The National Energy and Climate Plans (NECPs) of European Union (EU) Member States are largely falling short in recognising the vital role of energy storage, the Energy Storage Coalition has said.

The coalition, formed by trade groups across different renewable and clean energy technologies in Europe, said last week (11 January) that the EU’s targets for renewable energy will not be achieved without approximately doubling the continent’s installed storage capacity by 2030 to 200GW.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

However, while at a high level, this requirement has been alluded to by many EU countries, when it comes to the NECPs assessing the different needs of individual states and determining how energy transition schemes will be implemented, what are often “simple steps” to promote storage are being overlooked.

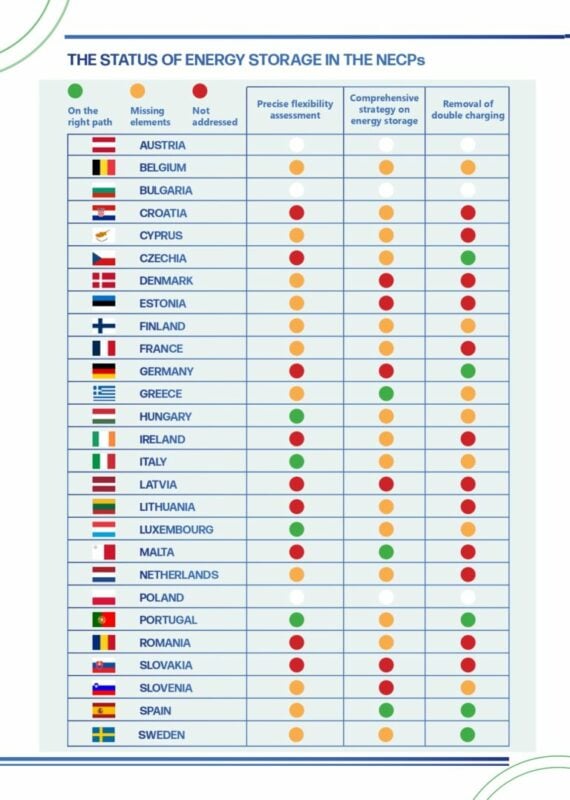

A new analysis of draft NECP submissions from the 27 Member States examines how energy storage is treated in the plans across three key areas identified by the coalition: assessment of price flexibility in energy markets, publication of a comprehensive strategy on energy storage and the removal of double charging of grid fees for transmission-connected storage assets.

None of the NECP drafts have been categorised as “on the right path” in all three metrics. Only Spain and Portugal have earned commendations in two out of the three, with the majority only winning the trade organisation’s approval for one at most.

The blank white circles above denote that relevant texts were yet to be published at the time of the Energy Storage Coalition’s analysis at the beginning of this year. The coalition was formed by solar PV trade group SolarPower Europe, the European Association for Storage of Energy (EASE), wind energy group WindEurope, together with sustainable energy venture capital (VC) investor Breakthrough Energy.

Spain’s NECP is one of the “most complete” drafts, including a reinforced commitment to procuring flexibility for the grid and a comprehensive energy storage strategy. Since 2021, the country has had in place a storage deployment target of 20GW by 2030, and then 30GW by 2050 as part of its storage strategy.

Metrics: Double charging, flexibility assessments and storage strategy

Double charging of fees for grid use has long been highlighted as a major barrier to the investment case for energy storage across Europe.

In short, energy storage facilities are treated as both generation and supply to the grid in most regulatory regimes, and charges are levied at the point of both withdrawing (charging) and depositing energy (discharging).

Putting an end to double charging, which largely only exists because regulations were written before grid-connected storage capacities were expected to be deployed at scale, would be a powerful supply side driver for storage.

This is perhaps the area where the most action has been taken, with five among the Member States considered to have taken action on double charging: Czechia, Germany, Portugal, Spain and Sweden.

Meanwhile, with energy storage as a key resource to add flexibility in the balancing of supply and demand for electricity, national assessments of flexibility requirements on the grid network would help determine the volumes of energy storage needed and the sort of applications it could provide.

Only four Member States have carried out a precise flexibility assessment: Hungary, Italy, Luxembourg and Portugal.

An energy storage strategy is perhaps the most readily self-explanatory of the three metrics. Just three countries: Spain, Greece and Malta, have one of these.

Unsurprisingly, the Energy Storage Coalition called for action to be taken in all three areas, as well as calling for support schemes and regulatory treatment of storage to be technology agnostic.

NECPs were first implemented in 2019. Last year the European Commission called on Member States to make updates to them, ahead of this June when approved plans are signed into law.

As reported by our colleagues at PV Tech in mid-December, the EC’s own analysis of draft NECPs found that even the revised plans would fail to meet the 42.5% Renewable Energy Directive (RED) target by 2030 and fall far short of the 45% “ideal scenario” target.

Energy-Storage.news’ publisher Solar Media will host the 9th annual Energy Storage Summit EU in London, 20-21 February 2024. This year it is moving to a larger venue, bringing together Europe’s leading investors, policymakers, developers, utilities, energy buyers and service providers all in one place. Visit the official site for more info.