Energy storage systems were historically used for grid balancing purposes within Europe, limiting their use to such applications or to be considered as “auxiliaries” to renewable generation assets. However, as market prices evolve and new revenue streams emerge, stakeholders must discover the diverse applications energy storage can tap into, writes Naim El Chami, market analyst at consultancy Clean Horizon.

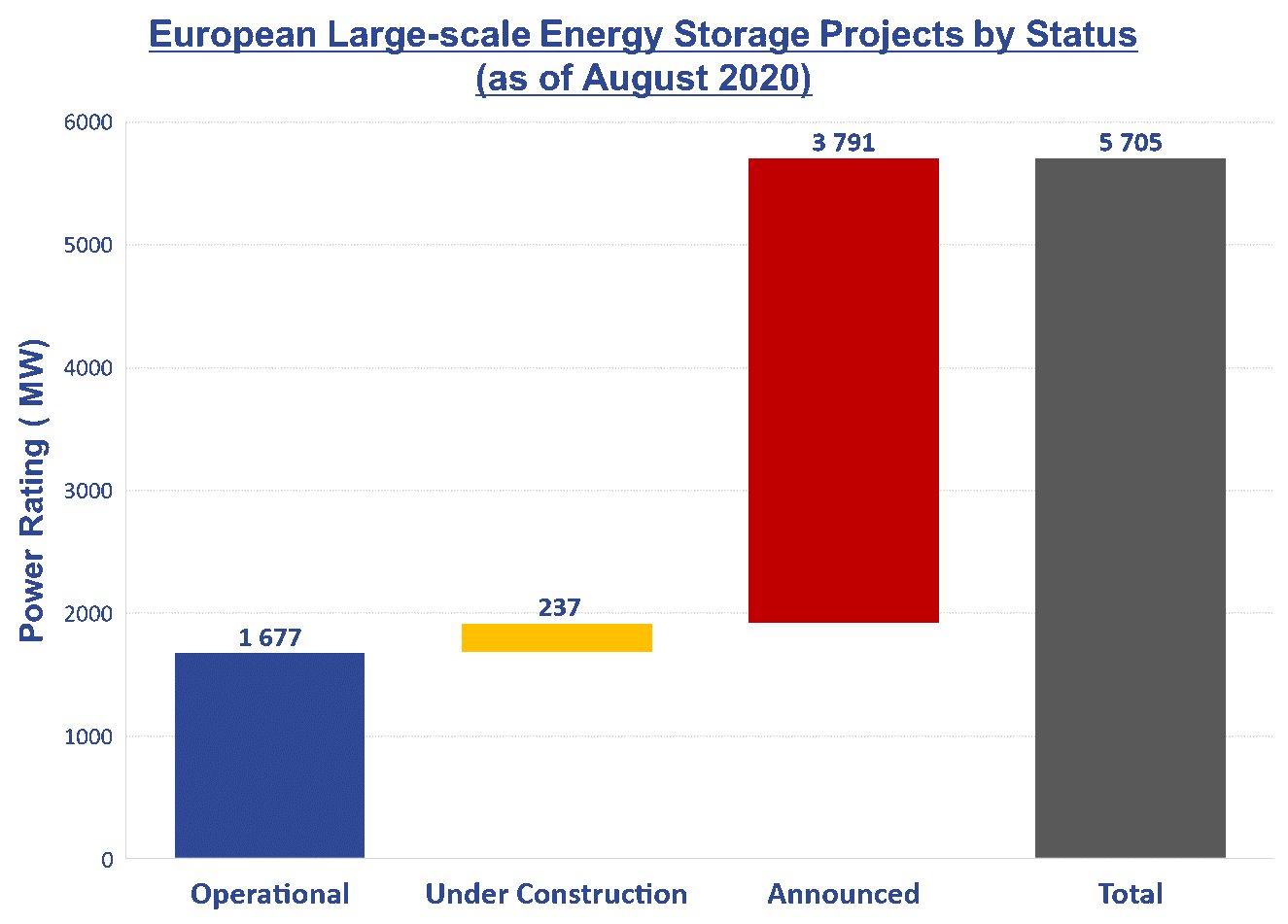

The European energy storage industry has witnessed remarkable growth over the last decade, going from 9MW of project announcements in 2010 up to a total of 5,700MW in 2020 (year to date). Out of these projects, around 1.7GW are operational while the remaining 4GW are either announced or under construction (Figure 1) [1].

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

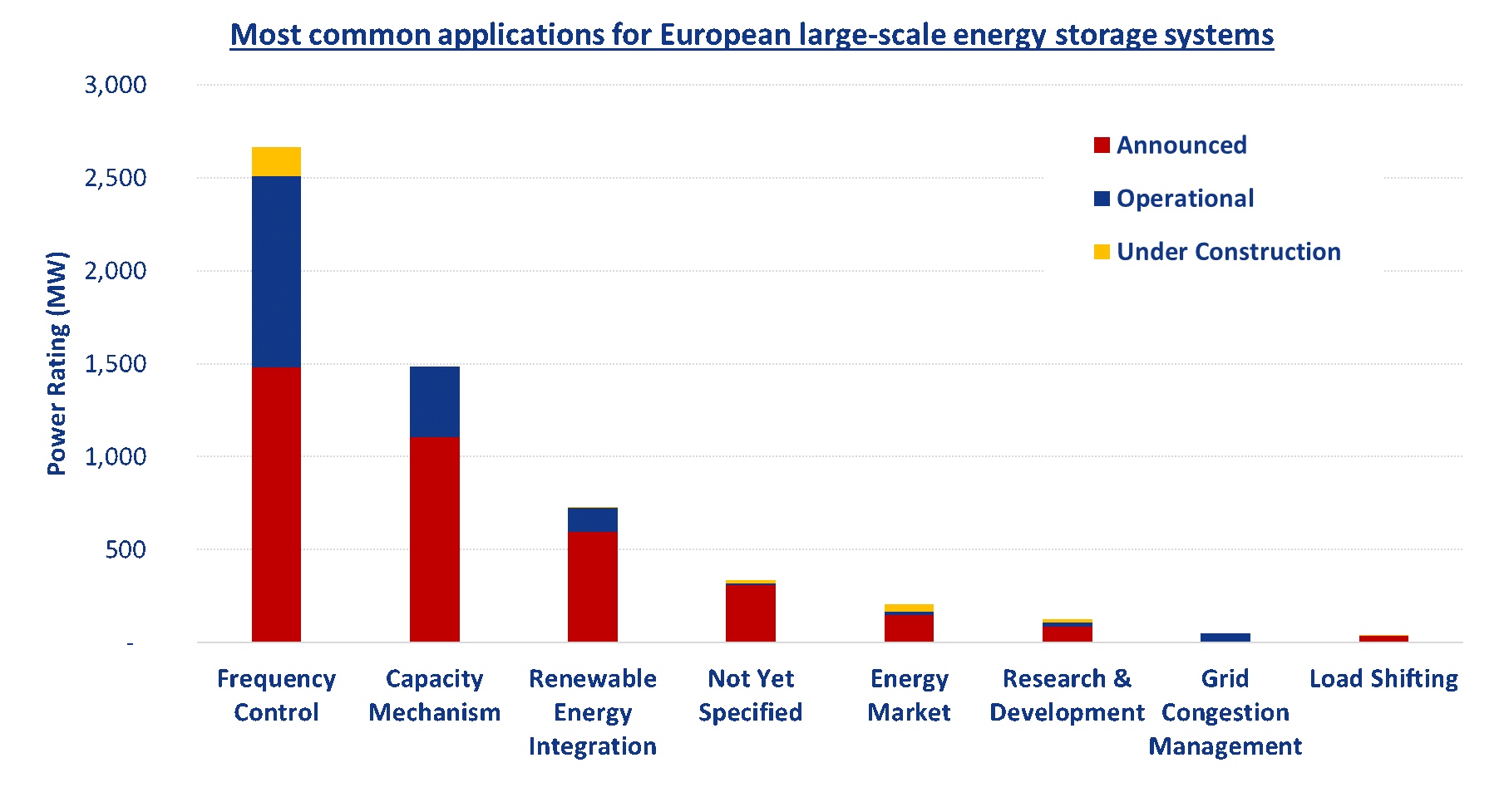

Such uptake has been predominantly led by frequency control applications. However, things are changing as new revenue streams emerge and market prices tend to decrease.

The rise and fall of the frequency control bonanza

European frequency control markets played a major role in energy storage uptake thanks to lucrative revenues and accessibility to new technologies such as batteries. In fact, batteries are well suited for primary reserve provisioning thanks to their fast response and the assets get remunerated by the grid operator for each MW available (payments in €/ MW/h) to ensure system resiliency.

In Western Europe, 3GW of frequency control reserves (denominated Frequency Containment Reserves, or FCR) are jointly procured by six countries on a common platform. The current FCR auction takes place daily and involves Germany (603MW), France (561MW), the Netherlands (74MW), Switzerland (68MW), Austria (62MW) and Belgium (47MW) with Denmark (DK1, 30MW) expected to join soon, as well as Spain (275MW) and Poland (168MW) in the years to come. Currently, 477MW of battery storage systems are already delivering this service (out of which 87% are located in Germany) with an additional 209MW on the way.

For each country, the frequency containment reserve requirement is based on the ratio of the yearly national production (in MWh) to the yearly total production over the synchronous European area. Procurement targets slightly vary every week based on TSO (Transmission System Operator) requirements and past years’ production. In fact, 30% of each country’s reserve must be nationally sourced and the exports to other FCR Cooperation members are limited to the maximum between 100MW and 30% of each capacity block.

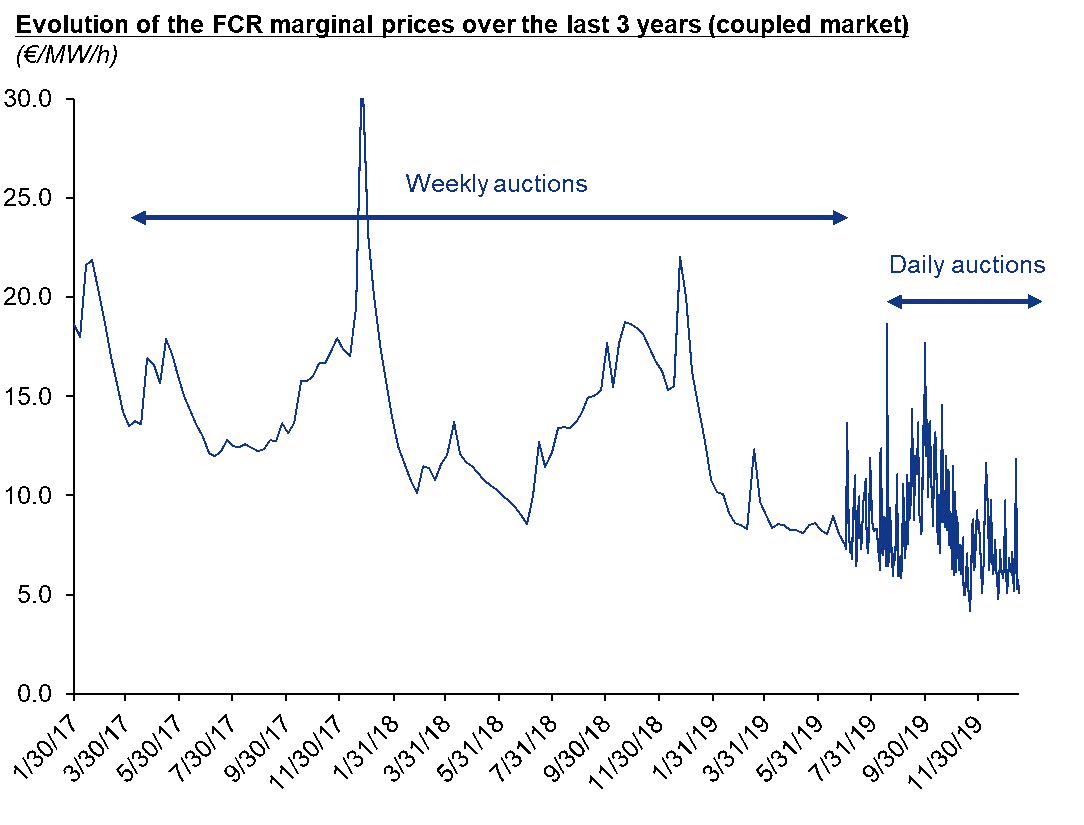

However, this market’s revenues fell from an average of €26/MW/h in 2015 and €18/MW/h in 2017 to as low as €5/ MW/h in early 2020. Henceforth, this market could no longer justify project viability by itself, requiring new and additional revenue streams.

The fall in FCR prices and the impact of energy storage systems

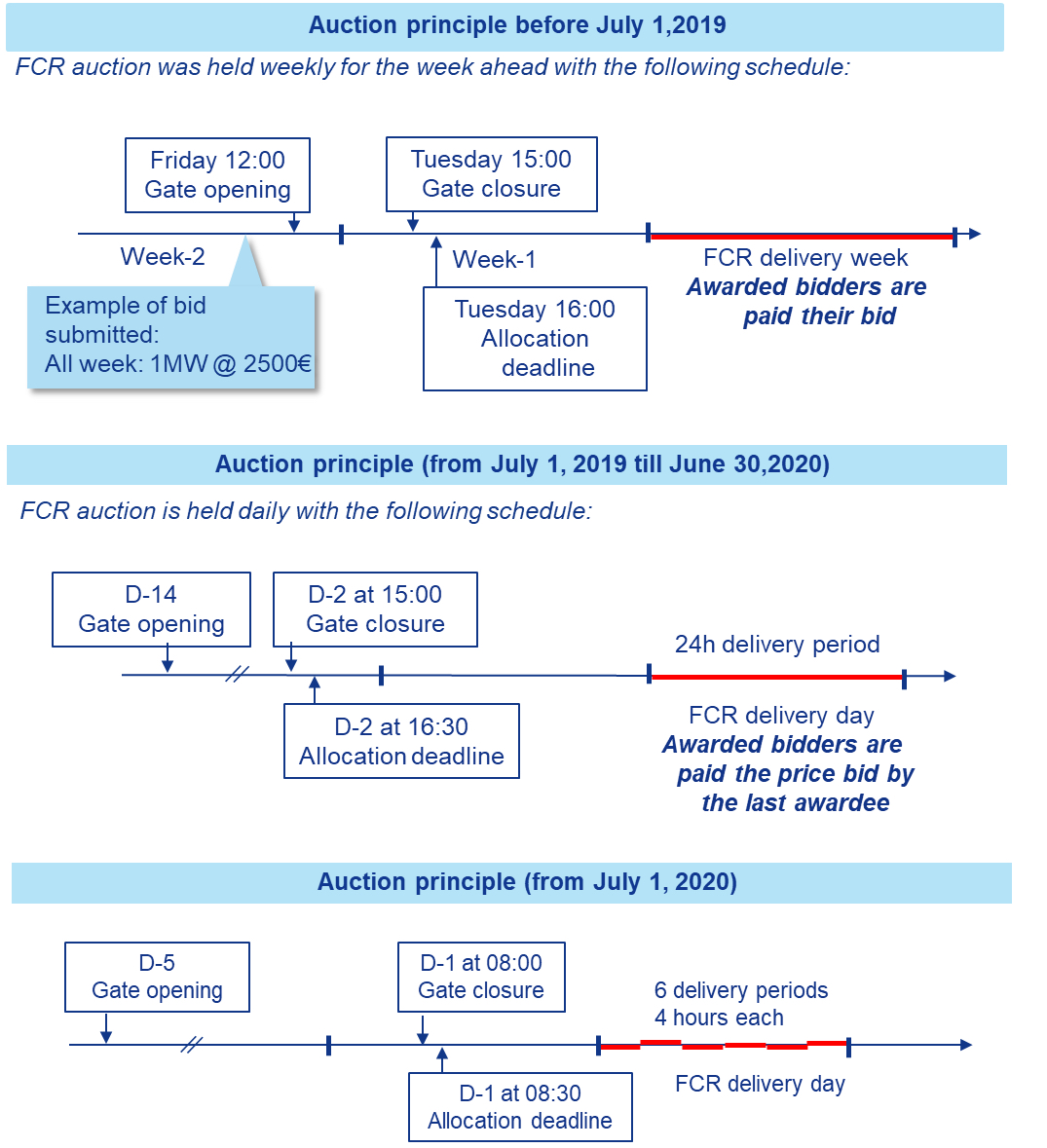

Frequency Containment Reserve auctions take place over the Regelleistung platform. Until July 2019, these auctions used to occur on a weekly basis before shifting to a daily one as products were procured on a day-ahead term. The older auction model incentivised bidders to “guess” bidding prices, rendering them unrepresentative of the actual merit order of FCR resources.

Another change took place on 1 July 2020 as the FCR auction timeline was once again changed: instead of bidding for 24-hour products, market participants are now able to bid daily for six four-hour delivery periods. This evolution offers more flexibility to market participants, allowing them to participate in other markets and diversify revenue streams within the same day. Thus, a better market transparency is expected since FCR prices will probably reflect market conditions (higher prices in the day, lower in the night).

This evolution can be seen in Figure 4 that represents marginal FCR prices over the last three years. The most significant event is the sharp decrease of market revenues as prices fell from an average of €18/MW/h in 2017 to as low as €5/ MW/h in early 2020. Such price fall renders the new market evolution even more crucial to ensure project viability through multiple revenue streams that will be discussed in the next part of this article.

One of the price fall causes is the high volume of battery storage uptake: there’s about 477MW of storage providing FCR services, which lowers prices as batteries are inherently more competitive than any other participant in this market since the marginal price for FCR provisioning is lower. Such impact was witnessed in multiple cases such as the French one following the conclusion of its long-term capacity market auctions (“Appel d’Offres Long Terme” – AOLT) through which 253MW of battery storage systems were contracted out of a 377MW total of new capacity uptake.

A Clean Horizon analysis shows that the deployment of 100MW of new battery storage capacity could lead to an 18% fall of FCR revenues. The analysis replays the FCR auctions by integrating additional storage shares (i.e. by introducing additional “floor” bids in the bid ladder for each day of the auction).

So, as previously mentioned, the market had to cope with such price movements in order to offer additional flexibility to asset owners so that they can tap into new and additional revenue streams while ensuring project viability.

New revenue streams emerge as stakeholders are progressively aware of energy storage potential

Arbitrage on the balancing markets

July 2020’s change in the FCR auction timeline will allow storage to diversify its activity within the same day. In France, at least two other ancillary services are evolving towards a storage-friendly configuration in the next two years: the Balancing Market should open to standalone storage systems by the end of 2020 following the recommendation of the French Energy Regulation Commission (CRE); and the French secondary reserve (aFRR) is expected to open itself to new participants by mid-2021, therefore allowing the current dedicated generators to move on to different activities while creating a new potential source of revenue for storage systems.

Regarding arbitrage on the balancing market, the imbalance management structure is quite similar among multiple European countries such as France and Germany. The TSO can adjust system imbalances through two mechanisms: the balancing market (ex-ante) and imbalance settlement (ex-post).

An asset that offers imbalance management services can either be remunerated by providing tertiary reserves (balancing market) or by contributing positively to system balance in order to benefit from the Settlement Price afterwards. In both cases, the remuneration depends on forecast abilities and market flexibility.

On D-1 (the day before delivery day, D), an asset owner can bid on the balancing market through 30-minute blocks (in the French case, 15-minute blocks in Germany) by precising available capacity (in MW) as well as an energy activation price (in €/MWh) for a given direction (upward or downward).

On D day, unexpected fluctuations in generation or demand or forecast errors lead to energy imbalances, which requires balancing assets to ensure system stability. Henceforth, reserves get activated with respect to the merit order of their energy activation prices. On the Billing Day, the TSO compensates for the additional reserve activation costs by penalising or remunerating market participants depending on their contribution to the imbalance event. The energy is remunerated through the Settlement Price.

Similarly to the FCR concept, national balancing markets (RR or Replacement Reserves) have been moving towards a European standardisation of the product since 2019 with the MARI (for manual Frequency Restoration Reserves or mFRR) and TERRE (for Replacement Reserves) projects. The main goals are to establish a common platform as well as 15-minutre auction blocks, which will be favourable to storage.

Grid investment deferral

During peak demand periods, the power that flows through the transmission and distribution networks might exceed the load-carrying capacity of such networks and lead to congestion issues. This issue has been addressed by system operators via traditional practices such as investing in new transmission and distribution assets to increase the initial carrying capacity. However, when such events happen occasionally and for limited periods, the investment in reinforcing the entire network does not seem to be the optimal solution.

Energy storage systems that are located on congestion points can act as ‘virtual power lines’ (also called non-wires alternatives) to enhance the power system’s performance without a need to overbuild transmission

and distribution assets. These ‘virtual lines’ act as an extra lane that appears whenever it is needed to provide the additional capacity required to ensure system reliability and redundancy for a smaller footprint. So, instead of, for example, upgrading a substation capacity from 15MW to an oversized 20MW to address an occasional event, system operators can procure the exact storage capacity to meet their demand forecasts. Moreover, as interconnectors could take up to seven (or more) years to get approved and constructed, large-scale battery storage can be operational within two years. Hence, storage systems do not face the same harsh permitting processes as new power transmission lines and poles do.

European countries are showing remarkable interest in storage as non-wire alternatives through multiple proactive approaches.

In France, both the Transmission System Operator (RTE) and the Distribution System Operator (Enedis) started experimenting with non-wires alternatives such as batteries for grid congestion management. In 2017, RTE initiated the RINGO project, which involves deploying three battery systems totalling 32MW/98MWh to experiment with grid congestion management once they go online in 2021. However, as per the European regulation, system operators are not allowed to partake in energy markets. So, RTE proposed to implement a particular operational protocol: at any time, the net energy balance of the three systems has to be null – when one battery discharges, others charge at the same time. RTE plans on selling those “virtual line” assets once the experiment is over, and contract third parties to provide the needed flexibility services starting from 2024.

Cover Image: Opportunities for energy storage in Europe are gradually scaling up from early pilots and one-offs. Image: Alfen.

This is the opening extract of an article which appears in full in the latest edition of our quarterly technical journal, PV Tech Power (Vol.24), in ‘Storage & Smart Power’, the dedicated section contributed by the team at Energy-Storage.news.

To download the entire article as an individual paper, or to subscribe to or download the entire 108-page book, visit the PV Tech Store.