A US$70 million funding round has been successfully closed by Highview Power, a UK-headquartered company which has developed a liquid air energy storage (LAES) system called the ‘CRYOBattery’.

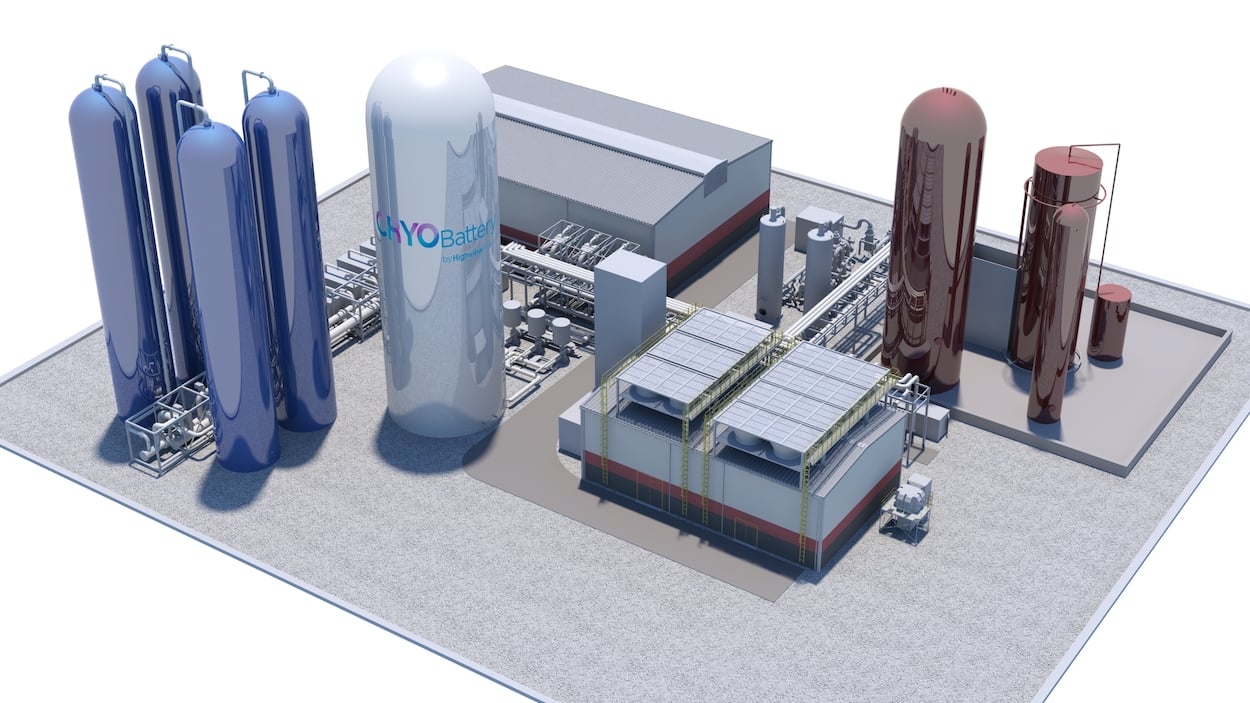

Highview’s proprietary technology is aimed at enabling bulk storage of electricity for grids safely and for long-durations, aiding the integration of renewable energy and providing grid services. The CRYOBattery cools ambient air to -196°C which is then stored at low pressure before being heated and expanded to drive a turbine and generate power. CEO Javier Cavada previously told Energy-Storage.news that Highview sees its competition as large-scale fossil fuel plants, not other energy storage technologies such as lithium battery storage.

The company claims it is scalable to enable multiple gigawatt-hours of storage with discharge durations of anything from four hours to several weeks as well as relatively cheaply manufactured using existing techniques and components adapted from other industries. Following the commissioning of grid-scale demonstrators, construction has begun on Highview’s first 50MW / 250MWh project in the UK, while there is now a claimed 4GWh pipeline of projects including several in the US which the company is working to develop. This includes a 400MWh project in Vermont, US, while the company has formed a joint venture (JV) to scope out potential ‘giga-scale’ projects in Latin America with Chile-headquartered Energia-Latina S.A. Enlasa (Enlasa).

The latest funding took the form of a Growth Capital funding round, aimed at expanding the company’s presence globally and includes US$46 million from Japan’s Sumitomo Heavy Industries — which was previously announced — topped up by investment from international conglomerate Janus Continental Group worth US$13 million and Spanish engineering, procurement and construction (EPC) company TSK, with whom Highview Power formed another JV to develop projects in various territories in 2019. Also involved were existing investors in the LAES company that added around US$5.5 million to the round.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

“Leading utilities are starting to issue RFPs for 10 hours of storage to be cycled every day,” Highview Power chairman of the board Colin Roy, who is also a seed investor in the company, said.

“Grid operators are starting to issue long-term contracts for the provision of synchronous stability services and constraint management. This is what is needed to make the energy transition a realistic proposition. And these things liquid air does better than any other storage system.”

The US$70 million raised brings Highview Power to a total of US$145 million investment in its activities to date and matches the US$70 million long-duration aqueous air battery startup Form Energy raised in a funding round last year from investors including Bill Gates’ Breakthrough Energy Ventures.