Leading BESS owner-operators across Europe discuss the key trends around the financing and deployment of grid-scale projects, with the segment now the driver of continent-wide deployments according to trade body SolarPower Europe.

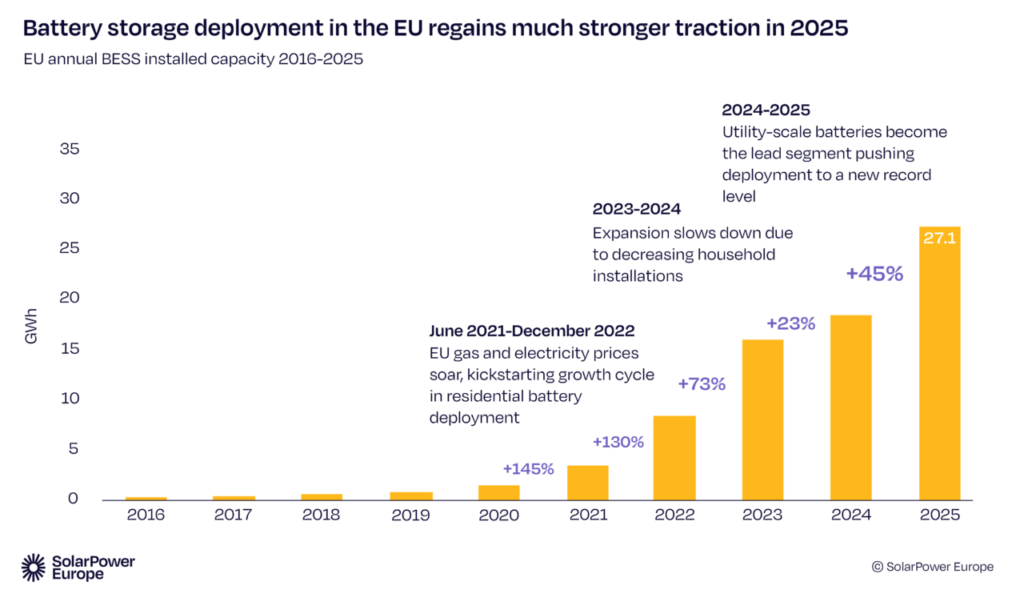

SolarPower Europe today (28 January) said that 27.1GWh of battery energy storage system (BESS) capacity came online in European Union (EU) countries last year, up 45% from 2024 figures. 55% of the 27.1GWh of this was in the grid-scale segment, while in previous years, residential and distributed-scale projects were the majority.

So what has enabled this, and what challenges remain?

Read on for the views of executives at major developers, owner-operator and financiers across the continent, including Fidra Energy, Kona Energy, Triple Point, Noveria Energy, Green Flexibility, Danske Commodities and ion Ventures. All will be speaking at the upcoming Energy Storage Summit 2026, which runs on 24-25 February in London.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Note that while the above figures from SolarPower Europe, published today in the trade association’s EU Battery Storage Market Review report, pertain to activity within the EU, this article considers markets in the wider European continent including the UK.

Market has reached ‘pivotal stage of maturity’

“The European energy storage market is at a pivotal stage of maturity, having transitioned from a niche technology to an increasingly mainstream infrastructure asset,” says Ariane Brunel, investment director at financing firm Triple Point.

Growing lender and investor confidence, improved technology performance and more sophisticated revenue-stacking strategies have driven this, she added.

Chris Elder, CEO of Fidra Energy, adds that longer warranties from BESS providers are allowing banks to give longer debt terms, reducing the cost of capital for the industry. Fidra is building the 1.4GW/3.1GWh Thorpe Marsh project in the UK, one of the continent’s largest.

Brunel says that the UK financing space has evolved from being dominated by a relatively small group of specialist lenders to a marked increase in participants. But the trend is similar elsewhere.

“Larger pan-European lenders have established dedicated renewables and BESS teams,” adds Ben Brooks, managing director of Bluestar Energy Capital’s European BESS platform Noveria Energy.

“BESS is now well-known and understood by most institutional investors’ investment committees and is readily financeable through both debt and equity.”

Evolving business case across the continent

In a nutshell, the business case for large-scale BESS across Europe can be segmented into a few ‘buckets’. In the UK, Northern Europe, Nordics and Baltics, merchant trading and ancillary service opportunities form the bedrock of the business case. Tolling is becoming widely available, but fully merchant projects are also being built, with primarily equity financing.

In Southern and Eastern Europe, the business case is more around load-shifting solar, combined with grant funding from EU-wide schemes like Recovery and Resilience, to kick-start the market. It is much more common to see BESS added to solar projects here.

Projects in Belgium, Poland and Italy are taking advantage of capacity market (CM) auctions to provide long-term minimum revenue guarantees on top of which they can stack other revenue streams. And in Italy, there is the relatively unique MACSE auction, effectively a BESS-specific CM.

Many UK players have expanded abroad, says Andy Willis, founder and CEO of developer Kona Energy: “Many developers have shifted their focus toward European markets such as Italy and Germany, attracted by greater contractual revenue certainty and materially higher returns than are currently available in the UK.”

Last year saw c.700MWh projects start construction in Germany, by RWE and Eco Stor, representing a new scale for the market.

The rise of tolls and other revenue-firming arrangements

It gets talked about a lot, but the rise of private sector tolling arrangements in BESS has enabled it to get to the investment volumes comparable to solar, particularly in light of the saturation of ancillary service markets in early-movers UK and Germany.

“Tolling has emerged as a significant trend across the European energy storage market, particularly as stakeholders seek ways to maximise asset value, secure predictable cash flows and manage risk,” says Leandra Boes, director of asset management at German owner-operator Green Flexibility.

Wider revenue-guaranteeing products are available beyond conventional tolls too, adds Rimshah Javed, principal originator at Danske Commodities, one of Europe’s largest power and gas trading companies.

“Merchant and floor deals are fairly understood at this point, and increasingly we see tolling, swaps and virtual products with newer entrants such as corporates. In general, the sector is good at collaborating on customised and unique offtake structures,” she says.

The trend is now a few years old, and in that time, there has also been an evolution in how much lenders rely on these structures. Brunel says, speaking primarily about the UK:

“For debt-financed projects, lenders initially required a minimum level of contracted revenues—often around 50% of projected cash flows, typically supported by floor mechanisms. As confidence in the asset class grew, this requirement softened, with many financings accepting significantly higher merchant exposure and, in some cases, little or no long-term contracted revenue beyond what might be provided under a capacity market or optimisation agreement, if at all.”

However, 50% is still around the sweet spot for large-scale financing, at least for Fidra Energy in the UK, Elder says.

In countries where less has been deployed, there are still opportunities to be innovative using conventional tolling agreements. 2025 saw numerous long-term rolling and BESS PPA agreements hailed as the first-of-their-kind, including in Germany, Italy and Spain. We heard from IPP Zelestra about its deals in the latter two, Italy and Spain for two previous articles.

As Boes says: “For forward-thinking BESS owners, there is now an opportunity to establish market standards by being among the first to successfully implement tolling agreements in this emerging sector while still benefiting from a merchant upside.”

Saturation of tolling market?

Most sources agree that the actual supply of tolling products is much smaller than might initially seem, given how frequently they’re discussed.

“While numerous market participants are actively exploring fixed revenue structures, only a limited number proceed to execution, largely because tolling offtakers apply steep risk discounts,” Boes says.

“The market is still relatively thin for people who are able to deliver reasonable volumes of tolls and floors. It is definitely a risk for the sector,” adds Fidra’s Elder.

However, some see the number and variety of companies offering tolling increasing.

“Aer Soléir’s 1GWh BESS toll in Italy with Shell’s Ego Energy was significant. It’s a positive sign that companies like Shell are finding potential future revenue in these projects and are happy to take the revenue risk on themselves,” an advisor says.

Although not necessarily an industry-wide trend, the launch of German startup Terralayr’s BESS tolling platform is notable as it provides another avenue to secure long-term revenues for projects simply (in theory at least) via software integration.

Whether most projects are getting to final investment decision (FID) with or without tolls or fixed revenue arrangements depends on where you are.

Boes, primarily discussing Germany, says a majority reach FID without them. Javed, primarily discussing the UK, says that “there are some merchant projects in the market through equity financing but the share of players requiring revenue guarantees is certainly larger.”

Portfolio deals and the future of BESS financing

Boes adds there is “a shift away from single-project financing, with an increasing emphasis on utilising both equity and debt facility structures that aggregate multiple projects into a single portfolio.”

The same trend has been seen in European solar, although some would argue portfolio financings are just a series of single project-financings rolled into one agreement.

Discussing the topic of financing, Hassen Bali, co-founder and director of developer ion Ventures, says that the future will see financing go beyond simple revenue forecasts and towards the wider value that BESS can generate.

“It’s a constant evolution, like any commercially pre-emptive response to cause and effect. We live in a more technologically complex world, with different cashflows than before, and a bidirectional power system with greater variability of generation,” he says.

“The financing view needs to shift to value rather than revenue from MWs. What else can the company do to create value in its assets which isn’t as black and white as returns from trading and ancillary services? Our answer lies in derisking our supply chain and with that, a host of other responsibility-linked actions which safeguard operations and bring value in other ways.”

Flower, an optimiser and BESS owner-operator mainly active in Sweden, has argued that the most value for the technology lies in its ability to hedge long-term risk for renewable operators. But, CEO John Diklev told us last year, the market is not yet mature enough to price this under long-term agreements.

Expansion of the range of services that BESS can provide, displacing other tech

The range of services that BESS can provide and the roles it is playing on the grid are evolving too. While the particulars of this evolution might not be front of mind for BESS financiers when doing deals, it’s worth noting what’s coming down the line.

One obvious one is grid-forming services. These include synthetic inertia, voltage support, black start capabilities and more.

Bali says he expects inertia to emerge at scale as a new application for BESS. Unpacking this a bit in the context of the UK, Willis says that these kinds of services will start to be valued accurately by the market over time.

“Kona continues to believe that operability revenues remain materially undervalued by both the market and many optimisers. We expect a significant increase in the utilisation of BESS assets for non-energy services from 2027 onwards, as system needs evolve and the value of stability, voltage and other operability products becomes more clearly recognised,” he says.

Javed adds: “BESS is also displacing more expensive technologies. In Sweden, [TSO] Svenska kraftnät publishes data that shows BESS is often becoming the price-setting technology and displacing other forms of flex, like hydro.”

Grid

Challenges around grid interconnection are more relevant to financing development portfolios, rather than reaching FID, but they are significant.

At the time of writing, the UK’s grid interconnection reform has been lamented by developers and owner-operators. Beyond 2027, no one is certain of their grid connection date, making financing for them impossible, a source says.

In Germany meanwhile, the challenge is more around the emergence of Flexible Connection Agreements (FCAs) and how to navigate these, Boes says.

Move towards long-duration energy storage (LDES) assets

Another trend worth noting is the move to longer durations, average between 2-3 hours for projects with 2026 COD dates across Europe.

Many large-scale projects are going much higher, with 4- to 8-hours being now common in Italy. 4-hour systems are the norm in the Netherlands, Belgium, Poland.

The UK’s long-duration energy storage (LDES) cap-and-floor scheme is noteworthy, with numerous very large BESS projects in with a chance of winning support.

Conclusion

Huge progress has clearly been made in the past few years in getting large-scale BESS to FID in Europe, driven by developments within technology, finance and business models. That’s set the continent up to be on its way to 2030 goals. Whether it gets to those now appears to depend on how the industry navigates the next set of challenges around grid and market policy.

Energy-Storage.news publisher Solar Media is hosting the Energy Storage Summit EU 2026 in London, UK, on 24-25 February 2026 at the InterContinental London – The O2. ESN Premium subscribers can get exclusive discounts on ticket prices. See the official website for more details, including agenda and speaker lists.