BlackRock-backed developer Akaysha Energy is reportedly considering options to raise additional funds, including selling a minority stake, to support the expansion of its battery energy storage operations.

According to reports from Bloomberg, the Australian-based developer may raise “several hundred million dollars” based on its valuation of over US$1 billion.

Companies are currently being approached, but Energy-Storage.news understands that discussions are at an early stage, and any deal will be contingent upon market conditions, according to a source familiar with the matter.

Energy-Storage.news approached Akaysha Energy regarding the reports; however, the company declined to comment.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Akaysha Energy has become hot property in the global utility-scale energy storage market after completing the development of the “world’s most powerful battery” in terms of power output, in New South Wales: the 850MW Waratah Super Battery.

The battery storage system achieved its first full output to the National Electricity Market (NEM) in October last year. However, a catastrophic transformer failure raised concerns around the project before it entered a planned balance of plant shutdown from 20 November to 2 December.

Estimates suggest the transformer failure could result in total losses between AU$50-80 million (US$32-51 million), according to Dr Tom Harries, partner at NARDAC, a specialist energy and infrastructure broker that provides battery energy storage insurance.

Beyond the Waratah Super Battery, Akaysha Energy is also developing several other utility-scale battery storage systems that, although smaller than Waratah, are still significant.

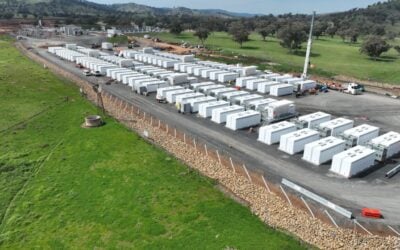

For instance, in December last year, Akaysha Energy put the first phase of its 155MW/298MWh Ulinda Park BESS project into operation in Queensland. Once fully completed, this battery system will be 350MW/1,078MWh in size.

Akaysha Energy confirmed that Ulinda Park BESS is currently providing energy shifting arbitrage and participating in Frequency Control Ancillary Services (FCAS) markets in the NEM.

The developer is also nearing the completion of its 205MW/410MWh Brendale BESS, with the site in Queensland having been added to the Australian Energy Market Operator (AEMO) Market Management System in Q3 of last year.

Other significant battery storage projects Akaysha Energy is developing in Australia include the 311MW/1,244MWh Elaine BESS in Victoria, and the 415MW/1,660MWh Orana BESS in New South Wales.

Beyond Australia, Akaysha also has exposure in several international markets, including the US, Japan and Germany. In September 2025, the group secured an AU$300 million corporate debt facility to support its expansion into these markets.

The Energy Storage Summit Australia 2026 will be returning to Sydney on 18-19 March 2026. To secure your tickets and learn more about the event, please visit the official website.