The rapid acceleration in energy storage deployment expected over the coming years will require innovation in the quality and safety standards underpinning new battery and associated technologies. VDE’s Jan Geder looks at the technical work underway to ensure the coming storage boom has firm bankability and insurability foundations, in a paper which first appeared in PV Tech Power’s Energy Storage Special Report 2019.

Renewable energy is taking up an increasing share in the global energy mix. Utilities, distributors and users are facing the increased need to supplement renewables with energy storage systems to tackle the intermittency of these sources and ensure stable supply. Bankability and insurability of renewables, particularly photovoltaic systems, is nowadays a common concept with clearly defined criteria and processes.

As the viability and availability of energy storage becomes the crucial factor in further growth of renewable energy generation, it is necessary to ensure bankable and insurable solutions for deployment of energy storage systems. This article explores the status and outlook for bankability and insurability of battery energy storage systems.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Recent years have seen a stellar rise in the generation of electricity from renewable sources. In the first half of 2019, 47.3% of net electricity generation in Germany came from renewables [1], an increase of 9.1 percentage points (23.8%) since 2017 [2]. According to Eurostat, the share of renewables in European Union’s energy mix of 2017 amounted to 17.5%, an increase by two thirds since 2007 [3]. At the same time, the share of renewable energy has been increasing in developing markets as well. This is particularly the case for PV systems, which are set to break the 100GW milestone of newly installed capacity in 2019 [4]. This is driven mainly by rapid growth in the developing markets of Latin America, Middle East and Africa.

Increasing solar capacity and its share in the overall electricity mix requires an increase in energy storage capacity. This is due to the intermittent nature of solar irradiation, which rarely corresponds to required grid demand in real time. A 2015 report by the Rocky Mountain Institute lists 13 different services that battery energy storage system can provide to the grid [5]. These services can be provided to system operators and utilities, as well as to end-customers. There is a clear distinction between centralised and distributed systems as battery systems can be placed at three different levels: at distribution level, at transmission level and behind the meter. The latter, customer-sited and most decentralised systems, are also capable of providing the largest variety of services to grid.

The case for bankable energy storage systems

Projections for Germany [6] predict that 110-190GWh of energy storage systems would need to be installed by 2050 in order to meet energy transformation goals. Based on nine different scenarios, this is divided into 70GWh of pumped storage and 40-120GWh of battery energy storage systems, and excludes heat storage and power-to-fuel systems. These storage systems would be integrated in a grid with an installed capacity of renewables between 193 and 536GW, of which 122-290GW would belong to PV systems, according to the same projections.

Battery energy storage systems play a significant role in future rural electrification in developing countries. They are namely expected to enable deployment of renewable energy-based microgrids where photovoltaic system would play the major role in power generation. Reliable battery systems would therefore eliminate the need for costly infrastructure investments aimed at connecting remote and insular areas to the grid. Furthermore, efficient and sustainable microgrids would reduce the current dependency on diesel generators and their sensitivity to the logistics of the fossil fuel supply chain and its price volatility.

Both cases mentioned above face the challenge of acquiring financing for the construction, commissioning and operation of battery systems. At the utility scale, one expects to deal with large systems on which the reliability and stability of the grid shall depend. In the case of microgrids, the global majority of potential implementation sites are located in developing countries, where the low purchasing power of consumers may hinder the initial investment. For both cases, it is therefore equally important to ensure high-quality technical foundations that help ensure the profitable operation of battery systems, which is crucial for enabling the financial sector to provide financing products at reasonable conditions for these systems.

What makes batteries different from solar panels?

In the timeline of renewable energy development, batteries are commonly seen as the next big thing after the success of PV at the beginning of 21st century. Cheap and reliable storage is believed to deliver a much-needed boost to the solar-powered renewables boom which is happening globally. To follow the successful path of PV deployment, battery storage also needs to become bankable, insurable and investable. Although adding battery storage to the equation does not require us to completely reinvent the ideas of bankability and insurability, it is worth noting several important technical aspects of batteries that affect and influence the financing decision-making process for energy storage.

The most obvious distinction between batteries and PV systems or wind turbines is that batteries only store energy for later consumption and do not generate power themselves. The reality of bi-directional energy flows to and from battery systems requires careful dimensioning with regards to expected load profiles on both the charge and discharge sides. Energy storage systems therefore need to be planned to operate with regards to generation and consumption characteristics of the grid. This includes accounting for future upgrades based on the grid’s needs.

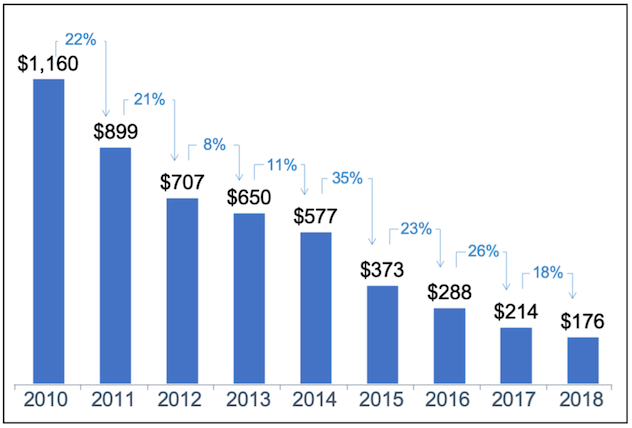

On the costs side, there are further differences between battery systems and PV systems. “Lithium is not silicon” is an oft-invoked saying when the long-term price prospects of lithium-ion battery systems are discussed and compared to the last two decades of price development for PV modules. In fact, the lithium-ion cell price per kilowatt-hour dropped 85% between 2010 and 2018, with an average annual decline of 20%. This happened mainly due to technical improvements on the product side (higher energy density electrodes) and the process side (larger, more efficient manufacturing lines).

However, the rate of price decline may slow down in the future due to several factors:

• Increasing price of relatively scarce resources such as lithium and cobalt;

• Increasing demand for batteries from the electric vehicle industry;

• Consolidation of the industry with a few globally dominant manufacturers.

Parallel to improvements in energy density and price declines, there has also been a shift towards safer lithium-ion technologies. Safety of lithium-ion cells has marginally improved since their first commercialisation in the 1990s, though there is currently still no such thing as a “safe” lithium-ion battery. A state-of-the art lithium-ion battery is a thermodynamically meta-stable system whose failure modes may lead to grave consequences in the forms of explosions and fires. Recently, more than 20 battery storage system fires made headlines in South Korea [8]. These incidents caused hundreds of energy storage systems country-wide to be suspended from operation and inflicted millions of dollars’ worth of damage to adjacent facilities. Investigations conducted by local authorities suggest that the fires were caused by poor site management [9].

Such prospects raise the issue of insurability of battery energy storage systems to a much higher degree than in the case of PV systems – the tendency of lithium-ion batteries to catch fire in an uncontrollable manner may lead to much higher total damages. It is therefore critical to devise rigorous processes of safety and quality assurance in order to gain the confidence of insurance companies, banks and investors. As the track record of such processes is yet to be established, it is critical that all stakeholders get on board and enforce the best practices in design and operation of battery systems.

Development of technical criteria to support bankability and insurability

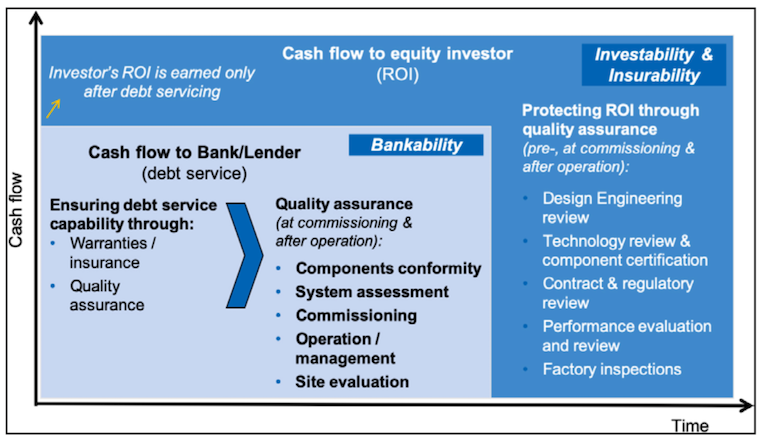

The basic idea of bankability and insurability is presented in Figure 2. Quality assurance is understood as a wide range of measures aimed at securing the technical foundations for insurability and bankability of a project. Furthermore, it is important to recognise that the quality assurance requirements of an investor or an insurer can go beyond the requirements of a lender. There are two main objectives of quality assurance with regards to project economics and financing:

- Understanding, mitigation and control of risks in order to make the residual risks of the project acceptable for insurers and investors;

- Performance and efficiency analysis, reviews and tracking to ensure profitability of the project.

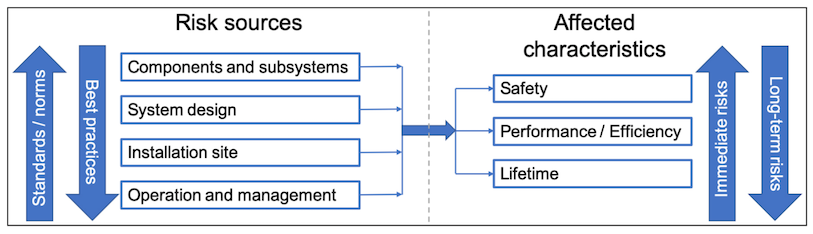

The origins of technical risks in a battery system can be divided into four major sources: components, system design, installation site and management/ operation. They affect three crucially interconnected system characteristics: safety, performance/efficiency and lifetime.

Various risk sources require different approaches to quality assurance. On the component level (e.g. battery module, power conversion system), one can rely on a large number of applicable international and national norms and standards, for example IEC 62619 for battery modules, IEC 62909 for bi-directional converters and VDE-AR-E 2510-2 for battery systems intended for low-voltage grid connection. Component conformity is the cornerstone of quality assurance and the very foundation of risk management. Basic components, such as cells, modules and auxiliary systems (e.g. cooling systems, monitoring systems) shall be tested and certified to the above mentioned standards. However, with increasing levels of component complexity, design reviews are gaining importance as a supplement to pass-or-fail tests. This is particularly true for components such as the battery management system or energy management system, which are critical for functional safety.

Going beyond components, the complexity of quality issues surpasses the pass/fail dichotomy of the standards and related tests and reviews. As the publication of relevant international standards, such as those from the International Electrotechnical Commission (IEC), lags behind the need for quality assurance on the ground, one needs to increasingly rely on empirical “best practices” and other tailored criteria. With these, overall system design and the battery system installation site can be evaluated.

Finally, it is important to look at how the battery systems are managed on a day-to-day basis. This includes keeping the system and its environment consistently in proper condition, conducting regular maintenance, adhering to plausible risk management principles, and implementing strict control of documentation and record-keeping for the system. With proper practices, system risks are kept under control even as the system ages with time and inevitably decreases in performance.

There are several best practice documents and norms dealing with various individual segments of the above described processes. However, taking into account the lessons learned from bankability in the solar industry, it is important to take a holistic view of quality assurance for the entire system and project. A stakeholder that is looking to secure technical bankability and insurability through quality assurance would be best advised to implement the following practices into their processes:

• A guideline of compliance requirements and best practices for designing, installing and managing battery energy storage systems;

• A criteria catalogue or checklist based on the guideline that enables evaluation of each system considered;

• A procedure of inspections of system sites, preferably conducted by independent engineers, to regularly evaluate risks arising from the above-mentioned risk sources.

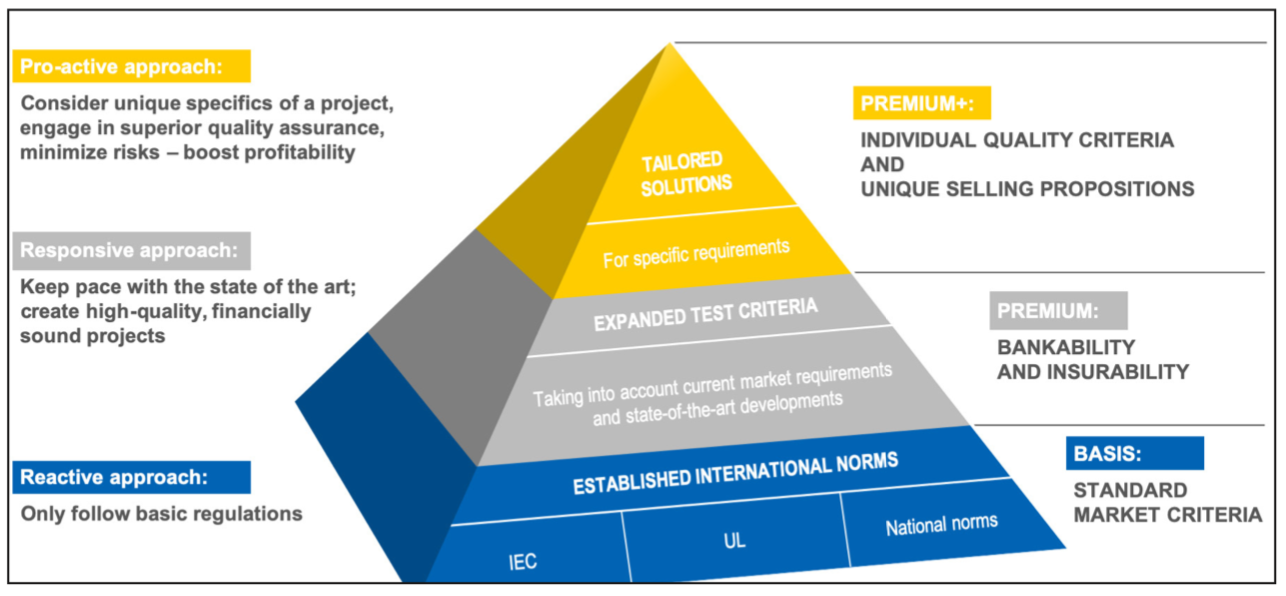

The described process of defining the criteria is visualised by the “VDE Quality Pyramid” as seen in Figure 4. The fundamentals (first level) are the standard market entry criteria in the form of national or international standards. These make sure that core components are compliant with basic regulations, but do not always follow the state-of-the-art developments in the market. Therefore, the test/evaluation criteria are expanded to address requirements of the highly competitive market and industry, rather than only those from the legislator/regulator point of view (second level). At the top level, tailored criteria are introduced to address the specific requirements and purpose of the project/system.

A look into the future of financially sound battery energy storage

As the demand for safe and reliable energy storage steadily follows the increase in renewable power generation, the involvement of financial institutions will become indispensable to provide the necessary financing and insurance for storage systems. Testing, inspection and certification institutions and technical consultants are developing processes and criteria to secure technical foundations for bankability and insurability of battery systems. In this case, the experience and progress with PV bankability and insurability can serve as a basis and reference point.

As was the case with PV systems in the past, many challenges lie ahead on the way to establishing a track record for reliable quality assurance for energy storage systems. Well-known safety issues of lithium-ion systems and the related pricing development are perhaps the most pertinent. On the other hand, there are many opportunities to capitalise on the lessons learned. Furthermore, battery energy storage may become even more economically attractive with the concept of repurposing used batteries from electric vehicles for stationary storage (i.e. second-life applications). Needless to say, this concept will again require stringent quality assurance and risk management tailored to the application.

This article first appeared in PV Tech Power, Vol20, which is available now to download for free, here. The Energy-Storage.news Energy Storage Special Report 2019, which collects together all of the feature articles from Volume 20’s focus on ESS, can be downloaded from our ‘Resources’ page, here.

References

[1] Burger, B. 2019, “Stromerzeugung in Deutschland im ersten Halbjahr 2019”, report by Fraunhofer ISE, www.ise.fraunhofer.de/ content/dam/ise/de/documents/publications/studies/daten-zu-erneuerbaren-energien/ISE_Stromerzeugung_2019_Halbjahr.pdf

[2] Burger, B. 2017, “Power generation in Germany – assessment of 2017”, report by Fraunhofer ISE, https://www.ise.fraunhofer. de/content/dam/ise/en/documents/publications/studies/ Stromerzeugung_2017_e.pdf

[3] ec.europa.eu/eurostat/statistics-explained/index.php/Renewable_ energy_statistics#Renewable_energy_ produced_in_the_EU_ increased_by_two_thirds_in_2007-2017

[4] Heggarty, T. and Attia, B. 2019, “Global solar PV markets: Top 10 trends to watch in 2019”, report by Wood Mackenzie Power & Renewables

[5] Fitzgerald, G., Mandel, J., Morris J. and Touati H. 2015, “The Economics of Battery Energy Storage”, report by Rocky Mountain Institute

[6] Henning, H.-M. and Palzer, A. (2015), “What will the energy transformation cost?”, report by Fraunhofer ISE

[7] Bloomberg New Energy Outlook 2019: https://about.bnef.com/new-energy-outlook/

[8] http://www.koreatimes.co.kr/www/tech/2019/05/133_268188.html [9] http://www.koreaherald.com/view.php?ud=20190611000679