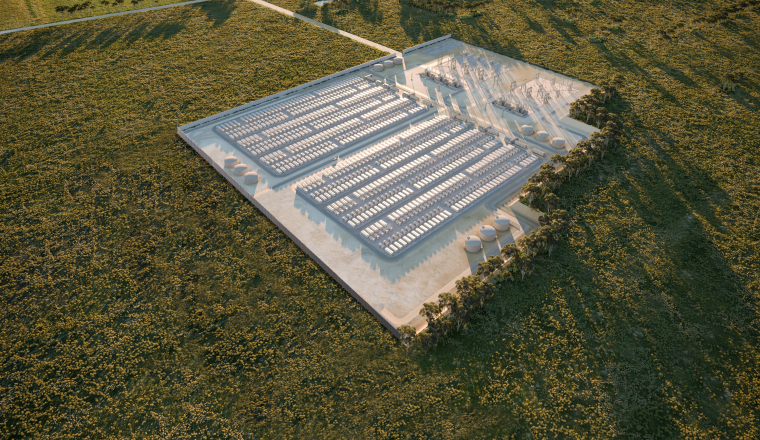

The Australian government has granted approvals to the ‘Melbourne Renewable Energy Hub’ (MREH), a 1,200MW/2.4GWh two-hour duration battery energy storage system (BESS) in the state of Victoria.

MREH is owned and developed by Singapore-headquartered renewables investor and developer Equis, in partnership with Australian renewables engineering, design and construction group Syncline Energy. Equis said that the project will be the largest BESS in the Asia-Pacific region.

The environmental approvals were announced this week by Minister for the Environment and Water, Tanya Plibersek. She said: “We know renewable energy is cheaper, cleaner, and crucial to helping us cut emissions and reach our goal of net zero by 2050. Projects like this will help us transform our energy system and build it for the future.”

The project will be connected to the National Electricity Market (NEM) and will act as a repository for solar, wind and hydro energy from across rural Victoria, as well as holding excess power generated from rooftop solar installations to flow into the transmission grid. The MREH will also include a 12.5MW co-located solar installation.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Following these approvals development is set to begin in late 2023, with commercial operations expected in 2025.

Equis originally announced plans for the project in November 2022, saying that the BESS would have multiple connection points to the NEM that allow it to perform multiple functions. It is also designed to support the development of Victoria’s renewable energy zones (REZ), areas that are designated for renewable energy developments throughout the state.

Plibersek said of the government’s backing for the project: “We’re undoing a decade of political fights that stalled progress and cost the environment. This is what action on climate change looks like – cutting emissions, investing in renewables, and better protecting our environment.”

BESS investments are one of the few areas of Australia’s clean energy economy that have seen favourable conditions of late. As reported by our sister publication PV Tech, the Clean Energy Council said that the downturn in renewable energy generation investments over the first half of 2023 as “concerning”, with just four new projects receiving financing over 6 months. Storage, however, has seen a blockbuster Q2; 1497MW/3802MWh of new projects closed financial commitments, well above the quarterly average for the preceding year.