Italy-based Energy Dome, the maker of a proprietary CO2-based long-duration energy storage system, has closed the second tranche of its Series B, raising another €15 million and bringing the total to €55 million (US$62 million).

It builds on the €40 million first tranche the company raised in April. New investors in the second tranche include Oman’s national venture capital (VC) investment arm Innovation Development Oman Investments, the VC arm of tank storage manufacturer Royal Vopak, and investors represented by impact investing advisory firm Sagana.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Existing investors 360 Capital and CDP Venture Capital also participated in the second tranche, having already participated in the first.

It brings Energy Dome’s total fundraising to nearly €100million to-date, following €17.5 million of grant and equity from the European Innovation Council in January plus money raised across earlier rounds prior to 2023.

Its tech is based on a thermodynamic cycle, which charges by drawing carbon dioxide from a ‘Dome’ gasholder, storing it under pressure, and dispatching by evaporating and expanding the gas through a turbine back into the gasholder.

The additional funding will help the company scale commercially and execute on a pipeline of over 9GWh of projects in five continents, it said. It will also help it complete its first utility-scale project, a 20MW/200MWh project it expects to have operational in 2024 (its largest operational system is a 2.5MW/4MWh one in Sicily). The announcement did not specify but it could be one it was exploring with Danish energy giant Ørsted.

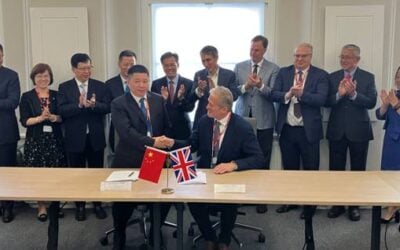

Energy Dome has also signed a memorandum of understanding (MOU) with the Oman Investment

Authority, which Innovation Development Oman Investments is part of, to explore potential areas of collaboration in the country.

Claudio Spadacini, founder and CEO of Energy Dome, said: “We offer our customers unparalleled flexibility and value. They can either enter into long-term capacity offtake agreements with Energy Dome, where we will fund, build, own, and operate the CO2 Battery for the customer under a Storage-as-a-Service model.”

“This allows the customer to have reliable, clean and affordable power far below the cost of pumped hydro or Lithium Ion. Alternatively, the customer can opt to buy the CO2 Battery directly from Energy Dome with a performance guarantee under an Original Equipment Manufacturer model.”

The firm’s SVP of strategy, corporate development and investor relations Ben Potter recently gave an interview to Energy-Storage.news where he claimed that its technology can reach a Capex per MWh half that of a four-hour lithium-ion battery storage project.