More than a quarter of US commercial and industrial (C&I) electricity users could potentially use energy storage to lower premium rates they are charged during periods of high demand, the National Renewable Energy Laboratory (NREL) has found.

NREL has just undertaken what it described as the most exhaustive effort to date to evaluate utility rates across the US, surveying over 10,000 separate utility tariffs that are available to around two-thirds of American C&I users.

In the States, those C&I users of power are commonly levied what are known as demand charges onto their bills. While private homes will pay only for the kilowatt-hours of energy consumed, demand charges mean that businesses are monitored for the amount of power drawn from the grid at specific times and during short time frames.

A charge relative to this rise in demand is then payable by the C&I customer. A ‘typical’ utility plan might calculate its charges from measuring the highest average electricity usage during a 15-minute window, in other words tracking the rate of consumption of kilowatts and charging accordingly.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Anecdotally, it is often said that these demand charges can form around 50% of a business’ electricity costs. NREL cites that generally, demand charges make up anywhere from 30% to 70% of total billed amounts. So far, demand charge reduction has been a strong rationale and economic driver for activity from companies including Stem, Sonnen and Green Charge which all install medium-sized energy storage systems for C&I customers in the US.

NREL found that in fact, while there are 18 million or so commercial and industrial customers of electric utilities in the US, more than a quarter of those – 5 million customers – are seeing demand charges on their company bills higher than US$15 per kW, making energy storage seem an attractive option.

Variations are state-by-state – and within states

While New York and California got a lot of headlines for getting in early on the action for C&I energy storage providers, NREL found that outside of these two ‘first-mover’ states, an economic case for energy storage built around demand charge reduction exists in huge swathes of the US: in the Midwest, the Mid-Atlantic and Southeast regions.

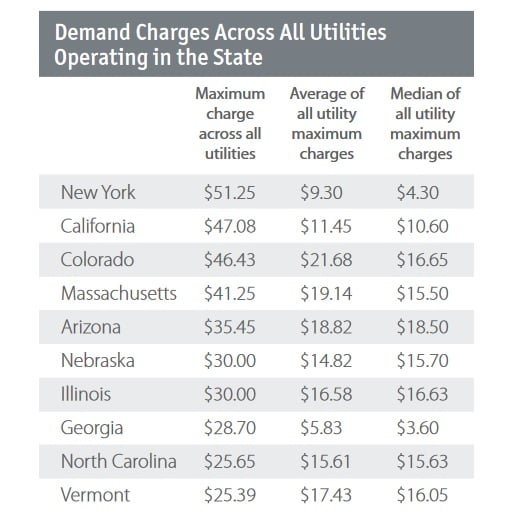

High demand charges apparently are levied by utilities scattered across the US. For example, there are several states where demand charges are more than US$20 a kW, such as Georgia, Iowa and New Mexico – all dotted around in different parts of the country, the south, the mid-west and southwest respectively.

In addition to these regional or state-by-state variations, there can also be big discrepancies within states. NREL found that average maximum demand charges in New York were around US$10 per kWh, but some businesses in the state’s Long Island district are laden with demand charges closer to US$50 per kWh. Differences in the charges could reflect a utility’s billing policy and rate design – but also in the case of Long Island, the area requires higher levels of investment and maintenance money spent on electricity infrastructure – so circumstances could be quite specific to single projects or utility service areas.

While solar on its own can help lower demand charges, it becomes a lot more effective with energy storage, with no variability in the power generated or stored and running through the system, energy storage can do it more reliably and steadily, NREL said. When solar and energy storage are integrated effectively, “[the two] technologies can often complement each other and increase demand charge savings through an effective demand-management strategy”.

The NREL report puts forward the numbers of C&I customers in each state where demand charges have gone beyond the US$15 per kWh threshold, but was careful to point out that the 5 million estimated companies in this category have rate plans with high demand charges available to them – they have not necessarily subscribed to such plans.

The first-movers California and New York have the most eligible customers, with 1,420,000 and 648,000 potential payers of high demand charges respectively. Georgia, Colorado and Michigan then all have between 200,000 and 240,000 potential customers, then Massachusetts, Texas, Connecticut, Minnesota and Ohio all have between 120,000 and 190,000 potential payers of demand charges in excess of US$15 per kWh.

The high charges are not restricted to states with generally high electricity prices – in fact NREL found that C&I opportunities for energy storage exist in “nearly every state”. Even for customers with demand charges lower than that, falling energy storage system costs will continue to open up market opportunities, NREL said.