Following wins at the Energy Storage Awards 2023, Dr Ben Irons of Habitat Energy and Andrew Gilligan of Fluence take part in our end of year Q&A series.

Held in late September at the prestigious Park Plaza London Riverbank hotel, the first-ever Energy Storage Awards hosted by our publisher Solar Media recognised excellence throughout the European industry.

Enjoy 12 months of exclusive analysis

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Annual digital subscription to the PV Tech Power journal

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Fluence won in two categories: Product of the Year, and System Integrator of the Year, while Fluence senior policy and market development manager Lars Stephan earned recognition to place second in the Outstanding Contribution category. Answering on Fluence’s behalf is Andrew Gilligan, director of commercial strategy.

Habitat Energy meanwhile was the inaugural winner of Trading and Optimisation Team of the Year. Responding to the questionnaire is Dr Ben Irons, Habitat Energy co-founder and director.

See here for the full list of winners of the 2023 Energy Storage Awards.

Fluence: Product of the Year, System Integrator of the Year

Congratulations on the two award wins, for Product of the Year and System Integrator of the Year, as well as a Highly Commended trophy for Lars Stephan in the Outstanding Contribution category. What do these award wins and the commendation mean for Fluence?

These awards are strong external proof points of the value that Fluence’s ecosystem of products is bringing to our customers around the world. We are deeply appreciative of these awards as they bring increased visibility to the innovative solutions that Fluence and our customers are delivering around the world to help enable the clean energy transition.

These innovative solutions will help accelerate the process of solving the world’s energy challenges.

Fluence’s UltraStack, which won Product of the Year, is a BESS solution aimed at the ‘storage-as-a-transmission asset’ (‘SATA’) segment of the market. For the uninitiated, what is SATA, and what is special about a solution designed specifically for those applications?

Deploying storage-as-transmission assets (SATA)—a relatively simple, but not widely-known concept—offers networks new flexibility to meet capacity needs. Energy storage is placed along a transmission line and operated to inject or absorb power, mimicking transmission line flows.

Such applications represent a new and vital area in which storage is providing value, offering network infrastructure planners more options and more flexible tools for redrawing the network map around the world. In a renewable-powered energy system, with larger shares of volatile renewable generation building, a more flexible grid will allow for increased utilisation of transmission lines, creating benefits for grid customers.

With names like “virtual transmission” in Australia and “Grid Booster” in Germany, current projects totaling over 3GW of capacity are poised to increase system efficiency and reliability worldwide. They can do so on far faster timelines and with competitive costs and benefits compared to traditional infrastructure.

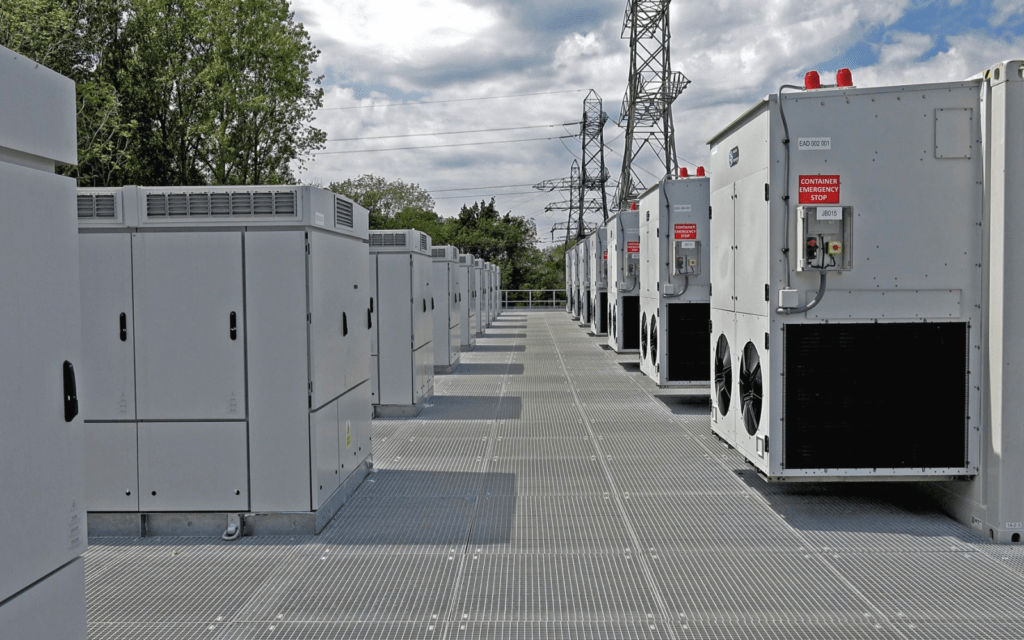

Ultrastack unlocks the power of battery-based energy storage for transmission network owners and operators. The product provides fast acting (less than 150 milliseconds) response with higher than 99% system uptime to meet the availability requirements of critical infrastructure. Advanced control applications, some with pending patents, have been developed by leading power system engineers with a deep understanding of transmission system operations and more than 15 years of experience in deploying grid-scale energy storage systems.

The system integrator field is an increasingly competitive one, but what are some of Fluence’s highlights from the past year or so that you think helped the company stand out for our judges?

This past year, Fluence launched several new technologies and innovative solutions that are tackling core challenges surrounding the world’s clean energy transition. In March 2023, Fluence launched Ultrastack, our highest-performance energy storage product to date that is transforming the way transmission and distribution networks operate and is addressing some of the main grid challenges created by the energy transition.

Fluence Nispera also expanded to provide real-time performance monitoring, AI-enabled performance analysis, and optimisation of energy storage assets. Nispera is an essential cloud-based product that allows asset owners to scale their portfolios of renewables and storage in support of the clean energy transition without scaling their resources.

Fluence also continues to lead the energy storage industry in safety. Last September, we completed a large-scale fire test that extended beyond industry standards and demonstrated the safety of our storage products. Sustainability remains a core focus for us and Fluence published our first sustainability report in May 2023, less than two years after the company’s initial public offering.

This October, we released Gridstack Pro, the latest solution within our Gridstack product line. Gridstack Pro is an advanced energy storage solution built for the next era of utility-scale projects. Gridstack Pro is also positioned as one of the first energy storage solutions to qualify for the 10% Investment Tax Credit domestic content bonus under the Inflation Reduction Act (IRA).

Energy storage is rapidly becoming a global industry, and Fluence is in more markets than many of its competitors. What are some of the most important considerations when it comes to taking BESS into new territories, new markets and new applications?

Fluence is active in a number of markets globally, and this scale allows us to competitively serve our customers at a global level and best utilise our supply chain.

When entering a market, we look to ensure there is the necessary regulatory structure and economic value for battery-based energy storage to take off as a critical threshold. There needs to be both the value (through a combination of capacity, ancillary, and energy revenue streams) and the regulatory structure to provide certainty that this value will be captured by storage. This sets the stage for a market to grow substantially. It may be that a market is on its path to reaching this threshold, and Fluence can support by referencing learnings from other storage markets. We also will often look to enter new markets with existing customers.

Despite the obvious successes of the industry, there’s still a long way to go for the strengths and advantages of energy storage in decarbonising and modernising electricity networks to be fully realised. What can the industry do to help ensure the right policies, regulations and market structures are put in place?

Utilising knowledge and lessons learned from existing markets can be a key to more efficiently setting up newer storage markets for success. There of course will be unique considerations for each market, but industry participants and relevant stakeholders can exchange information and use case studies to see what has worked well and what has not and build consensus for establishing a structure that works for the market in question.

What do you think 2024 will mean for energy storage?

The biggest year of new energy storage to date! At this point, each year we expect the global demand for battery-based energy storage systems to be larger than the previous, and that continues in 2024 – still driven by the largest global markets, but with newer markets starting to contract for large-scale storage as well.

Habitat Energy: Trading and Optimisation Team of the Year

Congratulations on the win for Best Trading and Optimisation Team. What does this award mean for Habitat Energy?

Habitat Energy has pioneered a merchant-first approach to battery optimisation since we first launched in 2017 and it’s very gratifying to have our success recognised by a panel of independent industry experts at the inaugural Energy Storage Awards, especially in such a competitive category.

It may be called Trading & Optimisation Team of the Year, but this award recognises the hard work that every single member of our team globally does every single day to deliver exceptional performance for our clients.

Energy trading in itself is not a new concept, but the role of battery storage within that is perhaps one that many people are still learning about. What’s the easiest way to explain what optimisers do?

Power traders traditionally have only been able to trade across markets or across the curve, but batteries allow power to be traded across time, which isn’t otherwise possible. But it’s not as simple as just charging the battery at night when the price is low and discharging during the day when the price is high. Power prices are very volatile so there are numerous chances to buy and sell every day, but at different times that are hard to predict and optimally trade across. And there are multiple power markets, state of charge, cycling, degradation costs to manage and so on.

As an optimiser it’s our job to manage all of these variables and make sure a battery is in the right market, at the right time, all of the time, while respecting its operational parameters.

On a day-to-day basis, how much of that is enabled by digital technologies like machine learning and artificial intelligence, and how much by the actions of a trading team?

Delivering bespoke multi-market trading strategies across a portfolio of batteries is not a problem a human can solve at scale. Algorithms facilitate speed and scalability while automation is necessary for the sheer amount of data you need to ingest and utilise. But these markets are in their infancy, and you can’t train algorithms on conditions and services they haven’t seen before.

Human traders play a vital role in overseeing the optimisation strategy, managing risk and responding to conditions that an algorithm doesn’t understand or can’t predict. For example, unplanned outages (our team are often the first to notice performance issues on site) or managing trading risk in particular market situations in line with client instructions.

We think the real value comes from having a continuous feedback loop between the traders and the technology, which is why at Habitat we maintain both in-house. Our team of data scientists and software engineers work hand in hand with our traders to continually hone our forecasts and algorithms, so we can deliver the best possible results for our clients.

We think the real value comes from having a continuous feedback loop between the traders and the technology, which is why at Habitat we maintain both in-house. Our team of data scientists and software engineers work hand in hand with our traders to continually hone our forecasts and algorithms, so we can deliver the best possible results for our clients.

What do you think our readers should look out for in the energy storage space in 2024 and beyond, both in terms of trading and optimisation, and wider industry topics?

There’s a lot to consider. Here in the UK, it’s exciting that we’ll finally be seeing changes via the Energy Security Bill/Electricity Act to recognise electricity storage as a distinct subset of electricity generation. The introduction next year of day-ahead balancing reserve and quick reserve markets will also help to reward the high degree of flexibility that storage assets provide. And everyone’s favourite subject, grid systems and codes. We’re hoping to see more holistic development across all relevant codes and rules governing the electricity system to reflect new flexible technologies so their full potential in supporting net zero ambitions can be realised.

In Australia the recent expansion of the Capacity Investment Scheme sees a new target of 9GW of storage by 2030. It effectively offers a revenue floor for asset owners, therefore we expect to see more announcements of large capacity, long duration storage projects receiving funding and coming online in the years to come. Winners of government auctions typically have obligations they must meet (e.g. system strength), so far from what we’ve seen these obligations will not significantly constrain projects, allowing them to maximise value for asset owners.

In the US and in ERCOT in particular regulatory changes around State of Charge (SoC) management, new ancillary service products and several new renewable assets being added to the grid will make for an exciting year for battery optimisers. The difference between the best and worst battery optimisers will become more stark as volatility persists into 2024.

Energy-Storage.news’ publisher Solar Media will host the 9th annual Energy Storage Summit EU in London, 20-21 February 2024. This year it is moving to a larger venue, bringing together Europe’s leading investors, policymakers, developers, utilities, energy buyers and service providers all in one place. Visit the official site for more info.