A milestone has been reached in the development of a market for utility-scale battery storage in Japan, with developer Pacifico Energy trading energy stored in two new projects.

The developer said last week (23 June) that it has commenced commercial operations, including bidding into power markets, for the battery energy storage system (BESS) projects. Each site comprises a 2MW, 4-hour duration BESS (8MWh).

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Construction began in September last year, with both projects quickly completed to start commercial operation earlier this month. One is in the north-east of Japan, in Shiroishi, a ward of Sapporo City on the island of Hokkaido.

The other is at the opposite end of the country’s main archipelago, in the south-east, in Itoshima City, Fukuoka prefecture, on the island of Kyushu.

In 2021, they were among the first projects in the country to have been selected for a government subsidy programme, designed to support the introduction of renewable energy around the country by the Ministry of Economy, Trade and Industry (METI).

Japan is targeting reaching a 36% to 38% share of renewable energy on its electricity network by 2030, and METI has identified BESS as a key technology to enable that. Along with the subsidy scheme, which helps fund equipment costs, regulations have been changed to allow standalone battery storage facilities like Pacifico’s to participate in power markets.

However, Pacifico Energy’s head of battery storage told Energy-Storage.news the two new BESS projects’ origination pre-dates the subsidy scheme, which was rolled out a few months into their development.

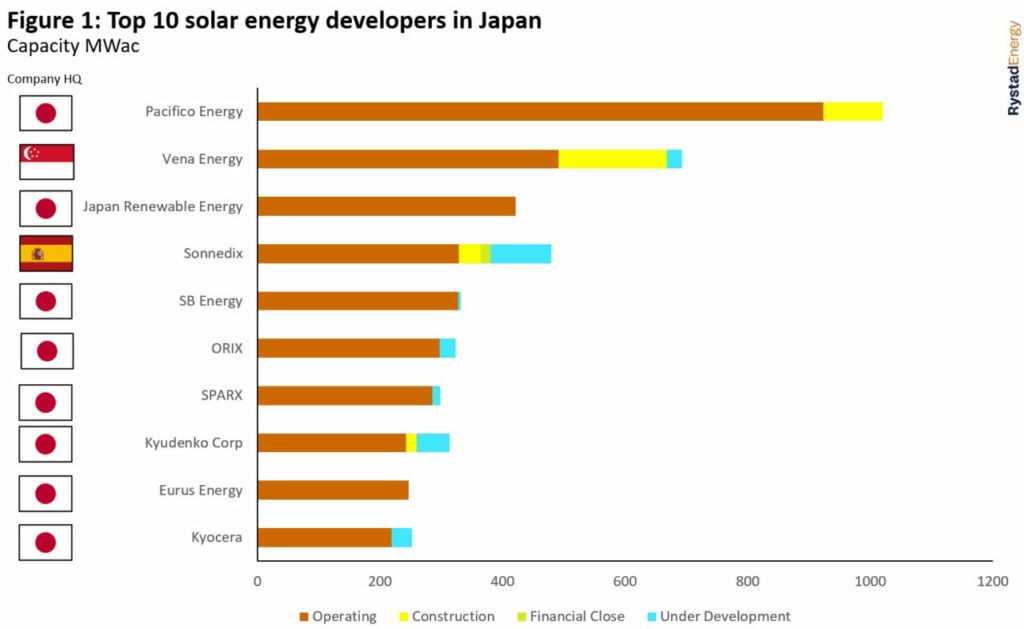

With over a gigawatt of completed solar PV projects under its belt, Tokyo-headquartered Pacifico is ranked as Japan’s most prolific developer, as shown in the chart below from Rystad Energy. Founded in 2012, the company set up its battery storage arm in 2021 to capitalise on the technology’s potential for the domestic market, Mahdi Behrangrad told Energy-Storage.news.

BESS is now one of the “three pillars” of Pacifico’s business, together with solar PV and offshore wind, with opportunities in the latter pursued in a joint venture (JV) with the UK’s SSE Renewables.

“We started [the energy storage business] because Pacifico believes in this market, and we believe that we can be a pioneer in bringing our international experience and knowhow to the Japanese market – and we believe that it’s going to be a win-win business model for everyone: for the broader energy industry and for us as a developer,” added Behrangrad, who joined the company in 2021 to set up that third pillar business division.

While that makes Japan a late starter compared to more mature markets such as California or the UK, it meant the developer was able to learn from some of them. Whether that be taking the successful aspects, or ensuring similar mistakes would not be repeated, Pacifico assimilated them into its own, Japan-focused approach.

The developer is certainly not alone in spotting this potential opportunity. Earlier this month, Energy-Storage.news reported that major Japanese conglomerate Itochu and utility Osaka Gas have partnered to develop a grid-connected 11MW/23MWh BESS in Osaka, Japan’s second largest city.

Meanwhile other major energy and renewables industry players in the country like developer Eurus Energy, financial services group Orix and conglomerates Toyota Tsusho and Mitsubishi Corporation among others are known to be developing or constructing grid-scale BESS, in many cases for the first time in the country (albeit several players have prior experience working with battery storage from those other more mature markets).

In a Guest Blog for this site, published yesterday, Hendrik Bohne, head of asset management & business development at Aquila Clean Energy Asia Pacific (ACE APAC) identified Japan, along with Australia, as one of the leading early adopter markets for battery storage as an instrument of decarbonisation in the Asia-Pacific region.

‘We don’t hunt for subsidies’

Getting the government subsidy is not, and should not be, central to the “win-win business model” for BESS, according to Behrangrad. The subsidy programme was rolled out several months after development work began and in fact meant the projects both had to be effectively put on hold for several months as they underwent assessments for eligibility to receive them.

“We don’t hunt for subsidies,” Behrangrad said.

“It’s very critical that from early stage of the business, you have a business strategy that doesn’t rely on any subsidy. Otherwise, your growth and your margin is always decided [for you]; it’s something that you have no control over and it makes it very difficult to make a financeable project, or a scalable project, both of which are critical in order to do this kind of business.”

What the subsidy is useful for, is in proving developers of BESS assets can be a trusted partner in Japan’s efforts to support and kickstart its industry. In fact, a big motivating factor to apply for them was for Pacifico Energy to demonstrate that it could simultaneously develop two grid-connected storage systems within the tight timeline required for the scheme.

With an expectation that if successful, the BESS projects will be followed by many more, and likely many more that will be larger in scale than the modest 2MW/8MWh initial installations, the two systems perform a range of applications.

Those include ancillary services, participation in the capacity market, and energy arbitrage. Being able to revenue stack i.e., earn income from multiple revenue streams from different services and applications, is absolutely central to Pacifico’s projections for a “win-win business case,” Behrangrad said.

A full interview with Mahdi Behrangrad, head of energy storage at Pacifico Energy will be published on this site for Energy-Storage.news Premium subscribers in the coming days.

Energy-Storage.news’ publisher Solar Media will host the 1st Energy Storage Summit Asia, 11-12 July 2023 in Singapore. The event will help give clarity on this nascent, yet quickly growing market, bringing together a community of credible independent generators, policymakers, banks, funds, off-takers and technology providers. For more information, go to the website.