Ed Gunn, VP of revenue at home battery storage and virtual power plant (VPP) specialist Lunar Energy, on the market’s recent past and future potential.

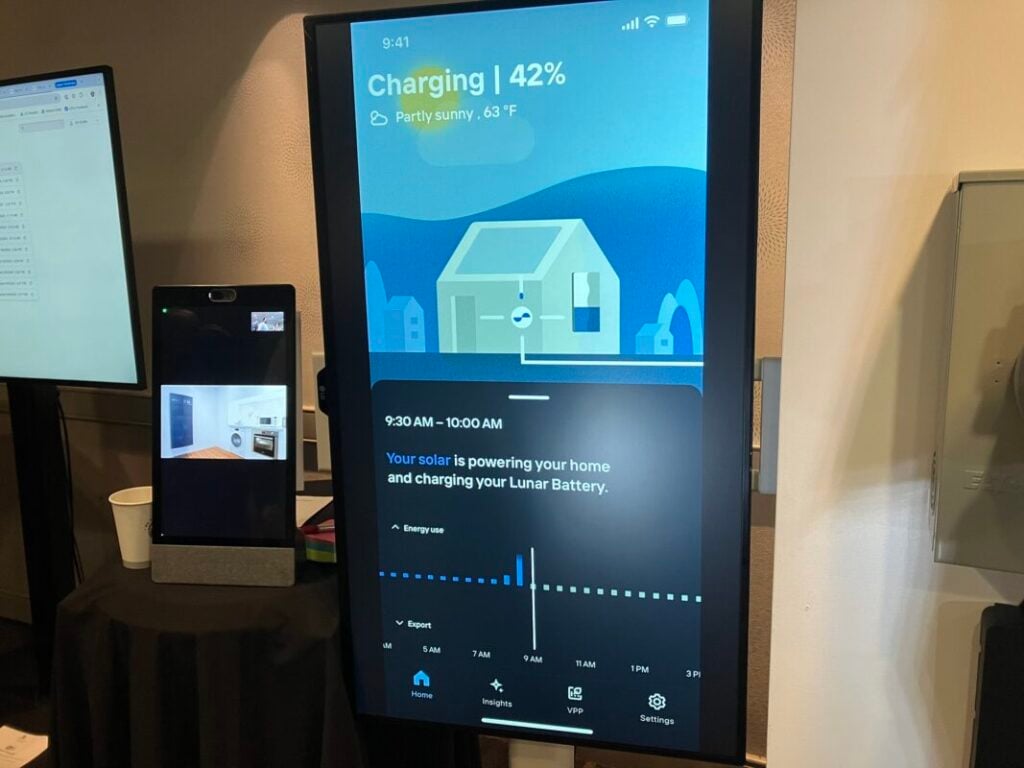

Lunar Energy’s 20kWh home battery storage solution, Lunar System, along with its accompanying software platform, is designed to help customers maximise energy savings while adding whole-home backup through outages with smart forecasting.

The company emerged from stealth mode in 2022, after raising more than US$300 million in funding a couple of years prior, with investment from leading US residential solar and storage leasing company Sunrun and South Korea’s SK Group.

Lunar Energy then acquired UK battery storage and aggregation software pioneer Moixa and began deploying its software, GridShare, to manage energy networks comprising homes in the US, Japan and electric vehicle (EV) fleets in the UK. Lunar remains partnered with Sunrun in coordinating the forecasting and dispatch of its growing VPP base.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Ed Gunn, who joined the company from Moixa, previously discussed the challenges of scaling virtual power plant (VPP) offerings in an article for ESN Premium in 2024, citing customer acquisition and the need to meaningfully compensate customers for the value VPPs can bring to utilities in managing their peak loads and reliability requirements.

Read more instalments from our annual Year in Review Q&A series here.

What did 2025 mean for the energy storage industry from your company’s perspective and the bigger picture?

2025 was a turbulent year, but one that reinforced the fundamentals of energy storage. From our perspective at Lunar Energy, it showed that intelligent, flexible home energy solutions – hardware and software working in lockstep – continue to create value even when the policy environment is uncertain.

This year, batteries proved they sit at the intersection of lower bills, reliability, and customer control. That combination resonated in 2025 despite market noise, and it’s why residential energy storage continued to move forward while other parts of clean energy struggled.

What do you think 2026 will hold, in terms of both things to look forward to and in terms of challenges ahead?

In 2026, the grid will get more complicated. More dynamic energy rates and evolving market rules will add complexity for both customers and utilities.

At the same time, this creates opportunity. Smart devices and intelligent software are ready to turn that complexity into value. The challenge will be navigating a more competitive and localised market, while the opportunity is unlocking more savings and earnings for customers through storage and VPP participation.

We are also seeing a rapid proliferation of new third-party ownership (TPO) finance options capitalising on the 48E ITC. There’s a mix of promising challenger TPOs innovating on pricing, business models, and product offerings, alongside established players reacting with new offerings.

That choice feels positive for installers and for customers today, however there will be a graveyard of failed TPOs by the end of the year, so installers must choose their finance partners wisely.

Is there a growing understanding of what distributed energy resources (DERs) can do, especially when aggregated into VPPs, and what needs to happen for VPPs to ‘hit the mainstream’?

The world now knows that DERs can do more than provide backup power. In 2025, VPPs clearly demonstrated their ability to unlock real economic value for customers, particularly as energy rates continue to climb.

It’s easy to get carried away with the nerdy technical jargon and assume that consumers understand or care about the inner workings of VPPs. We cannot forget that the fundamentals remain the same: savings, ease, and trust.

Does VPP participation save or make me money? Can I participate in an easy way that doesn’t require me to be an energy expert? Do I trust that the VPP operator has my best interests at heart?

For VPPs to reach the mainstream, focusing on the fundamentals is crucial. That’s how adoption follows.

Where are the most significant evolutions taking place in the DERs and VPP spaces, either in terms of technology, business models, or both?

The most significant evolution is happening at the software layer. Our customers earned US$464, on average, by participating in VPP programmes in 2025. The next wave of growth will be driven by smarter AI, smarter rates, and smarter devices working together.

As DERs become able to respond in real-time to price signals and grid conditions, they can optimise both system reliability and customer economics. This shift is fundamentally changing the role of the consumer, moving households from passive energy users to active, flexible participants in the energy system.

VPP models have stakeholders both behind-the-meter and on the utility side. What are the keys to meeting the different priorities of these different stakeholders?

The key is capturing value in a way that works for everyone. Customers care about lowering bills, earning income, and maintaining control. Utilities care about reliability and predictable performance. Smart devices and intelligent software make it possible to meet both sets of priorities by coordinating DERs in ways that support the grid, while delivering tangible financial benefits to customers.

We see a quiet revolution taking place in the last few years: VPP hype has led to many VPP operators chasing the quickest buck but forgetting about the end customer on whose device the VPP is built upon. We take a different approach. Our experience has shown that optimising VPP performance in addition to managing the customer cost and value of participating very carefully, and managing the customer experience, yields the best outcomes for customers and the grid.

What should the industry’s priorities be in 2026 and beyond?

The priority should be simple: save customers money with the smartest product and help installers cut costs and reduce risk with the most stable and reliable solutions.

That means executing and scaling what already works: the smartest software, flexible storage, and American-built hardware that can bend the cost curve down over time and maximise stability of pricing and supply.

Renewable energy has weathered difficult years before, but the fundamentals remain strong. With the right technology and execution, distributed energy can deliver a more resilient, affordable energy system for everyone.

The Energy Storage Summit USA will be held from 24-25 March 2026, in Dallas, TX. It features keynote speeches and panel discussions on topics like FEOC challenges, power demand forecasting, and managing the BESS supply chain. ESN Premium subscribers can get an exclusive discount. For complete information, visit the Energy Storage Summit USA website.