the way, conversations are being held with customers daily on how best to utilise that new capacity.

It’s a far cry from his early days in the industry, but when asked what the sector looks like now compared to how it did in 2010, he says some things have stayed the same and others have changed dramatically.

For example, 14 years ago the cost of lithium-ion battery storage was US$1,000/kWh. But that had changed just two years later when LG ES bid for one of the world’s biggest projects at the time for utility Southern California Edison (SCE).

The target price for the 32MWh Tehachapi project was “somewhere slightly lower than US$600/kWh,” which was a “crazy” price, but LG ES achieved it and deployed the project.

Today, LG ES can compete for prices that average at lower than US$200/kWh.

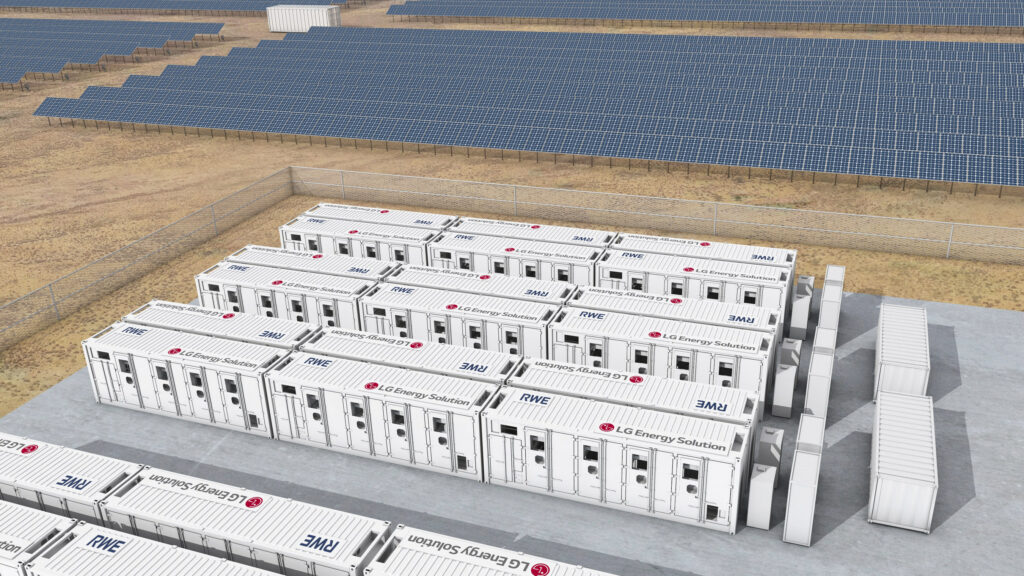

Another big change has been in energy density, with earlier commercially available standardised BESS solutions delivered in 40-foot containers. Today, 20-foot ISO container-type configurations are the norm, packing 5MWh of storage capacity or even more.

Other things that have changed include the development of safety standards and protocols, while the increasing standardisation of software is also a change from the highly customised projects of the past.

“The software itself to integrate so many different components like PCS and HVAC and cooling systems and batteries are no longer a differentiator,” Park says.

“Now, it’s more than that, [its] trading platforms and then machine learning technology and AI, all those things to improve revenues from the customer perspective, and decrease the operational expenditure during the lifespan.”

Data centres add major demand to already-booming US market

The US market has changed enormously since 2010 of course, and from inflection points we might judge as being from about 2015 onwards, almost every successive year sees records broken for utility-scale deployments. At the beginning of this year, LG ES forecast 30% growth in the US market during 2024.

Market opportunities today are more spread around the country from being extremely concentrated in California first and more recently Texas, although it is still a patchwork of markets based around utilities and transmission and market operators in scattered states.

There are some interesting trends emerging, says Jaehong Park, including the rapid growth in demand for electricity for data centres as AI use proliferates.

“California was the state where policy drove the ESS market at the beginning [with the AB2514 procurement mandate for utilities] in 2017-2018, and that was the only sizeable market. Beforehand, there was a market in PJM for frequency regulation, but everyone knew that it would be saturated sometime later due to the limitation of the necessity of the frequency regulation tool,” Park says.

Then, Texas’ ERCOT grid was a major driver of market growth for the US due to the volatility of wholesale electricity prices, which BESS is well-placed to capture.

Now, Park says, LG ES has gigawatt-hour-scale projects in Arizona and Nevada contracted or in negotiation, and others scattered around the country in territories including the Midcontinent Independent System Operator (MISO) market.

However, plans all over the US to invest tens of billions of dollars into data centres will create a “big problem,” in terms of providing stable sources of low-carbon energy to meet their demand, which for renewable energy and energy storage could be a big opportunity to solve.

“If you look at the infrastructure, the question is: is the infrastructure really ready and can Renewable Energy Credits (RECs) solve the problem? No, they cannot.”

RECs are structured so that a data centre developer or owner in Georgia could buy RECs from Texas and offset consumption, making it, on paper, 100% renewable-powered.

“In reality, you need power and energy within Georgia, where you have interconnection to your data centre.”

Park says he has found that “so many projects are under-developed” in that regard, and that data centre-driven energy requirements will be a big opportunity for energy storage. LG ES Vertech is seeking to focus on this trend and “try and follow where the market goes,” he says.

LG ES Vertech developing revenue optimisation software

Software will be key to capturing those and other opportunities and, as Jaehong Park has said in the past, leveraging NEC ES’ AEROS platform and its capabilities of modelling and optimising revenues against market conditions a key part of LG ES Vertech’s strategy in that respect.

The market will be a diverse one, including solar-plus-storage projects that help deliver renewable energy to the grid or corporate customers more smoothly along long-term power purchase agreement (PPA) contracting structures, to standalone battery storage assets that operate largely in merchant markets.

Volatility of wholesale electricity prices in merchant markets like ERCOT will continue to grow, Park says, and LG ES Vertech is developing software to maximise capture of that volatility through energy trading, or arbitrage.

Guaranteeing system availability, is more critical to the business case for merchant projects than it is for projects tied to PPAs, for example.

“Guaranteeing availability is one of the important things [even with a PPA-type contract], but in the merchant market, if you lose 5% of the market opportunity or even less, you could lose maybe 30% of the revenue, because the wholesale market price is quite spiky,” Park says.

“If you lose [availability in] a specific time period when the price is really high, then you lose most of the revenue stream.”

Localisation of value chain a ‘key differentiator’ in US market

Although LG ES had taken its decision to expand its battery manufacturing footprint in the US before the passing of the Inflation Reduction Act (IRA), that and other legislation like the Bipartisan Infrastructure Law are now the main drivers for growth of BESS and clean energy tech manufacturing, according to Jaehong Park.

“We already decided that localisation is one of the key differentiators for us to be the major player in the United States, before the IRA actually kicked in,” Park says, adding that LG ES was fortunate that it was already a recipient of policy support before the landmark legislation passed.

The IRA and Bipartisan Infrastructure Law’s direct support for domestic manufacturing and tax credit incentives for making and deploying domestically aligned with LG ES’ existing plans and activities the CEO claims.

“Localisation is not just simply building a factory; you have to have the entire value chain and supply chain built up in the United States. Otherwise, if you build a factory, but if you import every core material from outside the United States, it doesn’t really work.”

LG ES already had partnerships with US automotive industry OEMs in place and already has operational production facilities in the country, even without policy support via the Biden Administration’s legislation, localisation there made sense for the company.

“Now, the situation is really favourable for us to be a local player,” Park says.

While the 17GWh Queen Creek production plant in Arizona will represent a significant portion of the overall US manufacturing base when it opens, LG ES Vertech is seeing “extremely high demand,” and expects the market to continue growing.

As alluded to above, the company is considering options to ramp up further and meet that demand.

However, there do remain a few issues that could impact demand, and the ability of manufacturers like LG ES to assess with certainty the outlook for their business in the coming years, and chief among those are permitting and interconnection delays, with US grid operators having something like 100GWh of energy storage projects in their queues to connect to the grid.