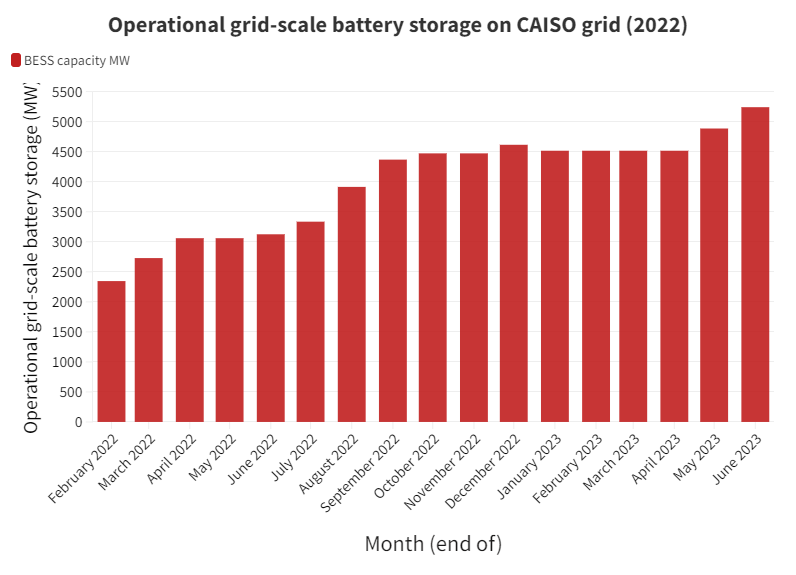

California has passed 5GW of grid-scale battery storage energy storage (BESS) projects, grid operator CAISO has revealed.

The state has long been a leader for BESS deployments, with an ambitious renewable energy goal of 90% by 2030 and the Resource Adequacy framework enabling long-term remuneration of large-scale BESS projects providing certainty for investments.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

As of the start of this month, the state now has 5.6GW of grid-scale connected BESS online, CEO Elliot Mainzer said this week (11 July).

“With our state experiencing more frequent climate extremes such as record heat waves and droughts, it is essential to invest in innovative technologies like energy storage to make sure we can continue to reliably power the world’s 4th largest economy,” Mainzer said.

The year started off quietly for the state, however, with CAISO’s official figures showing virtually no large-scale projects coming online in the first quarter, with the capacity actually decreasing from December 2022 to January 2023, shown in the graph below. In its place, the ERCOT, Texas market, led the charge, accounting for 70% of nationwide deployments in the first three months of the year.

Activity in California has picked up in the second quarter, with commissioned projects covered by Energy-Storage.news from global energy firm RWE and utility SDG&E.

Projects in California make the bulk of their revenues from Resource Adequacy agreements with utilities like SDG&E, the other investor-owned utilities PG&E and SCE, as well as various smaller electric co-operatives like community choice aggregators (CCAs), as well as trading energy.

The ancillary services market in California is relatively small compared to the quantity of grid-scale BESS, so these account for very small part of revenues for projects.

Solar PV-heavy markets like the southern US and south of Europe tend to be more of an energy, load shifting opportunity while wind-heavy markets like the Nordics, UK and Germany lean more towards the provision of ancillary services.

See all Energy-Storage.news coverage of the California market here.