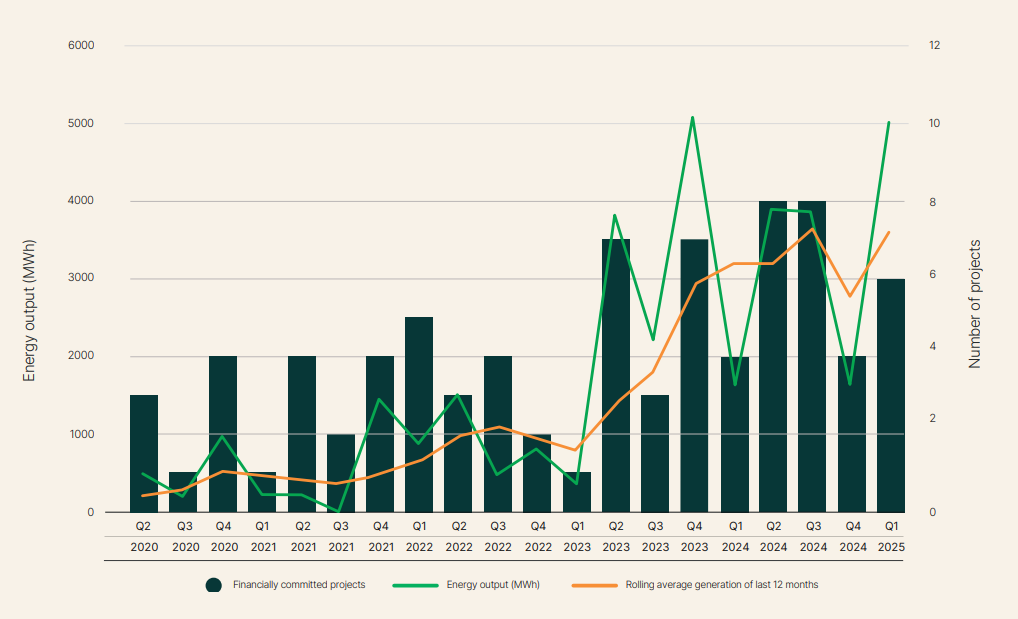

Trade association Clean Energy Council (CEC) has deemed Q1 2025 the second-best quarter on record for large-scale battery energy storage system (BESS) investment in Australia.

The organisation’s Quarterly Investment Report: Large-scale renewable generation and storage Q1 2025 details six projects worth AU$2.4 billion (US$1.54 billion), representing 1,510MW/5,016MWh, that have reached the financial commitment stage.

The largest of these projects is EnergyAustralia’s 350MW/1,400MWh Wooreen BESS located in the Latrobe Valley in Victoria. Construction started on this project in February, just after financial close had been achieved.

Finnish marine and energy technology group Wärtsilä has been contracted to supply the BESS solution for the site. At the same time, balance-of-plant (BOP) contractor Zenviron will provide balance-of-plant design, construction, installation, and commissioning of the site. Tilt Renewables is developing the project.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The second-largest BESS to reach financial commitment was stage two of the 270MW/1,356MWh Supernode BESS in Queensland, which is being developed by global investment manager Quinbrook Infrastructure Partners.

Since then, the size of this BESS has increased further to 750MW/2,540MWh via an offtake agreement signed with state-owned energy company Stanwell.

The remaining BESS that secured financial commitment in the first quarter of 2025 include Copenhagen Infrastructure Partners’ 240MW/960MWh Summerfield BESS, Intera Renewables’ 250MW/500MWh Limestone Coast North Energy Park, and Amp Energy’s 150MW/300MWh Bungama BESS (stage one), all located in South Australia. Additionally, Equis Australia’s 250MW/500MWh Calala BESS is situated in New South Wales.

These six projects represent a AU$2.4 billion capex investment, which is 83% higher than the revised rolling 12-month quarterly average for investment in new storage projects, currently at AU$1.3 billion.

Average duration of financially committed projects increases

The average duration of these six projects was 3.2 hours, which is an increase from the average duration of 2.2 hours for projects reaching financial commitment in Q1 2024. This coincides with Wood Mackenzie’s analysis, which estimates that longer-duration BESS, such as 4-hour duration, could become more lucrative in the National Electricity Market (NEM) in the near future.

It should also be noted that the 5,016MWh of energy storage projects that reached financial commitment in Q1 2025 appear more impressive when considering that, in the entirety of 2024, 11,348MWh reached financial commitment.

This figure was slightly lower than the record set in 2023, which was 4,663MW/11,509MWh. The total investment for these projects amounted to at least AU$3.9 billion for the year.

Construction began on three BESS projects in Q1 2025, totalling 840MW/2,860MWh. Additionally, two storage projects were commissioned this quarter, representing 56MW/98 MWh.

Investment in large-scale generation off to a slow start

Despite the positives of energy storage, investment in large-scale solar PV and wind generation in Australia, has gotten off to a slow start in 2025, after what was a very strong end to 2024.

During the quarter, two projects achieved financial close, totalling 386MW. These projects are Amp Energy’s 280MW Bungama solar PV power plant in South Australia and European Energy’s 106MW Lancaster solar PV plant in Victoria. Together, they represent a capital investment of AU$410 million.

Meanwhile, five generation projects totalling 756MW of new generation capacity completed commissioning in Q1 and are now fully operational.

Despite the shortcomings of investment in Q1 2025 compared to Q4 2024, the CEC noted that this is a common occurrence. Over the past five years, the average quarterly capacity of generation projects reaching financial commitment in Q1 has been 427MW. By comparison, the Q4 average over the past five years has been 1,153MW.

Clean Energy Council chief policy and impact officer, Arron Wood, said it was encouraging to see sustained momentum in investment for large-scale energy storage projects.

“Wind and solar combined with energy storage is the lowest-cost form of electricity generation and by installing more battery storage projects across the country, Australians can get the biggest benefits from renewable energy through cheaper, cleaner, more reliable power – while creating thousands of new jobs,” Wood said.