Centrica, one of Britain’s so-called ‘Big Six’ energy suppliers, has received planning permission for a brace of battery energy storage units at its UK headquarters in Windsor with a combined capacity of 1MW set to be built at the site.

The installations are intended to support the continuing efficient operation of Centrica’s Millstream Headquarters offices by charging up in off peak periods to increase the use of cheaper electricity on site.

Centrica also plans to take the batteries into the balancing services market while also supporting wider decarbonisation of the energy system by providing flexibility to allow greater concentrations of renewables to be installed.

The two units are also thought to reduce Centrica’s carbon footprint as off peak electricity results in approximately 50% of the carbon production of peak time electricity, the company argues.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

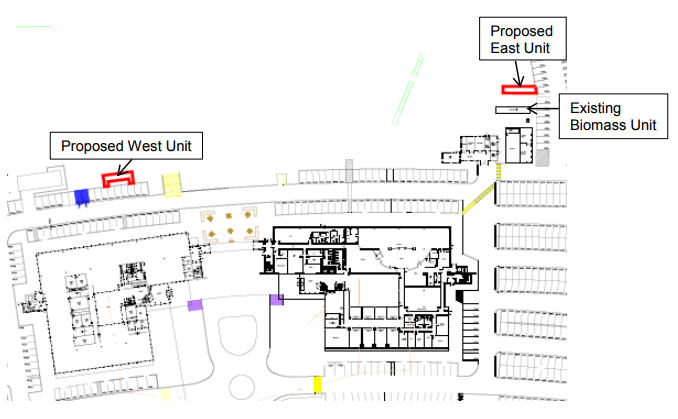

Millstream is Centrica’s UK headquarters for Centrica plc and Centrica Energy, located on the edge of the green belt. The site of the West Unit appears to be on the boundary between of this and the site, while the east unit sites within the green belt but is small enough (together they have a total footprint of only 37m2) to be acceptable to planning authorities.

Centrica was unable to reveal further details of the proposed batteries, including what battery technologies are to be used.

The company’s 49MW Roosecote project which is nearing completion in Cumbria uses lithium-ion batteries from Samsung SDI, while a 1MWh vanadium redox flow machine part funded by Centrica was the first to sign up to a local energy market being set up by the company in Cornwall.

Other significant moves by the company into energy storage include the recent submission of early stage plans for a 100MW battery facility in Ireland – currently being considered with a natural gas plant as an alternative – and an effort to integrate household battery systems into that aforementioned local energy market initiative.