The amount invested in energy storage soared globally during 2023, while battery manufacturing will require the biggest share of spending among clean energy technologies by 2030 to achieve net zero.

BloombergNEF has just published the latest edition of its annual ‘Energy transition investment trends’ report for 2024, including the above takeaways.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

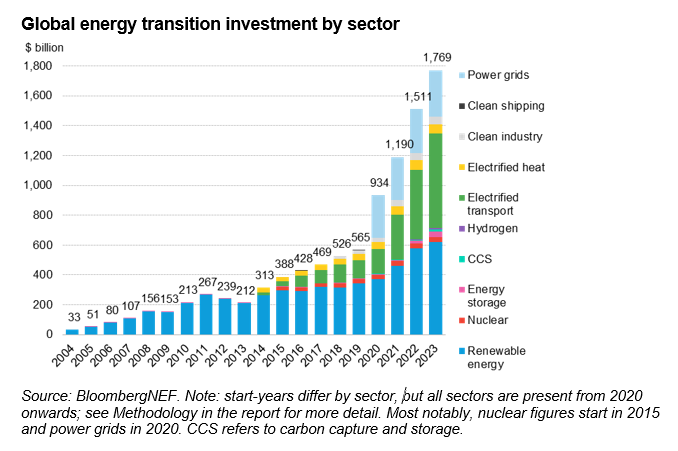

It found that total investment in energy transition technologies including renewables, hydrogen, electric vehicles (EVs) and carbon capture and storage hit record levels last year, with US$1.77 trillion total investment, a 17% increase from 2022.

China was the biggest among nations for investments, with US$676 billion representing 38% of the entire total, while electric transport accounted for the biggest share by technology, with US$634 billion invested – a 36% rise year-on-year.

EVs also overtook (no pun intended) renewable energy, which landed in a close second place with US$623 million invested during 2023.

Meanwhile, although as a share of the total energy storage’s US$36 billion of investment commitments during 2023 seems relatively small, it was a jump of 76%. Storage investments totalled more dollars than hydrogen (US$10.4 billion) and carbon capture and storage (US$11.1 billion) together.

BloombergNEF modelled a scenario aligned with net zero commitments made in the 2015 Paris Agreement to estimate from its calculations the levels of investments that will be required between 2024-2030 to meet them.

Investment in energy storage needs to accelerate rapidly nearly three times over to about US$93 billion annualised spending over the rest of this decade, while renewable energy investment needs to more than double to US$1,317 billion of investment on average each year, the research and analysis group said.

Power grids, a new addition to the scope of BloombergNEF’s analysis this year, attracted US£310 billion investment worldwide, but this sum again needs to more than double to US$700 billion annualised spending to meet the Paris Accord’s targets.

Supply chain investment exceeds net zero requirements but more needs to be focused on battery value chain

Similarly, electrified transport spending needs to nearly triple to US1.8 trillion. Of course, with EVs and battery energy storage system (BESS) both closely dependent on battery supply, and most commonly lithium-ion (Li-ion) batteries, Li-ion battery manufacturing plants would account for 70% of all clean energy supply chain spending, were they to be invested into to the full extent required for a net zero world.

The world is indeed already investing in battery production and investments are set to surge around 66% from 2023 to 2024 according to investment plans seen by BloombergNEF and battery gigafactories are a primary driver of this investment.

There was some other good news from BloombergNEF if we look at supply chain spending as a whole: it is currently actually at levels above what’s required to be on track for net zero by 2050. In fact, net zero can be achieved with yearly spending on supply chain at about 55% of the US$135 billion that was invested on things like equipment factories and battery metals during 2023.

The need to invest in supply of battery metals cobalt, lithium and nickel is however acute and would make up 20% of total supply chain spending commitments in the Paris-aligned scenario. In 2023, it was just 11% and BloombergNEF anticipates it rising to 18% in 2026, based on the lead times of announced projects.

BloombergNEF also found that the solar PV industry’s current situation of oversupply means no new PV factories are required before 2030. The module supply glut is going to put pressure on the sector “for years to come,” the analysis group said, as covered by our colleagues at PV Tech today.

A few months back, BloombergNEF forecast that globally, cumulative installations of grid-connected storage will reach 650GW/1,877GWh by 2030, in the firm’s 2H 2023 Energy Storage Market Outlook. Since then, the company has also published its first-ever list of Tier-1 BESS providers.

Energy-Storage.news’ publisher Solar Media will host the 9th annual Energy Storage Summit EU in London, 20-21 February 2024. This year it is moving to a larger venue, bringing together Europe’s leading investors, policymakers, developers, utilities, energy buyers and service providers all in one place. Visit the official site for more info.

Energy-Storage.news’ publisher Solar Media will host the 6th Energy Storage Summit USA, 19-20 March 2024 in Austin, Texas. Featuring a packed programme of panels, presentations and fireside chats from industry leaders focusing on accelerating the market for energy storage across the country. For more information, go to the website.