Australia’s Clean Energy Council has said that 2025 saw as many battery energy storage systems (BESS) commissioned as in the last eight years combined.

Australia’s utility-scale BESS market achieved several milestones in 2025, with the Clean Energy Council’s Q4 investment report revealing that 11 energy storage projects, totalling 1.9GW/4.9GWh, were commissioned during the year.

This annual total of 4.9GWh not only sets a new benchmark for the industry but also surpasses the combined output of all storage projects commissioned between 2017 and 2024.

The final quarter of 2025 was particularly significant, with four storage projects becoming operational. These projects alone contributed 1GW/2.3GWh, accounting for nearly half of the year’s total energy output.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

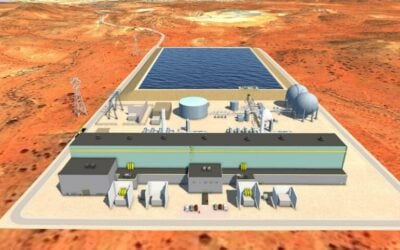

Among these, the 600MW/1.6GWh Melbourne Renewable Energy Hub in Victoria emerged as the standout, largest project.

The BESS, jointly developed by Singapore-based Equis’s Australian subsidiary and the Victorian government’s State Electricity Commission (SEC), features 444 Tesla Megapack units configured across three separate battery storage systems.

The Clean Energy Council’s report emphasised the transformative impact of 2025 on Australia’s energy storage landscape. It notes that the rolling 12-month quarterly average for commissioned storage projects surpassed 1GWh for the first time, reaching 1.2GWh, nearly triple that of the same period in 2024.

Several factors contributed to the record-breaking achievements in 2025. Policy support played a pivotal role, with initiatives such as the Australian government’s Capacity Investment Scheme (CIS) and New South Wales’ Long-Term Energy Services Agreements (LTESAs) providing financial incentives and reducing price uncertainty for investors.

The CIS, designed to support 40GW of new capacity nationally, has been instrumental in driving investment in renewable energy and storage projects.

Similarly, LTESAs offer generation, storage, and firming projects the right to access minimum cash flows over long contract terms, further enhancing investor confidence.

These measures have created a favourable environment for the rapid expansion of utility-scale battery storage systems.

Technological advancements and increasing durations

Technological advancements have also been a key enabler of this growth. Improvements in battery technology, including higher energy density, longer durations, and enhanced efficiency, have made utility-scale storage solutions more viable and cost-effective.

These advancements have allowed for the development of larger-scale projects capable of delivering significant energy output and providing critical grid services.

As such, the growing need for grid stability and renewable energy integration has further driven demand for these systems, as they offer essential services such as frequency regulation, peak shaving, and renewable energy firming.

Looking ahead, the report noted that the rapid deployment of storage projects is expected to continue, with several large-scale projects already in the pipeline for 2026 and beyond.

As of Q4 2025, there are 75 storage projects either financially committed or under construction, representing 13GW of power output and 34.7GWh of capacity. This pipeline reflects the strong demand for utility-scale storage solutions and investors’ growing confidence in the sector.

The report also highlighted the increasing prevalence of hybrid projects, which combine storage with generation technologies such as solar and wind.

Currently, 64 hybrid systems are at various stages of development across Australia, with nearly two-thirds of these projects integrating solar and storage technologies. This trend underscores the benefits of these technologies in supporting the energy transition.

Hybrid projects have become ever prevalent in Australia’s energy sector. Indeed, Neha Sinha, product manager for energy storage systems at Wärtsilä Energy Storage, told ESN Premium last year that DC-coupling will be “essential” for Australia’s solar future.

The Clean Energy Council’s report also provided detailed insights into the performance of commissioned storage projects over the years.

Between 2017 and 2025, the number of commissioned projects grew from just one in 2017 to a record-breaking eleven in 2025. Investment in these projects has also surged, with total annual investment reaching AU$2 billion (US$1.42 billion) in 2025, up from AU$90 million in 2017.

The Energy output of commissioned projects has similarly increased, with 1.9GW added in 2025 compared to 150MW in 2017.

Capacity has seen the most dramatic growth, rising from 194MWh in 2017 to 4.9GWh in 2025. The average storage project duration has also increased, rising from 1.3 hours in 2017 to 2.6 hours in 2025.

The Energy Storage Summit Australia 2026 will be returning to Sydney on 18-19 March. It features keynote speeches and panel discussions on topics such as the Capacity Investment Scheme, long-duration energy storage, and BESS revenue streams. ESN Premium subscribers receive an exclusive discount on ticket prices.

To secure your tickets and learn more about the event, please visit the official website.