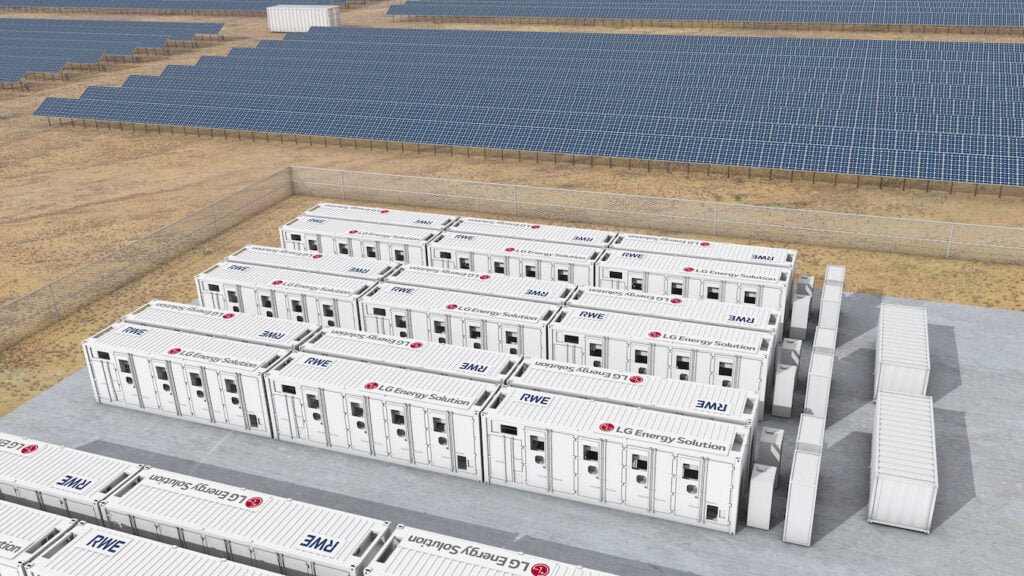

LG Energy Solution will build a new battery cell factory in the US with 43GWh annual manufacturing capacity, including 16GWh dedicated to the stationary energy storage market.

The South Korea-headquartered company said this morning that it will invest KRW7.2 trillion (US$5.5 billion) into the production plant in Queen Creek, Arizona.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Scheduled to break ground this year, the complex will feature twin production facilities, one for cylindrical 2170 battery cells targeting the electric vehicle (EV) sector with 27GWh annual production capacity, the other making lithium iron phosphate (LFP) pouch cells for energy storage systems (ESS).

According to LG Energy Solution (LG ES), the LFP production line would be the “first ESS-exclusive battery production facility in the world” and is expected to begin production in 2026, a year after the expected in-service date of the EV battery-making portion of the Arizona factory.

However, at the beginning of this week, another manufacturer, Pomega Energy Storage Technologies broke ground on what it said will be the US’ first dedicated factory for ESS-specific LFP cells, in South Carolina.

Given that that plant is expected to come online next year, it will be ahead of LG ES’ plan in that respect, albeit the Pomega plant’s annual production capacity will be much smaller at 3GWh.

Pomega was established late last year as a subsidiary of Turkish company Kontrolmatik Technologies, a vertically integrated manufacturer of battery cells and battery energy storage system (BESS) solutions.

At the time of its establishment last November, Kontrolmatik said that Pomega expected to receive more than US$900 million in incentives linked to the Inflation Reduction Act (IRA). While the plant had been planned even before the IRA was passed, when the legislation became law it prompted an increase in the planned annual output by 50% from 2GWh.

What is certainly not disputed is that the IRA appears to have put the rocket boosters onto the US’ ambitions to establish a domestic battery value chain, particularly in battery cell manufacturing.

While not perhaps purely dedicated to the ESS sector, other large-scale production plants that will make LFP cells for battery storage as well as EVs are on the way, with US startups Our Next Energy and American Battery Factory among those with ambitions in that regard, as well as KORE Power, which is a little further ahead in its plans for a 12GWh plant. In fact, KORE and American Battery Factory’s chosen sites are also in Arizona.

LG ES too said that the Inflation Reduction Act was a key factor in its own Arizona plant’s business case, as well as allowing the company to bring production much closer to the expected demand for batteries for mobility and stationary applications and allow it to build closer relationships with end-customers. The ESS portion of the plant represents KRW3 trillion of its planned investment there.

The company also has its own BESS solutions company, LG ES Vertech, and is thought to be pursuing a vertical integration strategy since its acquisition of energy storage system integrator NEC Energy Solutions a while back.

Energy-Storage.news’ publisher Solar Media will host the 5th Energy Storage Summit USA, 28-29 March 2023 in Austin, Texas. Featuring a packed programme of panels, presentations and fireside chats from industry leaders focusing on accelerating the market for energy storage across the country. For more information, go to the website.